by Don Vialoux, EquityClock.com

Responses to the Federal Reserve’s News at 2:00 PM EDT

The Federal Reserve maintained the Fed Fund Rate at 0.00%-0.25%. The Federal Reserve continues to purchase assets valued at $120 billion per month without tapering. Timing for start of tapering depends upon data showing additional recovery in the U.S. economy and could be announced as early as the next FOMC meeting on November 2-3rd. Responses to news after 2:00 PM EDT were as follows:

Yield on 10 year Treasury yields moved higher while yield on 2 year Treasuries were virtually unchanged. Interest rate spread on Treasuries rose sharply.

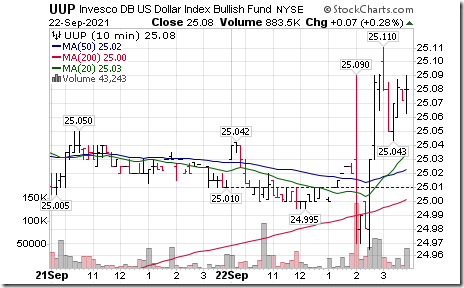

U.S. Dollar Index ETN strengthened with higher long term Treasury yields.

S&P 500 Index was virtually unchanged.

Financial Services SPDRs initially moved higher, but closed virtually unchanged.

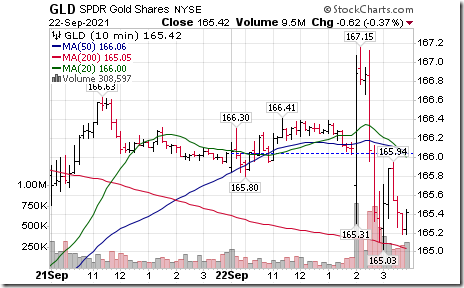

Gold ETN initially moved higher, but closed lower.

Technical Notes released yesterday at

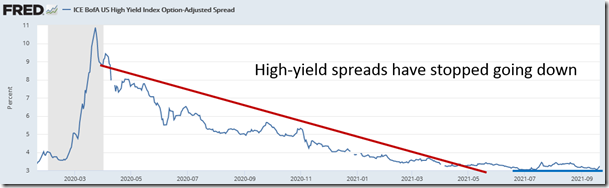

High yield spreads have stopped going down. equityclock.com/2021/09/21/… $STUDY $MACRO $JNK $HYG $LQD

Facebook $FB an S&P 100 stock moved below intermediate support at $347.70

Peloton $PTON a NASDAQ 100 stock moved below $96.06 extending an intermediate downtrend.

Incyte $INCY a NASDAQ 100 stock moved below $70.97 extending an intermediate downtrend.

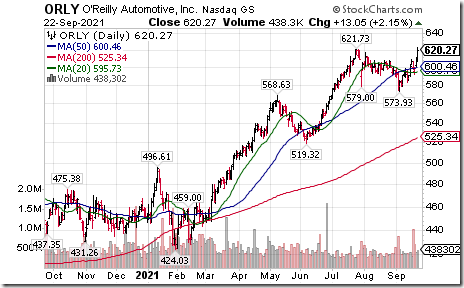

O’Reilly Automotive $ORLY a NASDAQ 100 stock moved above $621.73 to an all-time high extending an intermediate uptrend.

Trader’s Corner

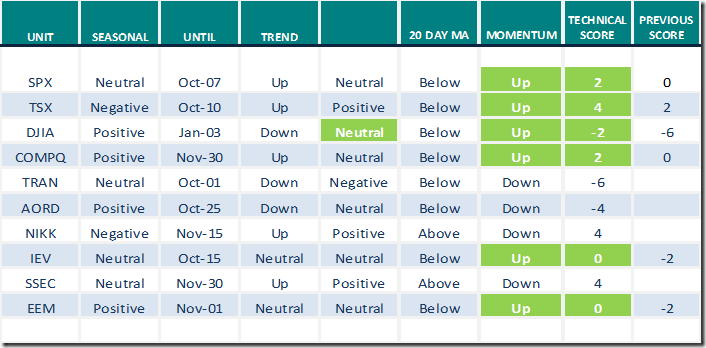

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

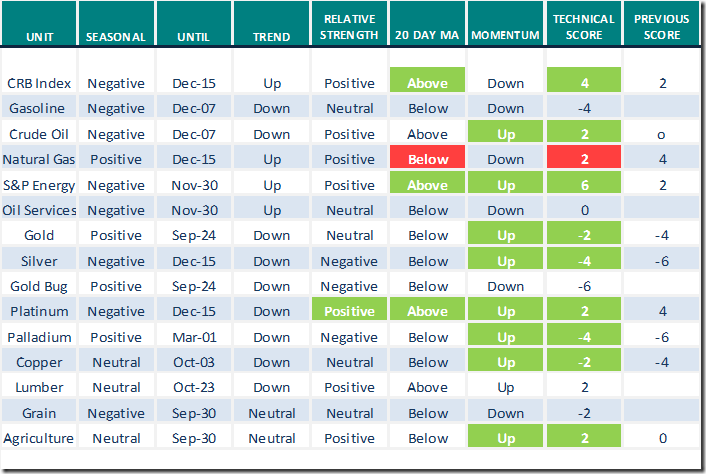

Commodities

Daily Seasonal/Technical Commodities Trends for September 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

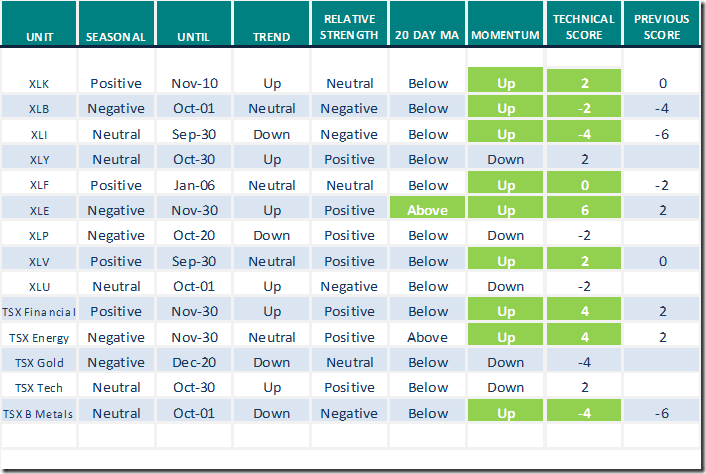

Sectors

Daily Seasonal/Technical Sector Trends for September 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Links from valued providers

Education: How to Draw and Use Trend Lines | Greg Schnell,

https://www.youtube.com/watch?v=Vs0KdcCIkmI

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for the following links:

How to High Grade Your Portfolio For 2022 – Uncommon Sense Investor

Four Reasons the Evergrande Debacle Will Not Sink Stocks – Uncommon Sense Investor

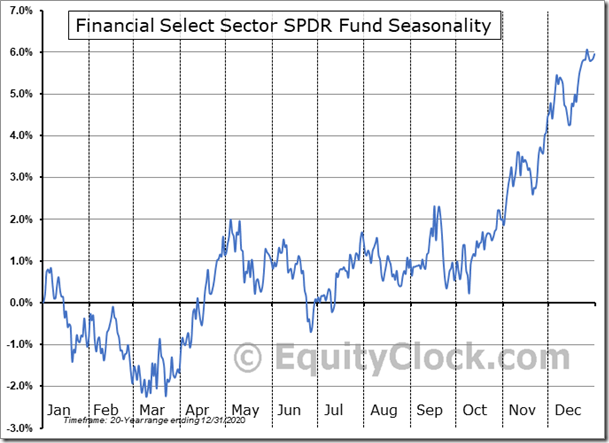

Seasonality Chart of the Day from www.EquityClock.com

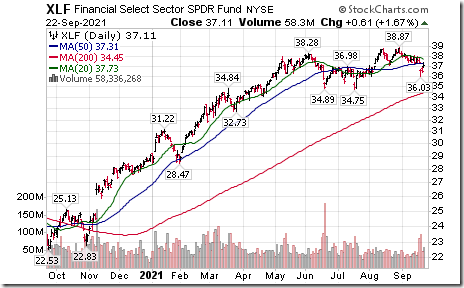

Seasonal influences on a real and relative basis for Financial SPDRs (XLF) normally bottom near the third week in September for a seasonal trade lasting until January 3rd

XLF is expected to benefit from increasing interest rate spreads. Intermediate trend is up. A move by units above their 20 day moving average at $37.73 and 50 day moving average at $37.31 will attract technical buyers. Short term momentum indicators turned higher yesterday. A move above $38.87 to an all-time high will attract additional technical buying.

S&P 500 Momentum Barometers

The intermediate term Barometer added 7.01 to 37.27 yesterday. It remains Oversold.

The long term Barometer gained 4.21 to 69.74 yesterday. It remains Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 3.66 to 49.03 yesterday. It remains Neutral.

The long term Barometer added 2.60 to 66.99 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.