by Don Vialoux, EquityClock.com

Seasonal weakness and greater volatility appears in North American equity markets

S&P 500 Index moved below its 20 day moving average

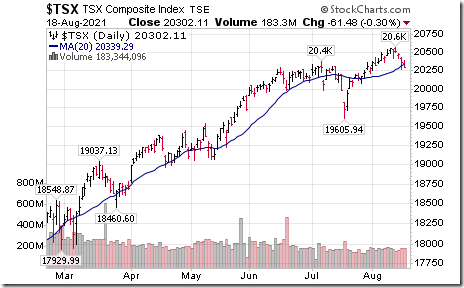

TSX Index moved below its 20 day moving average.

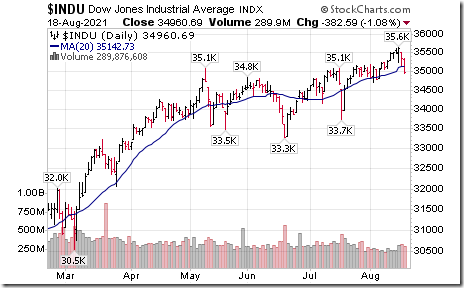

Dow Jones Industrial Average moved below its 20 day moving average

NASDAQ Composite Index moved below its 50 day moving average.

The VIX Index spiked.

Technical Notes released yesterday at

BHP Group $BHP moved below $84.54 completing a Head & Shoulders pattern. The company announced a major reconstruction of operations.

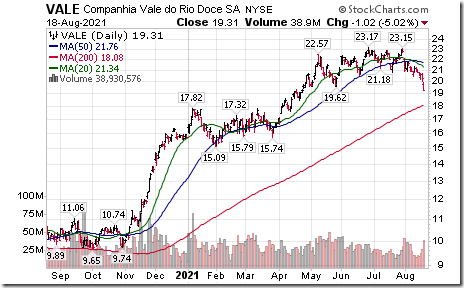

VALE SA $VALE one of the world’s largest base metals producer moved below $19.62 extending an intermediate downtrend.

Silver Equity ETF $SIL moved below $38.38, $38.22 and $38.10 setting a long term downtrend.

Palladium ETN $PALL moved below $229.16 extending an intermediate downtrend.

Salesforce $CRM a Dow Jones Industrial Average stock moved above $253.50 extending an intermediate uptrend.

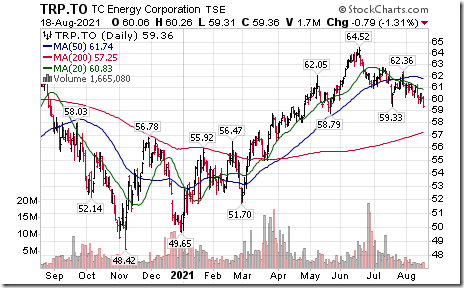

TC Energy $TRP.CA a TSX 60 stock moved below $59.33 completing a Head & Shoulders pattern.

CGI Group $GIB a TSX 60 stock moved below US$88.09 completing a Head & Shoulders pattern.

Trader’s Corner

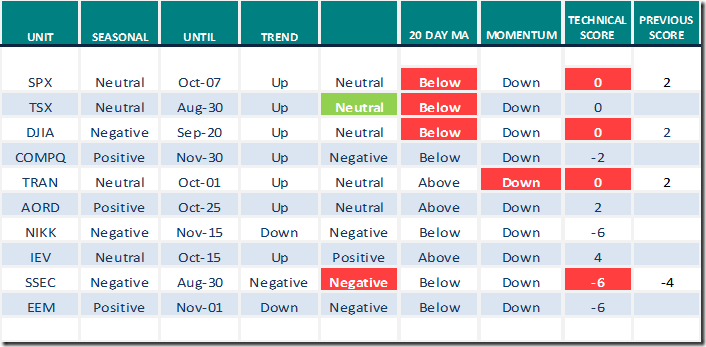

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

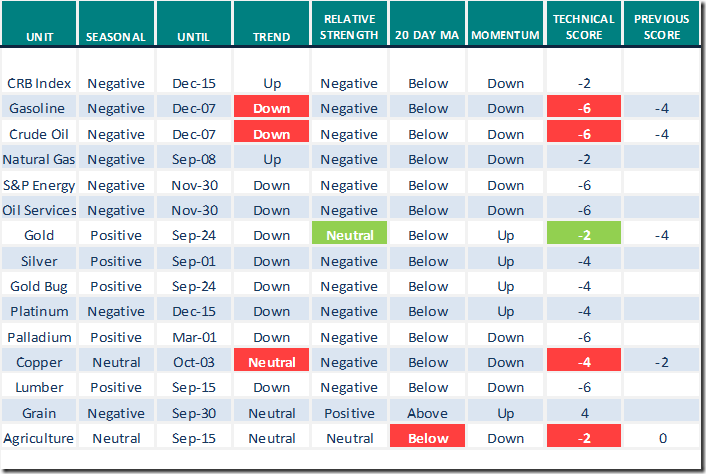

Commodities

Daily Seasonal/Technical Commodities Trends for August 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

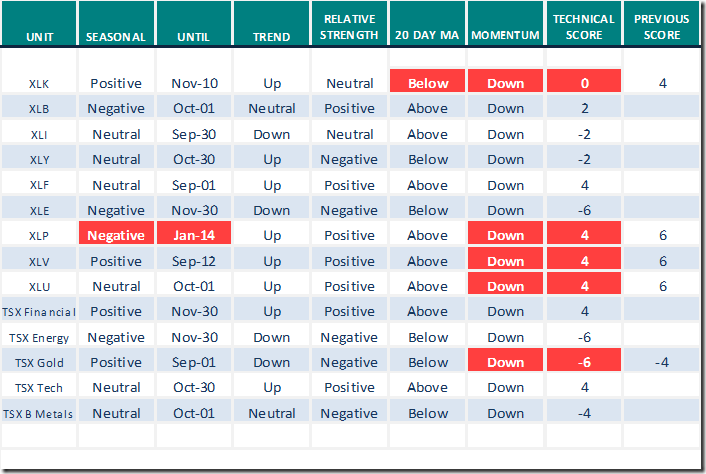

Sectors

Daily Seasonal/Technical Sector Trends for August 18th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Is Zillow the Google of Real Estate?

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for a link to the following comment and video:

This examination of Zillow is the first in a series of monthly, research-based videos we’re considering as a premium service to which we would charge a fair and reasonable amount for access.

After watching the video, please let us know if a premium service would be of interest to you by emailing the address below.

Please send comments and questions to this address:

www.info@uncommonsenseinvestor.com

Market Buzz

Greg Schnell discusses “a deep look into stocks”. Following is a link:

https://www.youtube.com/watch?v=75ncqHyGMcM

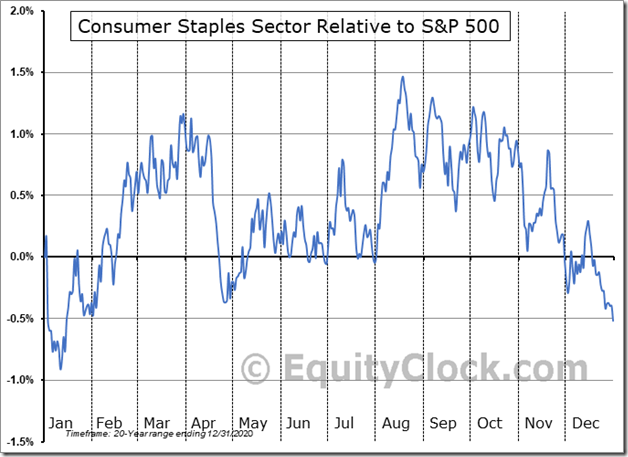

Seasonality Chart of the Day

Consumer Staples SPDRs XLP reached their peak of seasonal strength (relative to the S&P 500 Index) on August 18th, Units now enter a period of seasonal weakness to January.14th

On the charts, XLP maintained a positive technical profile until Wednesday: Units remained in an intermediate uptrend, remained above their 20 day moving average and their strength relative to the S&P 500 remained positive. However, short term momentum indicators (Daily Stochastics, RSI, MACD) rolled over from overbought levels yesterday. Traders are encouraged to take profits.

S&P 500 Momentum Barometers

The intermediate term Barometer plunged 6.61 to 56.71 yesterday. It changed from Overbought to Neutral on a move below 60.00 and is trending down.

The long term Barometer dropped 2.20 to 79.56 yesterday. It changed from Extremely Overbought to Overbought on a move below 80.00 and is trending down.

TSX Momentum Barometers

The intermediate term Barometer dropped 3.90 to 44.88 yesterday. It remains Neutral and trending down.

The long term Barometer dropped 2.93 to 65.37 yesterday. It remains Overbought and trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.