by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

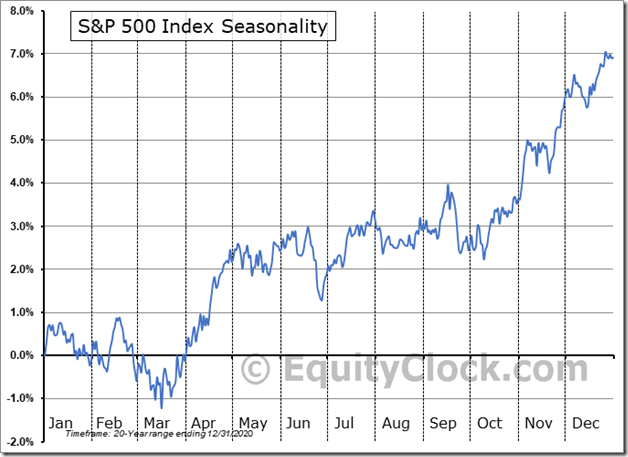

The S&P 500 Index has averaged an increase of 2.2% in November over the past two decades with 80% of periods showing gains. equityclock.com/2021/10/30/… $SPX $SPY $ES_F $STUDY

We have the list of stocks that have gained in every November over their trading history: equityclock.com/2021/10/30/… $EMR $PRI $XTL $SIX $DEEP $FNK $VLU $BFAM $XNCR $SAIC $SHOP $BIB $ARKK $AKRQ $ARKW $HACK $JETS. For the complete list, see www.StockTwits.com@EquityClock

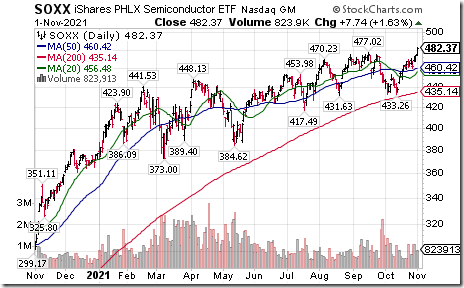

Semiconductor iShares $SOXX moved above $477.02 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are favourable until at least the first week in December and frequently to the middle of February. If a subscriber to www.EquityClock.com , see https://charts.equityclock.com/ishares-phlx-semiconductor-etf-nasdsoxx-seasonal-chart SMH also moved above $276.69 to an all-time high.

KLA Tencor $KLAC a NASDAQ 100 stock moved above $374.60 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences are favourable on a real and relative basis until at least early December and frequently to mid-January. If a www.EquityClock.com subscriber see https://charts.equityclock.com/kla-tencor-corporation-nasdaqklac-seasonal-chart

Natural gas ETN $UNG moved below $17.13 completing a short term Head & Shoulders pattern

Russell 2000 iShares $IWM moved above $233.03 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences are favourable on a real and relative basis to the third week in February. If a www.EquityClock.com subscriber, see https://charts.equityclock.com/ishares-russell-2000-etf-nyseiwm-seasonal-chart

CVS Health $CVS an S&P 100 stock moved above $89.55 extending an intermediate uptrend.

Intuitive Surgical $ISRG a NASDAQ 100 stock moved above $362.34 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are favourable until the end of January. If a subscriber to www.EquityClock.com see https://charts.equityclock.com/intuitive-surgical-inc-nasdisrg-seasonal-chart

McDonalds $MCD a Dow Jones Industrial Average stock moved above $249.95 to an all-time high extending an intermediate uptrend.

Editor’s Note: Seasonal influences are favourable on a real and relative basis until the first week in December. If a www.EquityClock.com subscriber, see https://charts.equityclock.com/mcdonalds-corporation-nysemcd-seasonal-chart

Shopify $SHOP.CA a TSX 60 stock moved above short term resistance at $1,862.63 establishing a short term uptrend.

Editor’s Note: Seasonal influences on a real and relative basis are favourable until late March. If a subscriber to www.EquityClock.com , see https://charts.equityclock.com/shopify-inc-nyseshop-seasonal-chart

Trader’s Corner

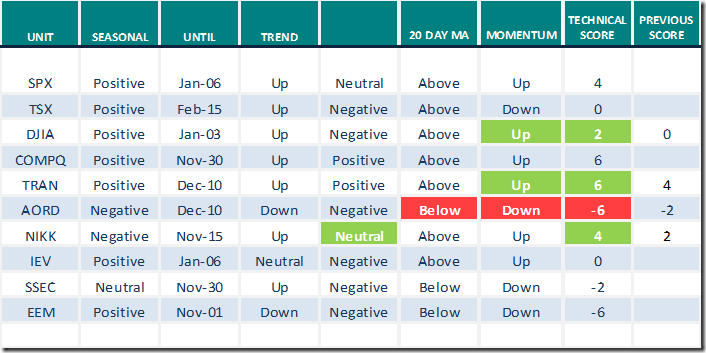

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Nov.1st 2021

Green: Increase from previous week

Red: Decrease from previous week

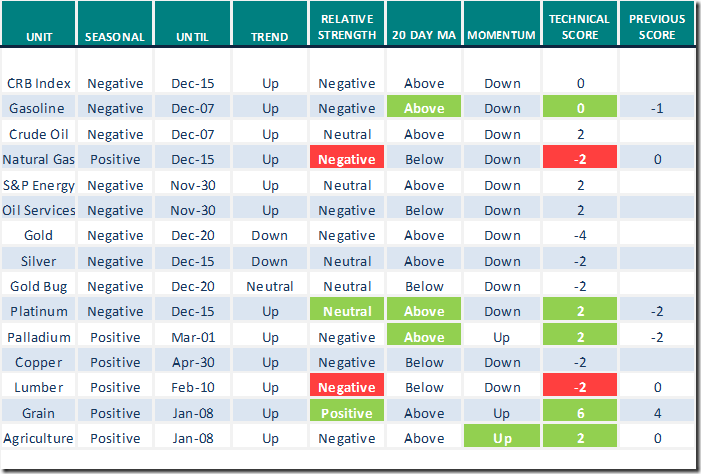

Commodities

Daily Seasonal/Technical Commodities Trends for Nov.1st 2021

Green: Increase from previous week

Red: Decrease from previous week

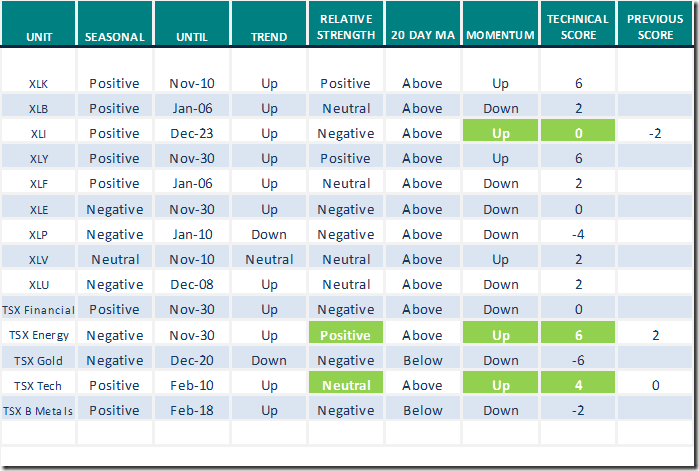

Sectors

Daily Seasonal/Technical Sector Trends for Nov.1st 2021

Green: Increase from previous week

Red: Decrease from previous week

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.82 to 66.06 yesterday. It remains Overbought.

The long term Barometer gained 2.61 to 74.70 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 2.93 to 61.46 yesterday. It changed back from Neutral to Overbought on a recovery above 60.00.

The long term Barometer gained 1.95 to 64.88 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

|

|

|

|

|

|

|

This post was originally publised at Vialoux's Tech Talk.