by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

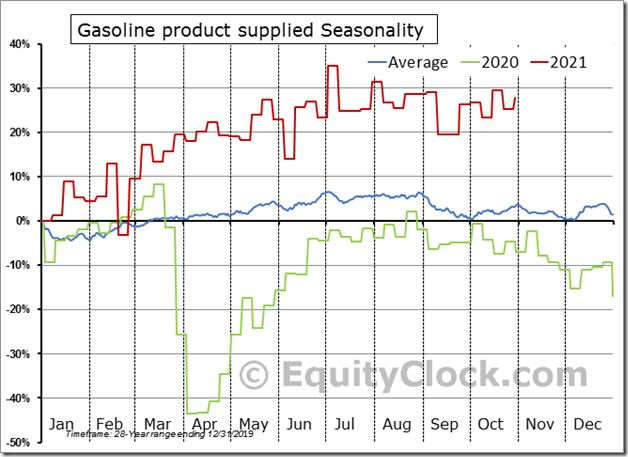

Don’t be fooled by the pullback in the price of oil as the demand fundamentals remain supportive of price. equityclock.com/2021/11/03/… $USO $CL_F $UGA $XLE $XOP

QualComm $QCOM an S&P 100 stock moved above $151.57 extending an intermediate uptrend.

Editor’s Note. Seasonal influences on a real and relative basis are favourable to mid-January. If a subscriber to www.EquityClock.com seehttps://charts.equityclock.com/qualcomm-inc-nasdaqqcom-seasonal-chart

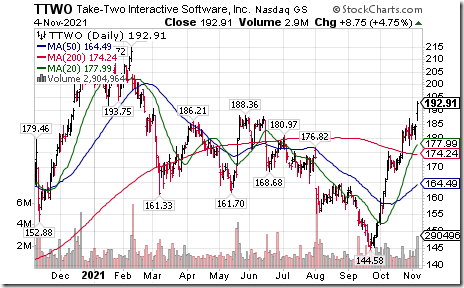

Take Two Interactive $TTWO moved above $188.36 extending an intermediate uptrend. Responding to higher than consensus quarterly results.

Moderna $MRNA a NASDAQ 100 stock moved below $293.58 extending an intermediate downtrend.

BlackRock $BLK an S&P 100 stock moved above $955.72 to an all-time high extending an intermediate uptrend

Editor’s Note: Seasonal influences on a real and relative basis are favourable to April.1. If a subscriber to www.EquityClock.com, see https://charts.equityclock.com/blackrock-inc-nyseblk-seasonal-chart

Nike $NKE an S&P 100 stock moved above $174.89 to an all-time high extending an intermediate uptrend. Seasonal influences on a real and relative basis are favourable to the third week in December. If a subscriber to www.EquityClock.com see:charts.equityclock.com/nike…

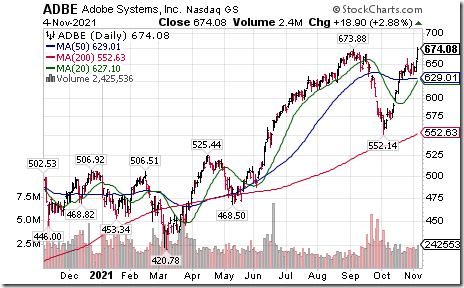

Adobe $ADBE a NASDAQ 100 stock moved above $673.88 to anall-time high extending an intermediate uptrend.

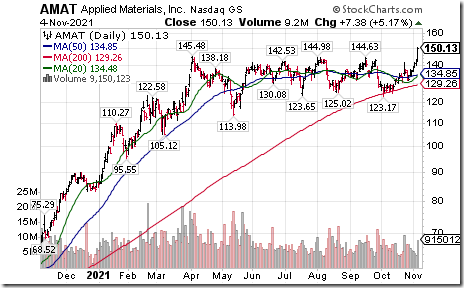

Applied Materials $AMAT a NASDAQ 100 stock moved above $145.48 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are favourable to the third week in March. If a subscriber to www.EquityClock.com, see: https://charts.equityclock.com/applied-materials-inc-nasdaqamat-seasonal-chart

Synopsys $SNPS a NASDAQ 100 stock moved above $340.66 to an all-time high extending an intermediate uptrend. Seasonal influences are favourable to mid-February. If a subscriber to equityclock.com/ see: charts.equityclock.com/syno…

AT&T $T an S&P 100 stock moved below $25.01 extending an intermediate downtrend.

Gildan Activewear $GIL.CA a TSX 60 stock moved above $50.43 extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are favourable until at least mid-February. If a subscriber to www.EquityClock.com see, https://charts.equityclock.com/gildan-activewear-inc-tsegil-seasonal-chart

Trader’s Corner

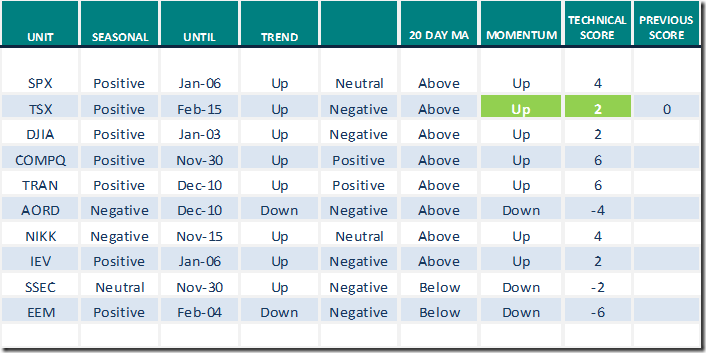

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Nov.4th 2021

Green: Increase from previous day

Red: Decrease from previous day

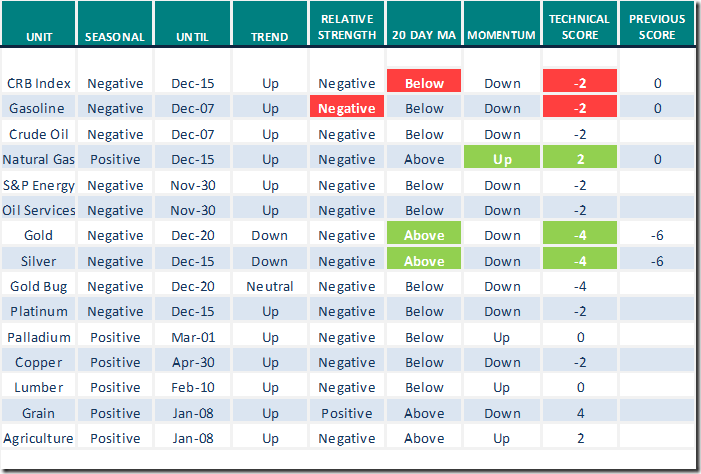

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.4th 2021

Green: Increase from previous day

Red: Decrease from previous day

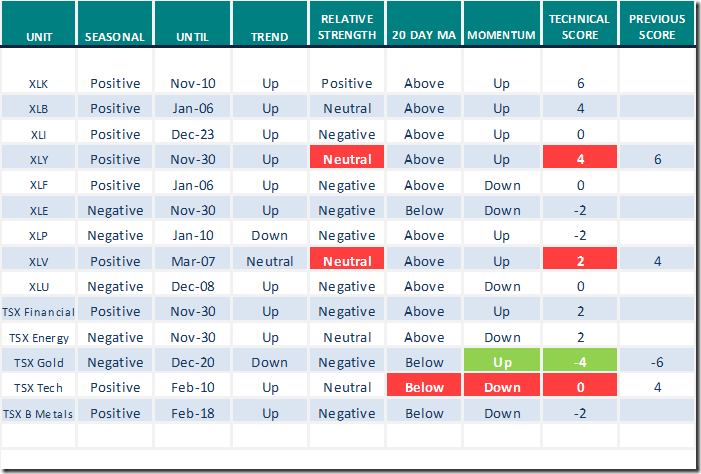

Sectors

Daily Seasonal/Technical Sector Trends for Nov.4th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

Canadian Association for Technical Analysis

The Association has arrived! Joining the Association provides an excellent opportunity to learn technical analysis techniques and to share opinions on markets.

The new web site has just been launched. The Association became “live” in October with free Zoom presentations featuring Keith Richards and Ron Meisels. Next two presentations have been scheduled featuring Greg Schnell on November 9th and David Cox on November 25th

More information on the Association, its services and the current bargain price for joining is available at Emailing – Canadian Association for Technical Analysis (canadianata.ca)

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 2.01 to 69.08 yesterday. It remains Overbought.

The long term Barometer eased 2.41 to 73.69 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate Barometer added 4.78 to 70.00 yesterday. It remains Overbought.

The long term Barometer eased 1.44 to 65.71 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.