by Don Vialoux, EquityClock.com

Editor’s Note: Next Tech Talk report is scheduled for release on Monday October 25th 2021

Mid-cap stocks are attempting to move past the trading range that they have been stuck in all summer.

*** Stocks highlighted are for information purposes only and should not be considered as advice to purchase or to sell mentioned securities. As always, the use of technical and fundamental analysis is encouraged in order to fine tune entry and exit points to average seasonal trends.

Stocks Entering Period of Seasonal Strength Today:

Subscribers – Click on the relevant link to view the full profile. Not a subscriber? Signup here.

Home Capital Group, Inc. (TSE:HCG.TO) Seasonal Chart

Eli Lilly & Co. (NYSE:LLY) Seasonal Chart

West Fraser Timber Co. Ltd. (TSE:WFT.TO) Seasonal Chart

Lennox Intl Inc. (NYSE:LII) Seasonal Chart

Energy Fuels, Inc. (TSE:EFR.TO) Seasonal Chart

Curtiss Wright Corp. (NYSE:CW) Seasonal Chart

F.N.B. Corp. (NYSE:FNB) Seasonal Chart

W. R. Berkley Corp. (NYSE:WRB) Seasonal Chart

Dine Brands Global, Inc. (NYSE:DIN) Seasonal Chart

Perficient, Inc. (NASD:PRFT) Seasonal Chart

First Asset Tech Giants Covered Call ETF (CAD Hedged) (TSE:TXF.TO) Seasonal Chart

iShares U.S. Aerospace & Defense ETF (NYSE:ITA) Seasonal Chart

The Markets

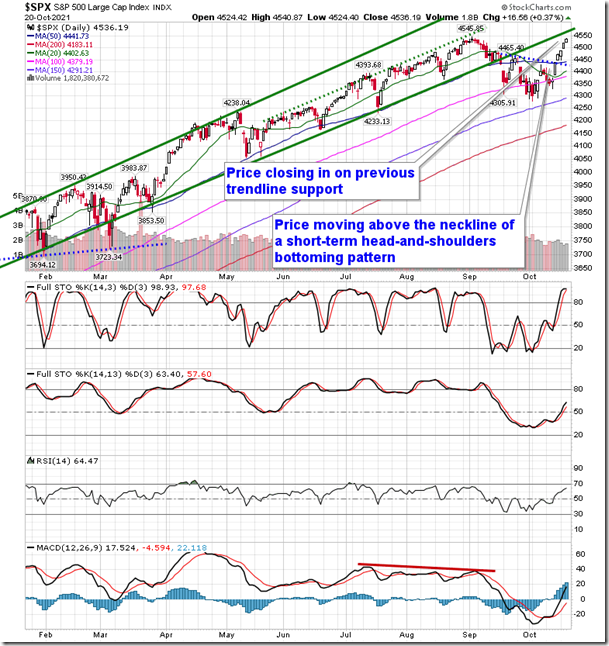

Stocks tacked on further gains on Wednesday as earnings enthusiasm continues to drive investors towards stocks. The S&P 500 Index gained just less than four-tenths of one percent, testing levels around the all-time highs that were charted at the start of September around 4545. The 20-day moving average of the large-cap benchmark has started to curl higher in recent days, placing the short-term trend on a positive tilt. Hints that the 50-day moving average is set to do the same offers an encouraging sign for the intermediate-term trend. Both moving averages are now in positions of support, which is what we like to see in order to be comfortable with the intermediate seasonal trends that we have pursued in recent weeks. We continue to anticipate that we could see some consolidation around the previous all-time peak before the end of October before the next momentum burst is realized into the month of November, assuming the fundamental backdrop remains intact. The upside target of a short-term head-and-shoulders pattern points to 4575, which is less than a percent away.

Today, in our Market Outlook to subscribers, we discuss the following:

- Mid-cap stocks

- The brick wall that the technology sector is up against

- Pharmaceutical stocks

- US Petroleum Inventories and the impressive trend of demand

- Crude oil and the target for the commodity

- Canada Consumer Price Index (CPI and what is driving activity

Subscribe now and we’ll send this outlook to you.

Sentiment on Wednesday, as gauged by the put-call ratio, ended bullish at 0.76.

Seasonal charts of companies reporting earnings today:

S&P 500 Index

TSE Composite

This post was originally publised at Vialoux's Tech Talk.