by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

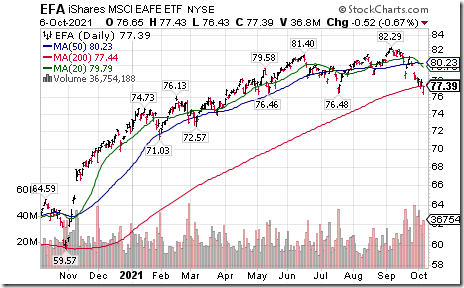

EAFE iShares $EFA moved below $76.48 and $76.48 completing a double top pattern.

Emerging Markets ETF $EEM moved below $49.11 extending an intermediate downtrend.

Turkey iShares $TUR moved below $20.88 extending an intermediate downtrend.

Base Metals ETF $XBM.CA moved below $16.60 setting an intermediate downtrend.

Marvel Technology $MRVL moved above 64.07 to an all-time high extending an intermediate uptrend.

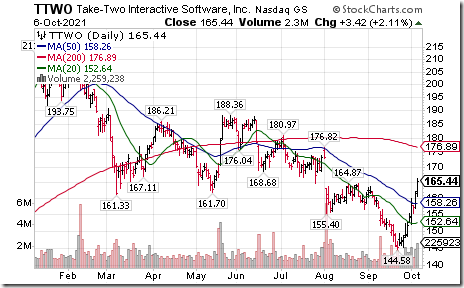

Take Two Interactive $TTWO a NASDAQ 100 stock moved above intermediate resistance at $164.87

Trader’s Corner

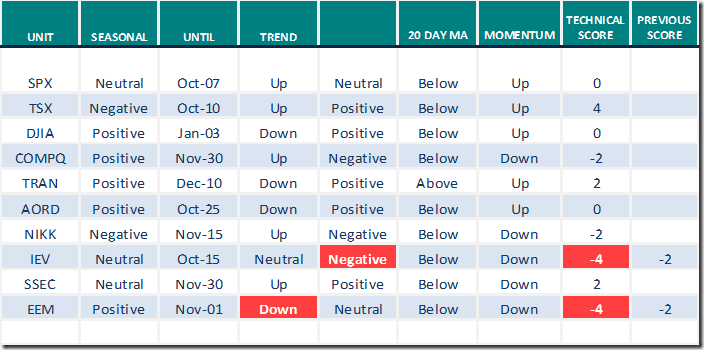

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for Oct.6 2021

Green: Increase from previous day

Red: Decrease from previous day

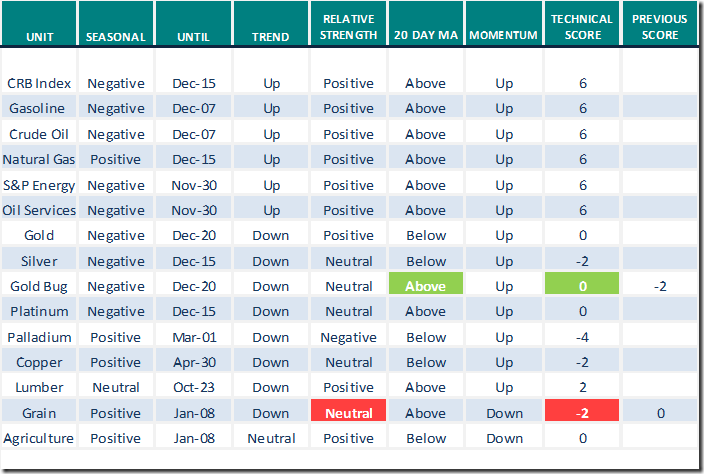

Commodities

Daily Seasonal/Technical Commodities Trends for Oct.6 2021

Green: Increase from previous day

Red: Decrease from previous day

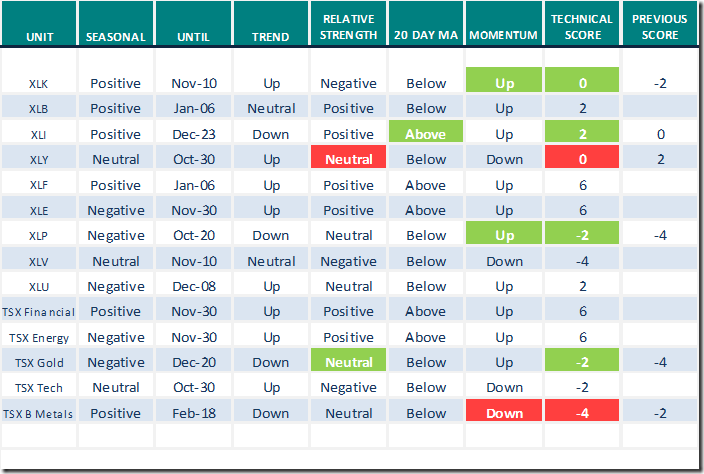

Sectors

Daily Seasonal/Technical Sector Trends for Oct.5 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Links from Valued Providers

Greg Schnell focuses on the mining sector.. Headline reads, “Miners poke a head out of the hole”.

Miners Poke A Head Out Of The Hole | Greg Schnell, CMT | Market Buzz (10.06.21) – YouTube

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following links to comments and videos:

https://uncommonsenseinvestor.com/why-a-60-40-etf-is-the-stupidest-worst-you-could-buy-right-now

These Stocks Can Grow Faster Than the Economy & Inflation – Uncommon Sense Investor

Investor with $2 Million Gets Advice on How to Find An Advisor – Uncommon Sense Investor

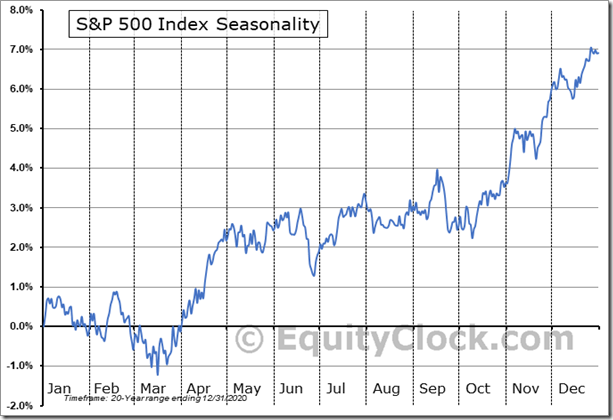

Seasonality chart of the day

from www.EquityClock.com

On average during the past 20 years, the S&P 500 Index has reached a seasonal low on October 7th followed by a significant advance to the first week in January.

S&P 500 Momentum Barometers

The intermediate term Barometer added another 2.00 to 35.67 yesterday. It remains Oversold and shows additional signs that a low was reached on Monday.

The long term Barometer added 0.60 to 69.14 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.93 to 35.19 yesterday. It remains Oversold.

The long term Barometer added 1.39 to 61.57 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.