by Brian Levitt, Global Market Strategist, North America, Invesco

September has a pretty bad reputation among investors, but is the wariness warranted? Brian Levitt explains why the case against September may be overstated.

The band Green Day sang, “Wake me up when September ends.” You can’t blame investors for feeling the same way. Over the past 120 years, September has been the worst month of the year for U.S. stocks, both on average and median.1 The media makes certain each year to remind us of this fact. Is there a rational explanation for this seasonal pattern or is it just a statistical anomaly?

I have heard everything from A) Investors sell stocks when they return from their summer vacations to B) Investors are forced to sell stocks to pay for their children’s college education to C) Mutual fund managers with fiscal years that end in the fall, sell their losers for window-dressing purposes. The last one would be on to something, but for the fact that a wide majority of mutual funds have fiscal years that end in December. And weren’t the investors returning from their summer vacations supposed to have already sold in May before they went away anyway? I’m confused.

The reality is that while average returns in September have been negative (as shown below), it is largely the case of a few bad Septembers (1929, 1930, 1931, 1933, 1937, 1974, 2001, 2002, 2008) spoiling a month’s reputation.1 Each of those Septembers are associated not only with recessions but some of the more spectacular downturns — The Great Depression, 9/11, the collapse of Lehman Brothers — on record. Those infamous September declines range in severity from a 30% decline in 1931 to a 6% decline in 2008, with the other ones mentioned falling within that range.

On the surface, September has been a rough month for stocks

Dow Jones Industrial Average: Average and median returns by month, 1900 – August 2021

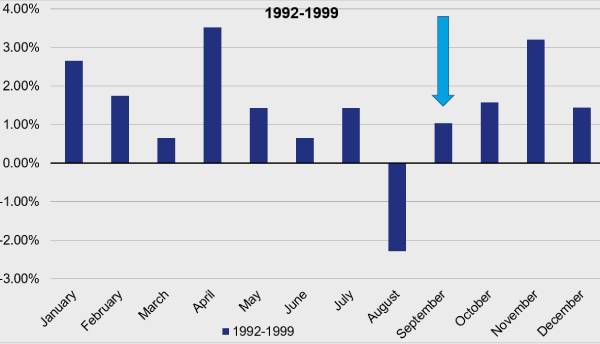

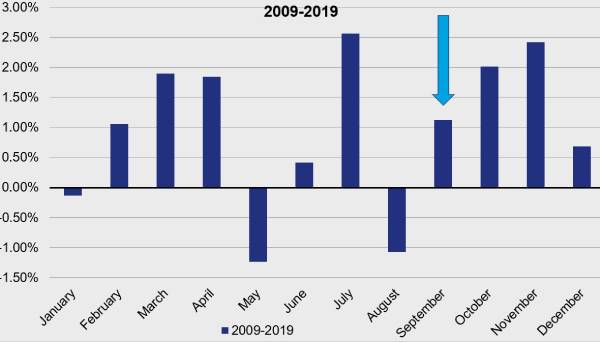

Admittedly, it’s hard to believe in coincidence, but it’s almost harder to believe that it’s anything more sinister. For example, there was nothing menacing about the average market returns of September within the past three business cycles of 1992 to 1999, 2003 to 2007, and 2009 to 2019 (shown below).

The average returns in September over those periods were 1.04%, 1.01%, and 1.13%, respectively.2 That’s good enough for September to not be the worst performing month over the last three business cycles. That indignity falls to August.1 For what it’s worth, January, February, March, May, and June also posted lower average returns than September over those periods.1 As Homer Simpson said, “… people can come up with statistics to prove anything … Forfty percent of all people know that.”

In the past three cycles, September has surpassed its reputation

Dow Jones Industrial Average: Average returns by month

What will this September bring?

So, will this September join the ranks of the infamous Septembers of the past, or will it look more like September 1998 (+4.0%), September 2007 (+4.0%) and September 2010 (+7.8%)?1 Only time will tell. To quote Green Day once again, “It’s something unpredictable.” In the end, will it be right? For long-term investors, we suspect it will be. Over the past 120 years, stocks have posted positive returns 87% of the time over any three-year period, 90% of the time over any five-year period, and 97% of the time over any ten-year period, the bad Septembers of the past notwithstanding.1

I hope you (have) the time of your life.

1 Source: Bloomberg, 8/31/21. Stocks are represented by the Dow Jones Industrial Average.

2 Source: Bloomberg, 8/31/21. Stocks are represented by the Dow Jones Industrial Average. Periods selected are based on business cycles as defined by the National Bureau of Economic Research.

This post was first published at the official blog of Invesco Canada.