by Hubert Marleau, Market Economist, Palos Management

Saturday is the day when I take some time to wonder what the broad forces and main factors were which moved the market, believing, perhaps pretending, that I know how to interpret economic prints and consume media macroeconomic musings correctly. I go through this weekly exercise because it helps me understand what the risks and rationales are in predicting what could come next.

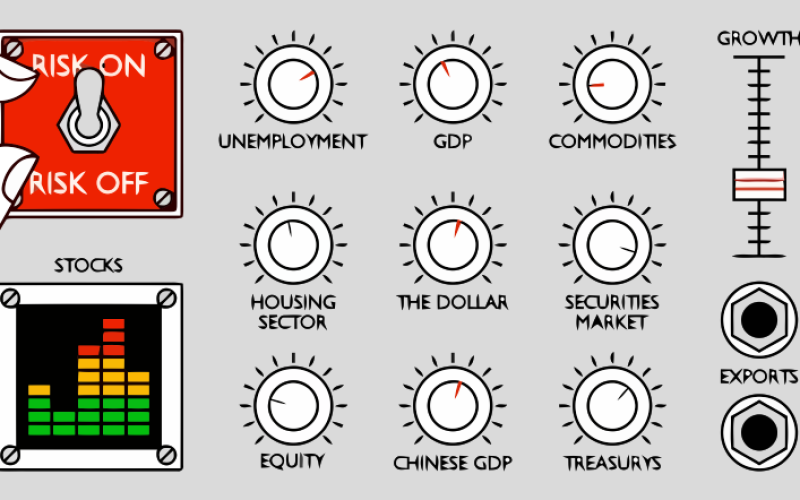

Downgrades to U.S. economic growth by various prominent dealers like Goldman Sachs and Morgan Stanley have prompted investors to question whether market forecasts have been too optimistic or ahead of themselves. In the face of renewed concerns that the latest y/y push in producer prices to 8.3% could dent optimism for continuing monetary support and force Congress to pare back fiscal stimulus, the timing for a market reassessment of risk seems appropriate and even rational, given that:

- The Delta variant of Covid-19 is causing organizations to delay their return-to-work plans, curbing people from dining out and businesses from travelling;

- The Democrats have a new proposal for a 2% levy on share buybacks;

- The Biden administration is weighing an investigation into Chinese subsidies, destroying the belief that tensions between the two nations were cooling; and

- A looming debt ceiling stand-off trap could not only taint the Treasury but disrupt the collateral market.

- The betting markets have priced in only a 62% chance that the statutory corporate rate will be hiked from 21% to 25% next year.

According to Bespoke Investment Group, there have been only 13 streaks of 300 days or more without a 5% S&P 500 drawdown since 1928. Based on the aforementioned storyline, the timing to recalibrate over-weighted equity institutional portfolios seems ripe.

Possibly the S&P 500 tracker has had it too good for too long, but probably not. At this point, measuring the market performance from the pandemic low makes absolutely no sense. In the 18 months following the pre-pandemic high, the broad market rose 30% for an annual rate of about 20% compared to the compound rate of 17% over the past decade. Stretches of that length normally bring pullbacks due to portfolio rebalancing. From the all-time high recorded on September 2, the S&P 500 fell for five consecutive sessions to 4459, registering a loss of 78 points, or 1.7%, as billions of dollars of corporate bonds were being successfully floated to the public at large, in record amounts, eating money flows that would have normally found their way into equity funds.

Investors should bear in mind that a high level of valuations is more of a speed limit for future gains, as opposed to a harbinger of a bear market, especially when earnings growth is promising, cash dividends to shareholders are rising and share buybacks are gaining steam. Accordingly, I don’t think that investors should get freaked out by current valuations. While price-to-earnings, sales, book value and dividends are worthy of consideration, it remains that the Equity Risk Premium (ERP) is probably the best valuation metric to rely on. The equity risk premium is a long-term prediction of how much the stock market will outperform risk-free debt instruments. Calculating the ERP can be done by taking the estimated future returns on stocks, currently 4.83% (the inverse of the 12-month forward P/E) and subtracting them from the estimated future return on risk-free bonds (10-year TIPS real yield), which is presently -1.06%. In this connection, the excess return or “equity risk premium” is a comfortable 5.90%. The ERP is thus reasonably valued, both relative to bonds and in absolute terms.

While the ERP is analytically valid, and supported with empirical evidence, it does have limitations. The theory does not work well when the recessionary risks and inflationary expectations are very high. Fortunately, that is not the case today, even though there are concerns in the media. Beyond the five-year expectation that inflation will run on average around 2.6% per year, the annual inflation rate is expected to revert back to 2.0% over the next 25 years. Meanwhile, the risk of having a recession is practically non-existent. Moreover, the Atlanta Fed’s NowCasting is predicting that the Real GDP will grow 3.7% in Q3 while the one which is used by the NY Fed is calling for 3.8% growth in Q4. Initial jobless claims tumbled to a fresh low last week, suggesting the labour market is still on the mend despite disappointing job numbers for August. Counterintuitively perhaps to some, the wide disparity between vacancies, hires, openings and job losses actually bode well for employment growth—if the new accelerating vaccination rate can last.

Indeed, the risk-off mood is bound to eventually reignite the interest of the dip buyers and long-term investors, if the experience of the past two years is anything to go by. Algorithmic trading models are usually buyers at the 50-day moving average of the S&P 500. That comes to another 2.5% slide or 4350. Interestingly, bearish forecasts on the benchmark tend to be marked to the market. I’m not very excited about owning an index fund, but I see a lot of value where upside earnings surprises and dividend growers are located, like financials, industrials, energy, materials, health care and certain services.

P.S. The best commentary of the week was in the WSJ. Kenneth Rogoff wrote: “Journalist James Glassman and economist Kevin Hassett took to these pages in March 1998 to dismiss concerns of a stock market bubble and offer a rationale for why stocks could still go a lot higher. That was already sticking their necks out. But then they stuck them out further, arguing that over the long run the DJIA could go to 35000. Over the long run, stocks offer a higher return without significantly greater risk. Their basic rationale, which depended on investors gradually coalescing around their view, was that stocks had to rise as the market risk premium came into line with empirical reality. Later, in 1999, they stuck their necks out even further in a best-selling book titled ‘Dow 36000’. The book was viewed as somewhere between outrageous and absurd. On Friday the Dow traded above 35000.”

The fact that the broad market for stocks has outperformed safe bonds over the fullness of time even if one can construct exceptions makes the idea of zero long-term risk basically logical, empirically true and therefore credible. Patient investors should treat the ERP not as a theoretical puzzle but as an investment opportunity indicator.

Copyright © Palos Management