by Alessio De Longis, Invesco Canada

The global economy remains in expansion, but a near-term peak in the cycle is increasingly likely. Read more from Alessio de Longis in this month’s update.

The global economy remains in expansion, but a near-term peak in the cycle is increasingly likely, as evidenced by some shifting dynamics in the relative performance between sectors, regions, and factors.

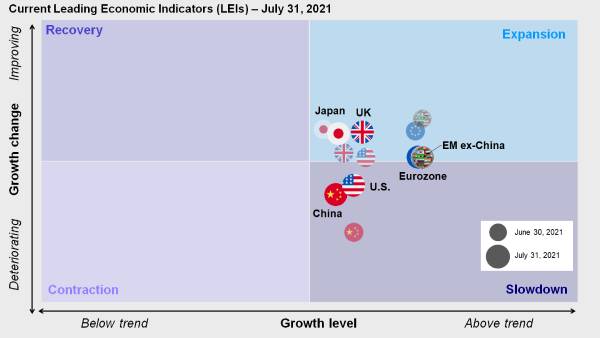

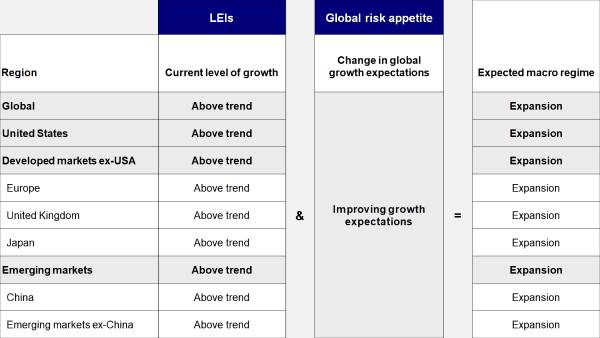

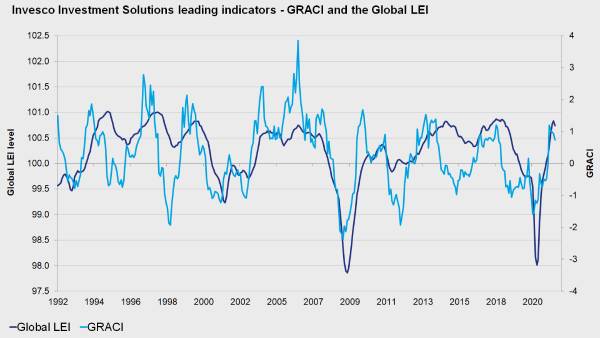

Leading economic indicators for the major regions around the world are peaking (Figures 1 and 2) at the same time global risk appetite is stabilizing at what we think are cyclical highs. Our macro regime framework remains in an expansionary regime, but it is increasingly flagging the potential for an inflection point in the next few months.

In our opinion, these transitions at the peak of the growth cycle are notoriously unstable, characterized by range-bound price action in asset prices and shifting themes, with overall positive performance for risky assets. While we believe the early-cycle reflation trade is not exhausted, it is approaching its last stages as evidenced by the recent pullback in the performance of value relative to growth, the performance of small-caps and mid-caps relative to large-cap equities, and the meaningful rally in long-term bond yields.

Figure 1: While the global economy remains in expansion, some regions appear to have shifted toward a slowdown cycle.

Figure 2: Invesco Investment Solutions leading indicators – GRACI and the global LEI

Emerging market (EM) equities have continued to underperform over the past month. We believe our overweight positioning to the asset class relative to developed market (DM) equities is certainly the most challenged active exposure in our portfolio, but one we continue to hold based on our macro framework. Several factors have contributed to the setback in EM equities after their strong outperformance between Q4 2020 and mid-February 2021.

- First, the rise in U.S. bond yields in the first quarter of this year, coupled with a stronger U.S. dollar, led to a tightening in EM financial conditions due to a higher dependance on external/U.S. dollar funding relative to developed markets.

- Next, slower vaccination progress, coupled with a resurgence of the virus via the Delta variant, moderated the expectation that the broad-based global reflation trade would lift local EM equities.

- Finally, China’s recent regulatory crackdown on the technology sector, among others, introduced additional uncertainty for foreign investors, causing additional underperformance in local equity markets.

In our opinion, this last development deserves more attention, given its potentially erratic nature, and the nexus between regulatory policy, macroeconomic policy, and investor confidence. Chinese authorities have shown a strong commitment to regulate market sectors that are growing rapidly with insufficient scrutiny over issues such as data security, consumer rights protection, fair competition, and oversight of overseas share listings.

While the uncertainty of these steps can certainly shake investor confidence in the near term, the willingness to introduce a solid regulatory framework in fast-growing sectors should benefit investors in the long term.

Furthermore, despite their ongoing efforts to tighten rules on technology firms, Chinese leaders are also expected to intensify policy support in the second half of the year to help support the economy.

The Politburo meeting on July 31 signaled more targeted support for the local economy through a focus on medium and small businesses, boosted fiscal spending, and the potential reduction of the reserve requirement ratio for banks.

Finally, the Politburo formally stated its aim of “enhancing independence of macroeconomic policy,” which could also imply an increasingly independent People’s Bank of China (PBOC) policy from the U.S. Federal Reserve (Fed). We believe this would allow the Chinese monetary stance to be more accommodative to local growth needs at a time when the Fed is entering into a gradual policy normalization path.

Our overweight exposure to EM equities is driven by two key factors:

1. Expectations that the global business cycle is in an expansionary regime, with rising risk appetite signaling the potential outperformance of riskier, more cyclical asset classes such as EM equities.

2. Expectations for medium-term U.S. dollar depreciation, supported by more favourable currency valuations outside the U.S., both in DM and EM; easing financial conditions; and capital inflows into EM assets.

The three broad developments that in our opinion have negatively affected the performance of EM equities have thus far slowed, but not derailed, market sentiment and global risk appetite, therefore leaving our investment framework tilted in favour of the asset class.

While our investment process is not expected to anticipate idiosyncratic fundamental developments such as the recent regulatory clampdown by Chinese authorities, we expect our framework to react in the event such policy shock derails global market sentiment and global growth expectations, in which case we would adjust our positioning accordingly.

Investment positioning

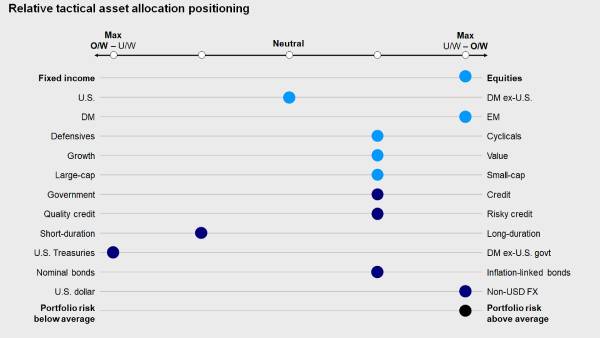

Within equities, we favour EM, driven by above-trend global growth, rising risk appetite, and medium-term U.S. dollar depreciation to support the asset class. We have neutralized our exposure to DM outside the U.S., relative to U.S. equities, as leading indicators seem to point to a near-term softening of the cyclical upturn in Europe. However, we remain tilted in favour of (small) size and value across regions. In addition, we are tilted in favour of momentum which currently captures value and smaller-capitalization equities, therefore concentrating risk in cyclical factors and reducing portfolio diversification relative to the past few years.

In currency markets, we maintain an overweight exposure to foreign currencies, positioning for long-term U.S. dollar depreciation. We remain constructive on EM foreign exchange given attractive valuations, an improving cycle, and a favourable backdrop for capital inflows, favouring the Indian rupee, the Indonesian rupiah, the Russian ruble, and the Brazilian real. Within DM, we favour the euro, the yen, the Canadian dollar, the Singapore dollar, and the Norwegian kroner, while we underweight the British pound, the Swiss franc, and the Australian dollar (Figure 3).

Figure 3: Global cycle remains in expansion regime

This post was first published at the official blog of Invesco Canada.