by The editor's desk, AGF Management Ltd.

The U.S. debt ceiling has once again emerged as a top concern of investors, but just how worried they should be all depends on when and whether the United States Congress can negotiate a plan to raise or suspend the country’s debt limit and save the U.S. Treasury from the sure-fire catastrophe of default. Here is a brief “by the numbers” history of the ceiling and what might be in play for it and equity markets moving forward.

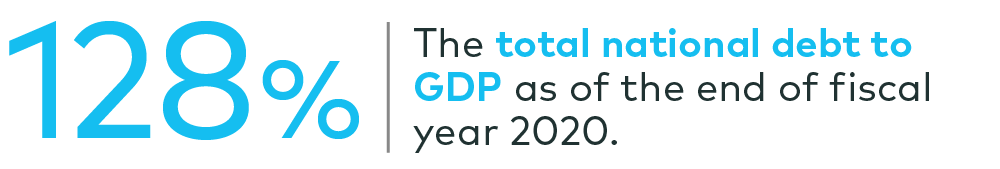

Source: The U.S. Department of the Treasury

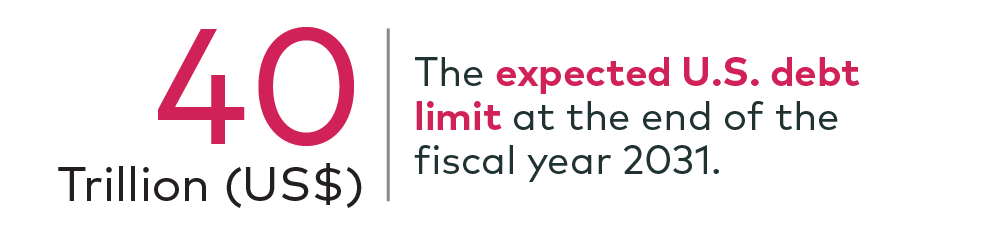

Source: Peter G Peterson Foundation live tracker, Sept 30, 2021

Source: Congressional Research Service (CRS), March 17, 2021, In Focus: The Debt Limit

Source: CRS, March 17, 2021, In Focus: The Debt Limit

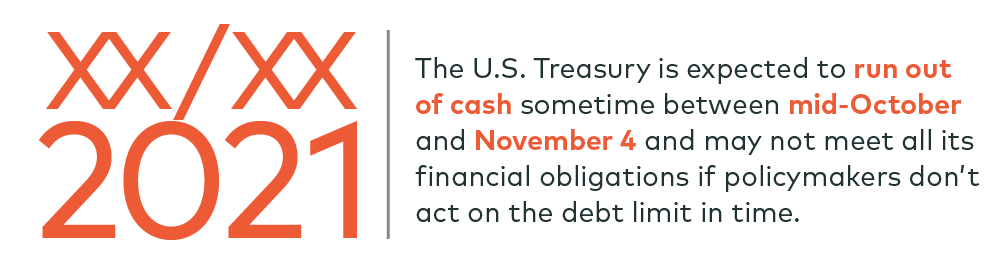

Source: The Bipartisan Policy Center, Sept 24, 2021, BPC Updates Debt Limit “X Date” Projection: Likely to Arrive Between October 15 and November 4

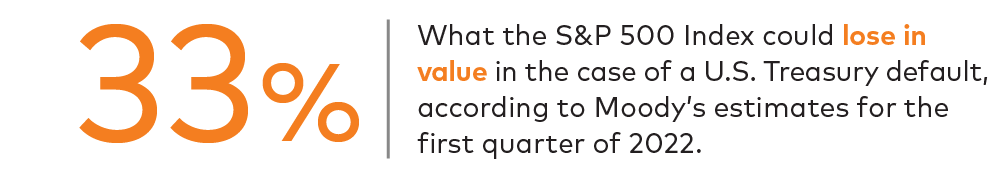

Source: Moody’s Analytics, Sept 21, 2021, Playing a Dangerous Game with the Debt Limit

Source: CRS, March 17, 2021, In Focus: The Debt Limit

Source: ThoughtCo., December 16, 2020, 6 Modern U.S. Presidents Who Raised the Debt Ceiling

Source: Moody’s Analytics, September 21, 2021, Playing a Dangerous Game with the Debt Limit

Source: CRS, March 17, 2021, In Focus: The Debt Limit

The commentaries contained herein are provided as a general source of information based on information available as of September 30, 2021 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or reliance on the information contained herein. Investors are expected to obtain professional investment advice.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

®The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.