The recovery has had its ups and downs, but the economy is moving in the right direction.

by Carl Tannenbaum, Executive Vice President, and Chief Economist, Northern Trust

Summer is the peak season for travel, and travelers know that every voyage will have its ups and downs. Road trips encounter traffic; train schedules are not always reliable; flights have turbulence, delays and cancellations (especially this year). But in the end, we do not remember the difficulties, but the good times spent at our destinations.

The U.S. economy is broadly on a path toward a year of fantastic growth, but there are bumps on the journey. Supply chain disruptions are weighing on output, while the delta variant of COVID-19 is causing some reopening plans to change. At this time, a return to lockdowns seems highly unlikely, but the path to a full recovery will be choppy.

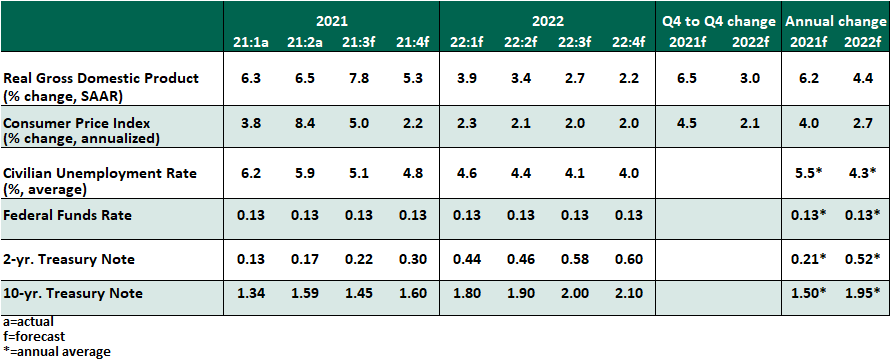

Key Economic Indicators

Influences on the Forecast

- The July Employment Situation Summary delivered evidence of a rebound in labor markets. 943,000 jobs were created, and the unemployment rate fell to 5.4%. The prime-age (25-54) labor force participation rate reached a post-pandemic high of 81.8%, but still has ground to recover to get back to its pre-crisis peak of 83%. Over six million people are estimated to be out of the labor force but want a job, and further job creation will bring widespread economic benefits as these people return to work.

- In the second quarter, gross domestic product grew at a 6.5% annualized rate. Under normal circumstances, that would be a rapid gain, but it fell short of expectations. Specifically, supply chain disruptions were evident in the unexpected declines in residential and business structure investment. As more businesses experienced supply chain delays, inventories were drawn down, weighing on total growth. However, consumer spending was resilient, and with this reading, total economic output has now caught up with the level last seen at the end of 2019. While inventories have been slower to rebound thus far, producers are working through bottlenecks, setting the stage for robust growth in the second half as business spending approaches its potential.

- At its July meeting, the Federal Open Market Committee made no policy changes. In its statement, it did acknowledge “the economy has made progress” toward the goals of its asset purchase program, signaling an announcement of tapering to come later this year. The Fed also created a standing repo facility, a permanent commitment to provide liquidity to markets in times of stress, as it did on a temporary basis in the past two recessions.

- Inflation fears are diminishing, but not yet gone. Month over month, the consumer price index (CPI) grew more slowly in July than it did in June, with hot categories like used cars and airfare leveling off. In June, the Fed’s preferred measure of inflation rose 3.5% year over year, after rising 3.4% in May. Many of the largest increases in price levels are behind us. However, supply chains are still out of sorts, while wages are rising and residential rents are on their way up. These costs are unlikely to fall from their new, higher levels than the norms of the pre-crisis economy, and will keep upward pressure on final prices.

- Bond yields are settling into ranges that do not appear consistent with a rapidly growing, moderately inflating economy. The yield on the 10-year U.S. Treasury note fell below 1.2% in August after peaking at 1.74% in March. Markets are awash in liquidity, holding yields low as capital flows into every financial instrument. We believe the fixed income market is ready for the taper of the Fed’s asset purchases.

- Renters had a moment of uncertainty and landlords a glimpse of relief, as the eviction moratorium expired at the end of July. It was then hastily replaced by an emergency extension into October. The moratorium was a necessary public health measure to allow people to stay safe and socially distanced in the worst of the pandemic, but it has run its course. Attention should now turn to using the largely undisbursed public funds to make landlords whole and keep tenants out of collections. The need to pay rent will also encourage a more rapid return to work.

- The rise of the delta variant of COVID-19 has been consequential: some employers are reconsidering their return-to-office schedules, while others are making vaccines a condition of employment. Some businesses and event spaces have begun to require proof of vaccination for admittance. Most encouragingly for a continued recovery, vaccine doses are once again on the rise after a long decline from their peak in early April. The better the virus is contained, the better the prospects for the strong growth cycle to continue.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2021 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.