The Delta variant and supply constraints are the biggest worries for the global outlook.

by Carl Tannenbaum, Executive Vice President, and Chief Economist, Ryan Boyle, and Vaibhav Tandon, Northern Trust

Advanced economies have continued to reopen with an emphasis on adapting to life with the virus still present. Some emerging markets (like India) are willing to tolerate much higher infection rates to limit the economic fallout. At the other end of the spectrum are Asian countries (like Vietnam) with low vaccination rates, which have adopted a zero or low infection tolerance. The trajectory of growth across countries will continue to be determined by these asymmetric approaches.

The rapid recovery in highly vaccinated countries is running into supply-side constraints emanating from Asian economies with more limited vaccination coverage. The initial surge of the recovery is behind us, and we are now in a phase in which supply constraints will limit activity and add to price pressures.

Inflation remains high in most markets, driven by positive base effects, idiosyncratic factors, and supply-demand mismatches. Labor markets are recovering swiftly, but Delta-related bottlenecks are proving to be more durable than expected. We expect price pressures to persist through next summer, prompting central banks and governments to dial back on their accommodation.

This month’s edition offers a deep dive into China’s economy, which has been battling fresh infections and a host of other domestic challenges.

China

- The Delta variant and related restrictions have weighed on the Chinese economy over the past several months. Economic activity and sentiment have suffered as consumers and businesses deal with uncertainty over the trajectory of the virus. While restrictions have recently eased, new outbreaks and containment measures remain a threat to the economy. We expect growth in China to continue to slow, with real gross domestic product increasing 4.0% year-over-year for 2021, modest by Beijing’s standards.

- Consumption has been the weakest link of the recovery in China and continues to disappoint. Real retail sales growth decelerated notably to 2.5% year-over-year in August. But it’s not just the consumers that are holding the economy back. The slowdown has become more broad-based. Fresh COVID-19 outbreaks, tightening macro policy and a regulatory reset have all played a role.

- The normalization of macro policy is weighing on real estate and infrastructure investments, which have been the main drivers of recovery in the past year. Fixed asset investment fell in July, while housing sales plunged 17.6% in August compared to the same period last year. With an eye on deleveraging, Beijing is tightening lending restrictions by raising mortgage rates, placing caps on property loans, temporarily halting land auctions in major cities, and barring private equity funds from raising money for investment into residential projects.

- China’s non-financial corporations are heavily indebted. While the risk of a systemic financial crisis remains low, rising debt defaults coupled with ongoing deleveraging efforts could add to financial stress. Concerns about the solvency of developers and financial institutions linked to the country’s deteriorating property sector are mounting. Evergrande is the clearest example thus far, but financing difficulties are starting to spread to other developers. A managed restructuring, which looks imminent, will be disruptive no matter how it’s done, but should help reduce systemic risk.

- Chinese policymakers want to avoid significant easing of macro policy, but the fear of a hard landing could force them to act. In our base case, we expect policymakers to rely on measures like a cut in the reserve requirement ratio and an increase in local government special bond issuance to underpin the economy. Tighter regulatory and lending conditions will persist, but a messy default by Evergrande could cause a reversal.

- Beijing has also introduced a slew of new regulations this year, guided by the aim to promote “common prosperity.” The technology sector has been a particular focus; the stocks of internet companies have slumped and investor confidence has been shaken. New regulations could impact the competitive landscape and profitability of firms in the affected sectors.

- While the reopening surge and supply-side disruptions are leading to high inflation readings in several advanced and emerging markets, inflationary pressures in China remain subdued (the CPI is up only 0.8% year-over-year). That said, pipeline pressures are building, with producer prices rising 9.5% in August, the fastest rate since 2008. Higher global commodity prices and skyrocketing shipping costs are at play. We expect inflation to increase in the coming months, but not beyond policymakers’ comfort zones.

- Exports remain the silver lining of the Chinese economy amid strong demand for consumer goods. However, the near-term outlook is clouded by the hit to the manufacturing sector from supply chain constraints at home and in neighboring nations. Demand rebalancing from goods to services will dampen China’s export growth. S. tariffs and sanctions are also a headwind for exports and the economy.

- Low efficacy of Beijing’s home-grown vaccines against the Delta variant and its zero-tolerance approach to fighting the virus imply that economic activity remains vulnerable to future waves. This alone could deliver a major setback to economic growth; coupled with the regulatory efforts discussed above, China’s challenges are mounting.

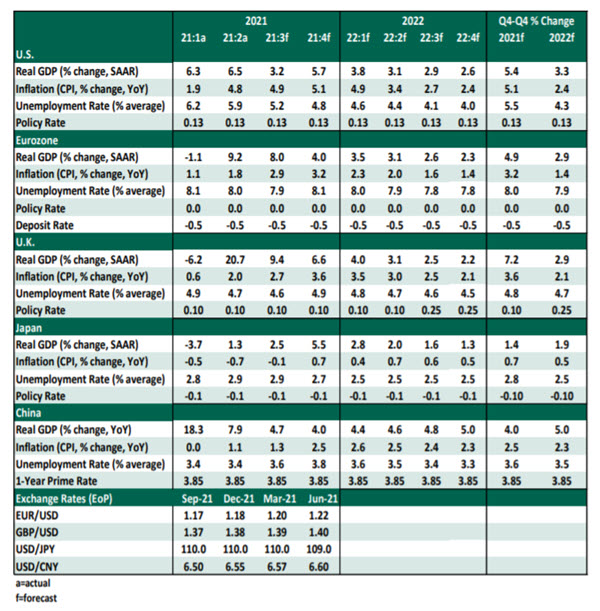

Global Economic Forecast - September 2021