by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Overnight weakness in world equity markets related to collapse of a huge Chinese real estate company has triggered intermediate breakdowns in a wide variety of big cap U.S. stocks including $KMI $CAT $UPS $AMD $IBM $SWKS $DOW

More big cap U.S. equity breakdowns! $AAPL moved below intermediate support at $141.46. $NXPI moved below intermediate support at $184.44. Pepsico $PEP moved below $153.04 completing a Head & Shoulders pattern.

With Chinese equity markets closed for a holiday today and tomorrow, traders are looking for guidance through Chinese equities and ETFs trading on U.S. exchanges in U.S. Dollars. $FXI is a bellwether for big-cap Chinese equities, down 4.2% today.

Weakness in the Canadian Dollar relative to the U.S. Dollar is weighing on Canadian equity indices in terms of U.S. Dollars Canadian iShares $EWC are much weaker than the $TSX.CA

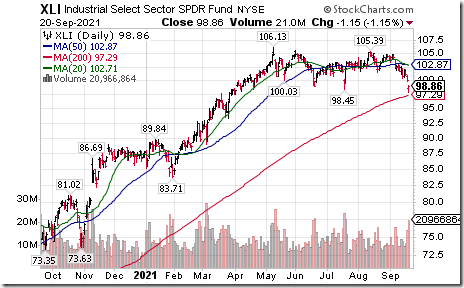

Notable economic sensitive U.S. ETFs, that broke intermediate support and set an intermediate downtrend, included $XLI $XLF and $GDXJ .

Base metals ETFs on both sides of the border moved below support setting intermediate downtrends. $PICK $XBM.CA $ZMT.CA $XME

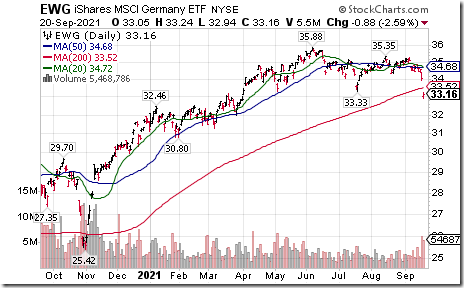

A wide variety of international equity ETFs trading in U.S. dollars moved below support setting intermediate downtrends including $EWG $EWA $EWY $EZU

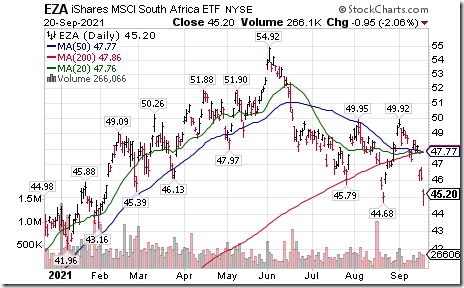

Another country ETF breakdown! South Africa iShares $EZA moved below $44.68 extending an intermediate downtrend.

TSX 60 stocks moving below support setting intermediate downtrends included $TD.CA $CCL.B.CA $BAM.A.CA

More TSX 60 intermediate breakdowns: $SHOP.CA and $BNS.CA . ScotiaBank moved below $76.56 completing a Head & Shoulders pattern

Lithium ETN $LIT moved below $78.90 completing a double top pattern.

Trader’s Corner

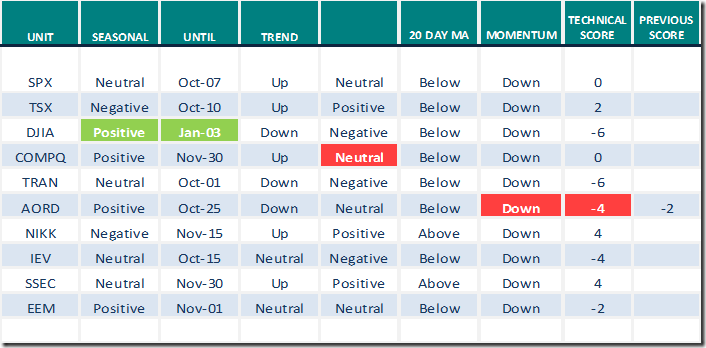

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for September 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

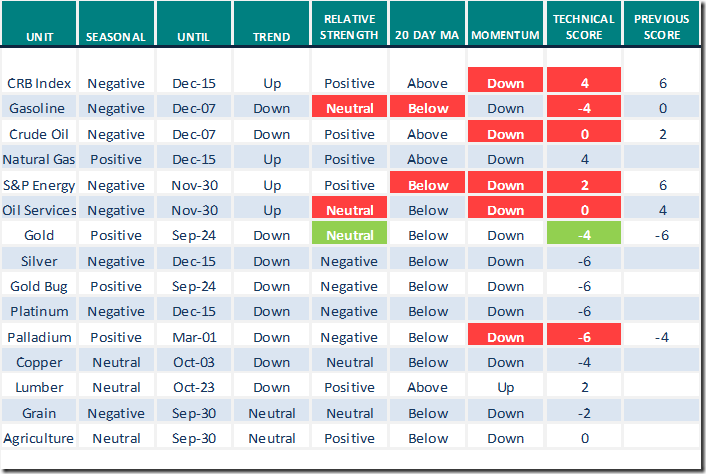

Commodities

Daily Seasonal/Technical Commodities Trends for September 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

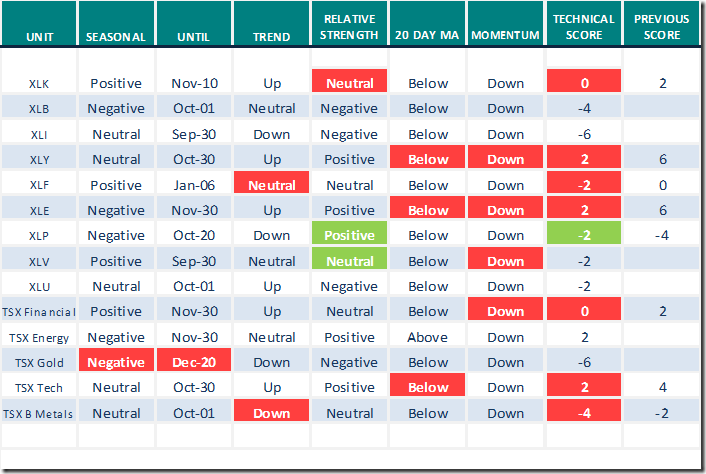

Sectors

Daily Seasonal/Technical Sector Trends for September 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Comment for Investor’s Digest

Editor’s Note: Tech Talk was asked last week by Investor’s Digest for a “Top Pick”. Comments were published over the weekend. Selection was the base metals sector and its related equities and ETFs. Technical action by the sector yesterday was decidedly negative and previous technical comments offered to Investor’s Digest no longer apply: Worldwide weakness in equity markets including the base metal sector was triggered by concern about financial difficulties by a major Chinese real estate company. However, favourable seasonal and fundamental prospects for the base metals sector remain intact. Preferred strategy is to wait for an entry point in the sector when short term technical indicators (e.g. Stochastics, RSI, MACD) turn positive. Following are notes offered during the interview with Investor’s Digest last week.

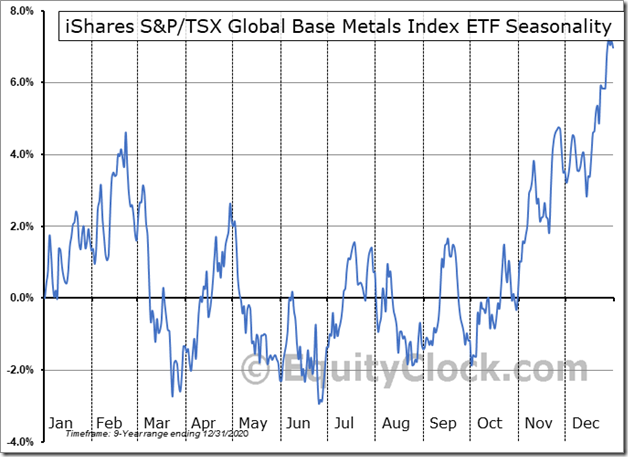

The outlooks for base metal prices and related base metal equities/ETFs are encouraging between now and next February.

Base metal prices (copper, zinc, aluminum, nickel) are rising. The base metals ETN trading on U.S. exchanges (Symbol: DBB based on a one third weight each in copper, zinc and aluminum) broke to an all-time high last week.

Seasonal influences for base metal prices on a real and relative basis (relative to the S&P 500 Index) are positive from the end of September to the end of February

Base Metal equities and related Exchange Traded Funds (e.g. COPX, PICK and XBM.TO) currently show an improving technical profile. XBM.TO at Cdn$18.42 recently moved above its 20 and 50 day moving averages. Intermediate trend remains up. Strong intermediate support is indicated near $16.75. An all-time high is reached on a move above $20.70. Strength relative to the S&P 500 and TSX Composite Index turned positive last week. On-balance volume shows positive accumulation since mid-June.

Demand and supply for base metals currently are unbalanced. Demand has increased strongly thanks to recovery in world economies following late stages of the COVID 19 pandemic. Demand in the U.S. is expected to accelerate if and when proposed infrastructure programs are approved by Congress later this month. Demand by Far East countries, notably by China already is accelerating as the country resumes post COVID 19 economic growth. Supply recently has been constrained by the shutdown of mines notably in South America due to COVID 19 infections. A decision last week by President Biden to withhold permitting for construction of a new copper mine in Southeast Arizona raises concerns about development of additional base metal production in the U.S.

Seasonal influences for Base Metal equity ETFs (e.g. COPX, PICK and XBM.CA) turn positive at the end of September for a significant upside move to the end of February.

Long term demand for “green” base metals, notably copper and nickel is expected to accelerate as world economies support the “greening” of economies. Greg Schnell, the Canadian Technician, in a report released on September 13th entitled “Green Power – All aboard?” noted that “Copper is the most important metal in the greening of our energy sources”.

Base metal prices are highly sensitive to inventories held by metals exchanges in London, New York and China. According to www.Kitco.com the London Metals Exchange recorded a

peak for Aluminum, Zinc and Nickel inventories in April/early May followed by significant drawdowns. Copper inventories continued to increase.

Recommendation: Weakness in base metal prices and base metal equity prices between now and early October will provide an opportunity to accumulate favoured base metal equities, Exchange Traded Notes and Exchange Traded Funds for a seasonal trade that could last to next February.

Interesting article from www.StockCharts.com yesterday

Headline reads, “The Correction Begins: The Worst Of September Is Coming” | John Kosar,

Following is the link:

https://www.youtube.com/watch?v=r8XflizkRNo

The article mentions the importance of a change in direction of the VIX Index yesterday

The article also discusses seasonal weakness in the S&P 500 Index during the last two weeks in September.

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 12.02 to 31.86 yesterday. It changed from Neutral to Oversold on a move below 40.00, but continues to trend down.

The long term Barometer dropped 4.61 to 67.13 yesterday. It remains Overbought and trending down.

TSX Momentum Barometers

The intermediate term Barometer plunged 15.53 to 38.35 yesterday. It changed from Neutral to Oversold on a move below 40.00, but continues to trend down.

The long term Barometer dropped 4.85 to 63.11 yesterday. It remains Overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.