by Rob Waldner, Invesco Canada

Are we further along in the economic cycle than expected? Maybe so, says Rob Waldner. He cites supply chain and labour market issues as factors that could hold back economic growth.

On the face of it, global growth is looking solid, as major economies reopen from the pandemic. The swift recovery since the shutdowns has already brought the overall level of U.S. gross domestic product (GDP) back to the levels that prevailed at the end of 2019, and we expect it to do the same for the eurozone during the third quarter. Furthermore, the rates of growth that we are seeing are well above what we have gotten in past economic recoveries.1 So growth news is all good, right? Not so fast — despite the good growth momentum recently, there are some real concerns about growth now, and issues that could also create risks for markets going forward.

Global growth momentum is slowing

High frequency data such as Purchasing Managers’ Index (PMI) data are showing that manufacturing growth momentum is slowing. As shown below, U.S. and European PMIs are still in expansion territory (above 50), but have been declining, indicating that the manufacturing expansion is losing momentum. PMI indicators have a strong correlation with the economic cycle and are important indicators to consider in market discussions.

Manufacturing survey data have peaked

In addition, recent GDP data have signaled some warning signs that the global economy may be held back by a variety of factors going forward. U.S. GDP underperformed expectations in the second quarter, and the underperformance was largely due to a run-down in inventories. Second-quarter GDP grew at a rate of 6.5%, but would have been 1.3% higher if inventories had not declined during the quarter.2

In other words, the economy was unable to produce at the rate of demand in the economy. Normally we would expect such a run-down in inventories to lead to more production in coming periods as inventories are being rebuilt, but recent events in supply chains are starting to raise concerns that production bottlenecks may be more of a risk than many expect and may take a lot longer to work through than desired. This will likely have medium term impacts on growth and possibly inflation across major markets.

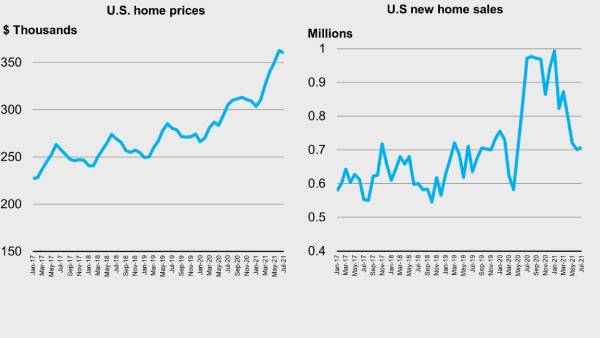

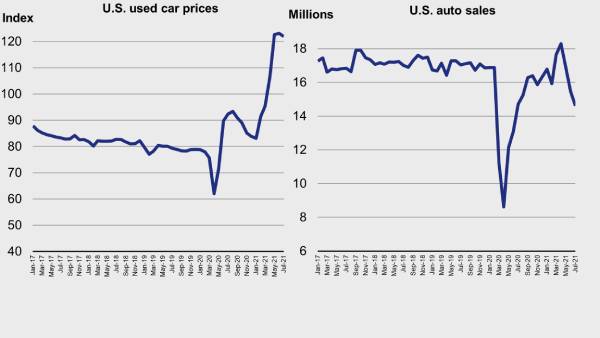

Autos and homes impacted by supply chain issues

There are signs of supply chain issues in many parts of the economy, but two industries that have been particularly impacted recently are autos and housing. The charts below show that both industries have seen recent declines in output, even while prices have been increasing. This is a highly negative set of circumstances in an environment in which demand continues to be robust and may hold back overall levels of economic growth and put upward pressure on prices. If the supply chain bottlenecks driving these moves are not resolved in short order, it could have a longer lasting impact on the overall output of the global economy and the vigorousness of the recovery going forward.

Despite rising prices, recent sales volume has declined for homes and autos

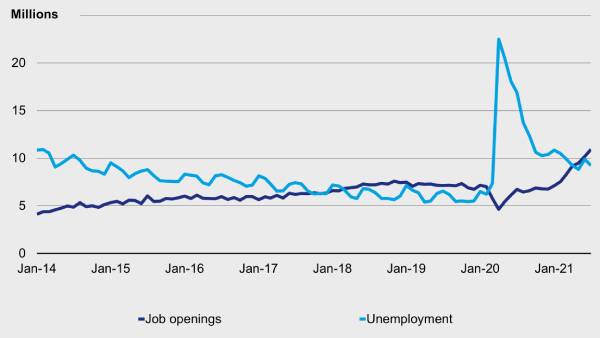

The labour market has underperformed expectations

Another worry for the economy, especially in the U.S., is developments in the labour market. Although job growth has been robust in recent quarters as the economy has reopened, the labour market has underperformed our expectations. While there are a number of factors that likely have been at play, anecdotal evidence and recent data hint at a deeper issue. As shown below, the number of job openings continues to climb sharply and now stands at 10.9 million, which means there are 2.3 million more job openings than unemployed people in the U.S. economy.3

Job openings should support the labour market

The demand for labour is outstripping the available labour in the economy, and the process of getting workers back and gainfully employed appears to be more difficult than hoped. Invesco Fixed Income believes that ongoing lack of labour to support economic activity and difficulties in matching unemployed workers with employers will likely hold back growth and dampen the vigour of the recovery going forward.

Conclusion

While we continue to expect the global economy to expand through the balance of this year and next, there are growing signs that supply chain and labour market issues could hold back growth and lead to weaker growth outcomes than we had expected. That may mean that we are further along in our economic cycle. Central banks are preparing to remove stimulus across many global economies. A weaker-than-expected growth outcome and reduced stimulus may create headwinds for markets going forward.

1 Source: US Bureau of Economic Analysis, based on GDP data from 1953 to present.

2 Source: US Bureau of Economic Analysis. Data as of Aug. 26, 2021

3 Source: US Bureau of Labor Statistics. July JOLTS data (Sept. 8, 2021) versus August unemployment data (Sept. 3, 2021)

This post was first published at the official blog of Invesco Canada.