by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Merck $MRK a Dow Jones Industrial Average stock moved above $84.56 to an all-time high extending an intermediate uptrend.

Boeing $BA a Dow Jones Industrial Average stock moved below $204.80 extending an intermediate downtrend.

Core-cyclical bets pulling back from levels of resistance into the end of the month, but there is little fundamentally, technically, nor seasonally to suggest that these segments are at risk for declines in the months ahead. equityclock.com/2021/10/27/… $XLI $XLB $XLF $XLE $CRAK

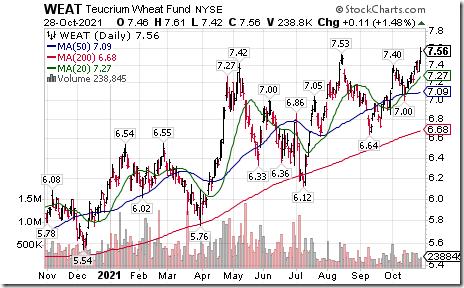

Grain prices continue to rise. Yesterday $CORN completed a short term breakout setting an upward trend. Today, $WEAT moved above $7.53 setting a five year high extending an intermediate uptrend. Good news for fertilizer/ agribusiness stocks and ETFs e.g. MOO and COW.TO !

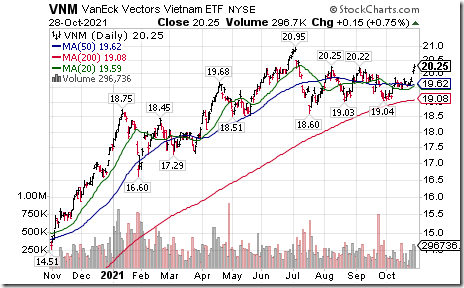

Vietnam ETF $VNM moved above $20.25 resuming an intermediate uptrend.

Rio Tinto $RIO the world’s largest base metals producer moved below $64.24 extending an intermediate downtrend. Responding to the virtual collapse in iron pellet prices.

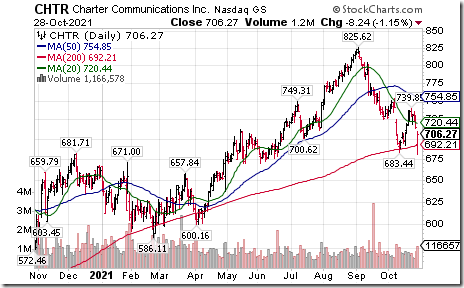

Charter Communications $CHTR a NASDAQ 100 stock moved below $683.44 completing a Head & Shoulders pattern.

Dollar Tree $DLTR a NASDAQ 100 stock moved above $106.64 extending an intermediate uptrend.

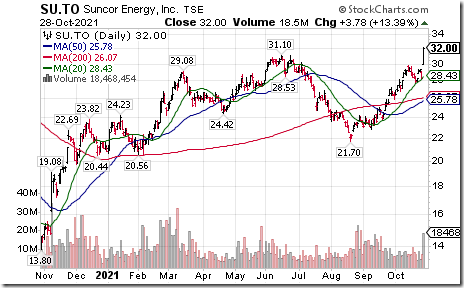

Suncor $SU.CA a TSX 60 stock moved above $31.10 to an 18 month high extending an intermediate uptrend.

Late News

The NASDAQ Composite Index moved above 15,403.44 to an all-time high and the NASDAQ 100 moved above 15,701.40 to an all-time high extending intermediate uptrends.

Please note that these indices are expected to open significantly lower this morning after heavy weight stocks in the indices including Apple, Amazon and Starbucks reported less than consensus quarterly results after the close.

Trader’s Corner

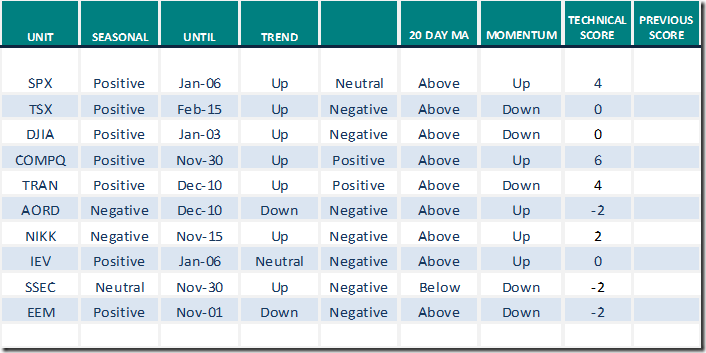

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Oct.28th 2021

Green: Increase from previous week

Red: Decrease from previous week

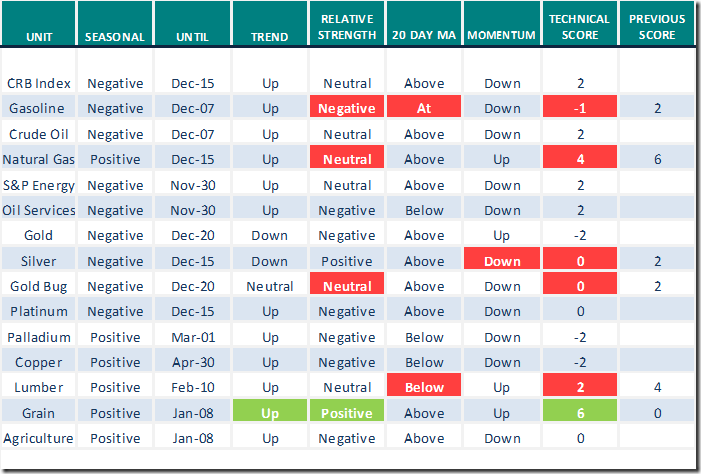

Commodities

Daily Seasonal/Technical Commodities Trends for Oct.28th 2021

Green: Increase from previous week

Red: Decrease from previous week

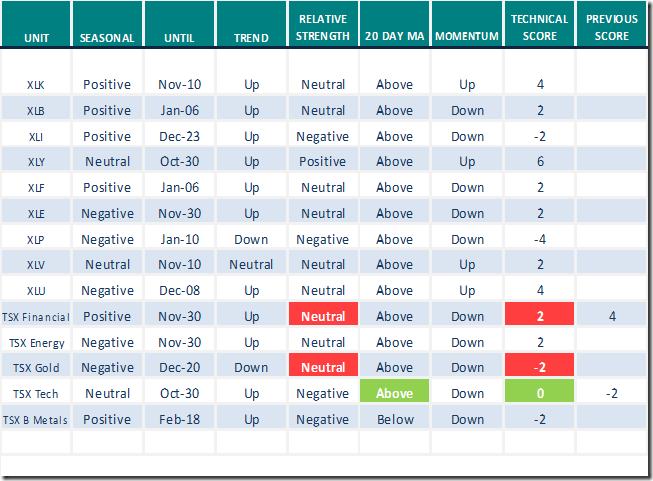

Sectors

Daily Seasonal/Technical Sector Trends for Oct.28th 2021

Green: Increase from previous week

Red: Decrease from previous week

All seasonality ratings are based on performance relative to the S&P 500 Index (except TSX)

S&P 500 Momentum Barometers

The intermediate term Barometer gained back 7.75 to 65.06 yesterday. It returned to Overbought from Neutral on a recovery above 60.00.

The long term Barometer added 2.55 to 74.10 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 3.40 to 62.14 yesterday. It changed back from Neutral to Overbought on a move above 60.00.

The long term Barometer slipped 0.49 to 63.59 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.