by Carl R. Tannenbaum, Ryan James Boyle and Vaibhav Tandon, Northern Trust

The obstacles to a full recovery have been identifiable for some time: Viral resurgence, long-term unemployment, supply chain dislocation. We still expect these are temporary challenges, but all are proving more durable than we had hoped.

The Delta strain of COVID-19 caused a surge that again stretched hospital capacity and challenged the outlook for recovery. The virus was evident in the data as hiring slowed and inflation in the travel sector ended its rapid ascent, a sign of impaired consumer sentiment. The uneven recovery continues to teach us lessons about the fragility of the old economy; rebuilding will continue, but with a greater eye toward resilience.

Vaccines, rapid testing and quarantine protocols have made it possible to live productively with the virus, but an economy without a pandemic would be preferable. While the most rapid portion of the reopening may be behind us, this slower interval does not change our expectation of a continued recovery.

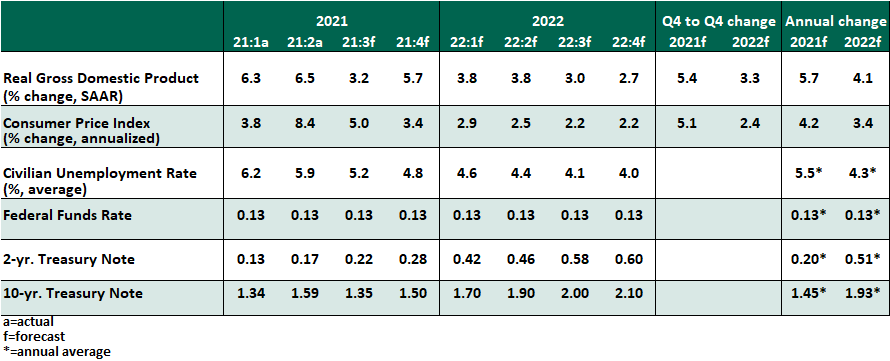

Key Economic Indicators

Influences on the Forecast

- The August Employment Situation Summary fell short of expectations. Only 235,000 jobs were created, leaving payrolls 5.3 million workers shy of the February 2020 peak. The labor force participation rate (total as well as prime-aged) did not change month-over-month; for growth to continue, more workers need to come off the sidelines.

- The slowdown was clearest in the leisure and hospitality sector, which added no jobs after recovering steadily in the first half of the year. The Delta variant has made a dent on customers’ willingness to visit and employees’ willingness to work in higher-contact settings.

- Temporary supports that may have slowed some workers’ return to the labor force have ended. Expanded unemployment insurance benefits lapsed at the start of September; the eviction moratorium was overturned; and children have returned to school in-person.

- In light of ongoing supply chain disruptions, we anticipate the third quarter will provide another depletion in inventories. In turn, this will weigh on other spending factors: Consumers cannot purchase, and businesses cannot invest in, items that are not available. This consideration has brought our estimate of third quarter gross domestic product growth to 3.2% at an annualized rate. However, we view this as mostly deferred activity. As supply linkages are restored, inventories will accumulate and spending will resume, with stronger growth to follow in the year ahead.

- The August reading of the consumer price index (CPI) remained elevated at 5.2% year-over-year. However, the core measurement, excluding food and energy, fell to 4.0%; food prices have been challenged by supply chains and weather events. Many of the product categories that led inflation upward earlier this year receded month-over-month, including air travel and used cars. The overall reading is still too high for comfort, but evidence of transitory effects coming to an end provides some reassurance.

- At the annual Jackson Hole monetary policy research symposium, Fed Chair Jerome Powell gave a speech that did not reveal any great hurry to begin tapering asset purchases. Slow job creation and more moderate inflation in August support the case for patience. Other Fed governors have signaled a greater willingness to begin winding down this policy. We expect an announcement of a tapering plan at the November 3 Fed press conference.

- Supply of housing remains constrained, as limited availability of building materials continues to weigh on builders’ capacity to start and finish new homes, keeping prices elevated. Meanwhile, urban centers are witnessing more interest from renters, helping to support rental price increases after a year of many tenants leaving cities. Shelter may be the next factor to apply upward pressure to inflation.

- Congress is working feverishly on four work streams: A 2022 federal budget, an increase to the debt ceiling, an infrastructure bill, and a broader partisan spending package. We expect the budget and debt ceiling to come down to the wire but will be ratified, as shutdowns and defaults reflect poorly on both parties. We further expect the infrastructure bill and a slimmed-down portion of the reconciliation bill to pass, which will unlock some long-term spending and reduce the fiscal drag caused by the expiration of temporary COVID programs.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2021 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.

Copyright © Northern Trust