by Don Vialoux, EquityClock.com

The Bottom Line

U.S. and Canadian equity indices were slightly higher last week. Greatest influences remained the possibility of a fourth wave by COVID 19 (negative) and continued expansion of distribution of a COVID 19 vaccine (positive).

Observations

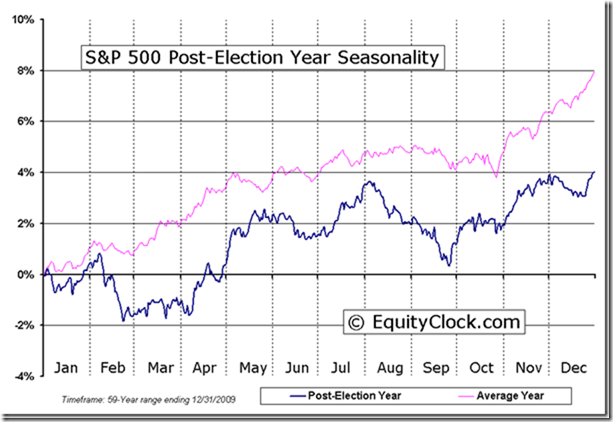

Favourable seasonal influences for U.S. equity markets end at the beginning of August (particularly in a Post-U.S. Presidential Election year). Last week, the S&P 500 Index, Dow Jones Industrial Average and the NASDAQ Composite Index continued to rally to record all-time highs. Strength into early August during Post-U.S. Presidential Election years is related to a “honey moon” period when investors anticipate launch of a new mandate by the President. Strength by U.S. equity markets last week was triggered by anticipation of surprisingly strong second quarter results that overwhelmed growing COVID 19 concerns: Of the 89% of S&P 500 companies that released quarterly results to date, 87% exceeding consensus earnings estimates and 87% exceeding consensus revenue estimates. However, if history repeats, North American equity markets shortly will reach an important intermediate top after a peak in frequency of quarterly earnings reports by major U.S. companies is reached. Normally, U.S. equity markets record a mild correction of 3%-4% between now and the end of September.

Early warning signs of a pending intermediate corrective phase in U.S. equity markets continued to appear last week. Major U.S. stocks came under profit taking pressures shortly after release of exceptionally strong second quarter results. Equities in this category include Eastman Chemical, Amgen, Marriott, Match, Cummins, CVS Health, Booking, General Motors, EOG Resources, Electronic Arts, Allstate, Etsy, Cigna and Becton Dickenson.

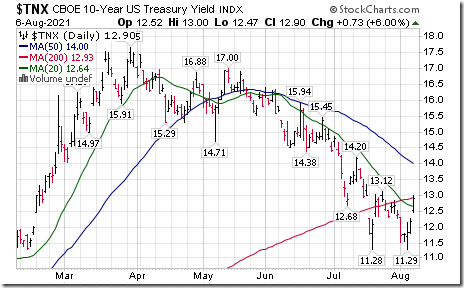

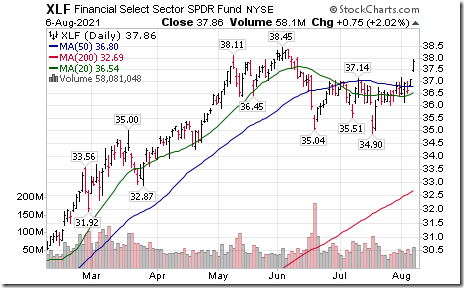

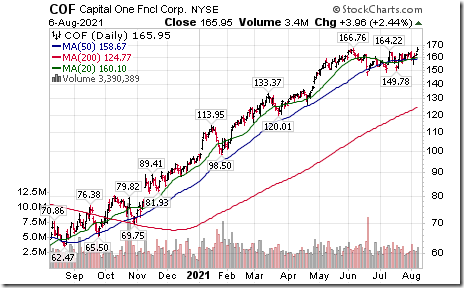

Notable exception last week was strength by financial services stocks such as Goldman Sachs and Capital One. Financials iShares advanced 3.7% last week and accounted for almost half of the gain recorded by broadly based U.S. equity indices. Financials responded to the stronger than anticipated U.S. July Employment Report released on Friday. Following the report, investors promptly increased the spread between short term and long term government bond yields, an event that significantly increases profit margins for major U.S. banks. Yield on 10 year Treasuries advanced from a low of 1.129% near the beginning of the week to a close at 1.290% on Friday while yield on U.S. Treasury Bills was virtually unchanged.

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) mostly moved higher last week.

Intermediate term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 50 day moving average) moved higher last week and changed from Neutral to Overbought on a move above 60.00%. See Barometer charts at the end of this report.

Long term technical indicator for U.S. equity markets (Percent of S&P 500 stocks trading above their 200 day moving average) was slightly lower last week. It remained Extremely Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors were higher last week, particularly the financials sector. Exception was the gold sector.

Intermediate term technical indicator for Canadian equity markets moved slightly lower last week. It remained Neutral. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (Percent of TSX stocks trading above their 200 day moving average) moved slightly lower last week. It remained Overbought. See Barometer charts at the end of this report.

Consensus estimates for earnings by S&P 500 companies continued to increase from our report last week. According to www.FactSet.com earnings in the second quarter on a year-over-year basis are projected to increase 88.8% (versus previous estimate last week at 85.1%) and revenues are projected to increase 24.7% (versus previous estimate at 23.1%). Earnings in the third quarter are projected to increase 28.0% (versus previous estimate at 27.7%) and revenues are projected to increase 14.4% (versus previous estimate at13.9%. Earnings in the fourth quarter are projected to increase 21.4% (versus previous estimate at 21.2%) and revenues are projected to increase 11.0% (versus previous estimate at 10.7%). Earnings for all of 2021 are projected to increase 41.6% (versus previous estimate at 40.7%) and revenues are projected to increase 14.3% (versus previous estimate at 13.9%). Earnings in 2022 are projected to increase 9.5% (versus previous estimate at 9.7%) and revenues are projected to increase 6.5% (versus previous estimate at 6.7%).

Economic News This Week

Second Quarter U.S. Productivity to be released at 8:30 AM EDT on Tuesday is expected to increase 3.5% versus a gain of 5.4% in the first quarter.

July U.S. Consumer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.5% versus a gain of 0.9% in June. Excluding food and energy, July CPI is expected to increase 0.4% versus a gain of 0.9% in June.

July U.S. Producer Price Index to be released at 8:30 AM EDT on Thursday is expected to increase 0.6% versus a gain of 1.0% in June. Excluding food and energy, July PPI is expected to increase 0.5% versus a gain of 1.0% in June.

August Michigan Consumer Confidence to be released at 10:00 AM EDT on Friday is expected to remain unchanged at 81.2 in July.

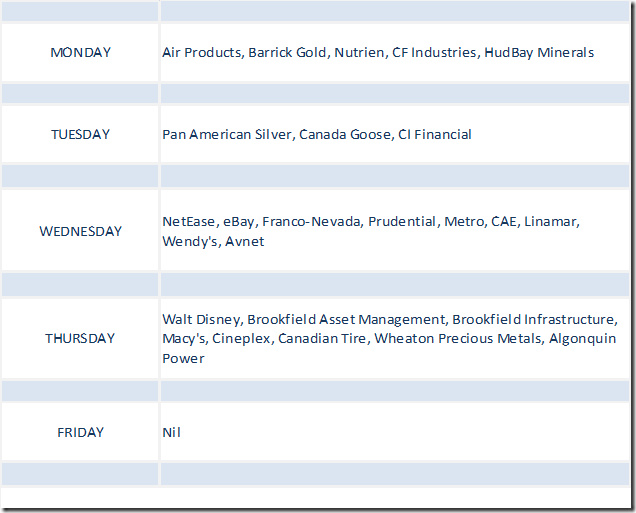

Selected Earnings News This Week

Frequency of second quarter reports by S&P 500 and TSX 60 companies winds down this week: 89% of S&P 500 companies have reported to date. Another 12 companies are scheduled to report this week. Focuses in Canada this week are reports by major gold producer companies.

Trader’s Corner

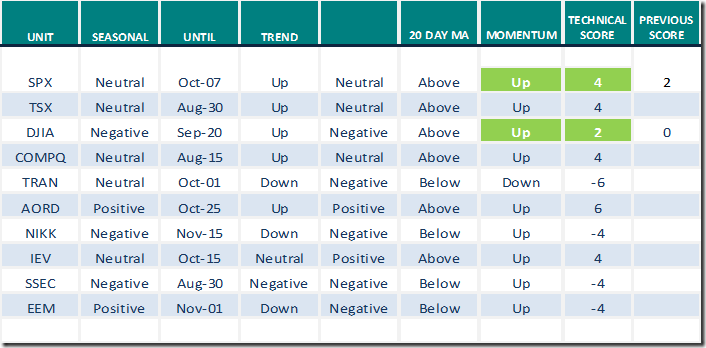

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 6th 2021

Green: Increase from previous day

Red: Decrease from previous day

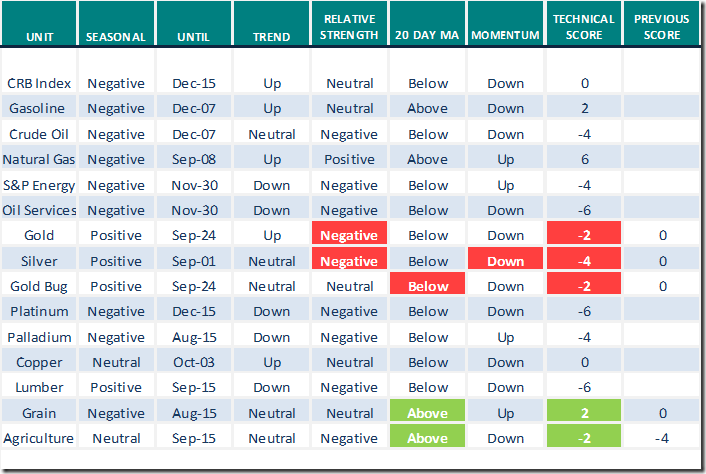

Commodities

Daily Seasonal/Technical Commodities Trends for August 6th 2021

Green: Increase from previous day

Red: Decrease from previous day

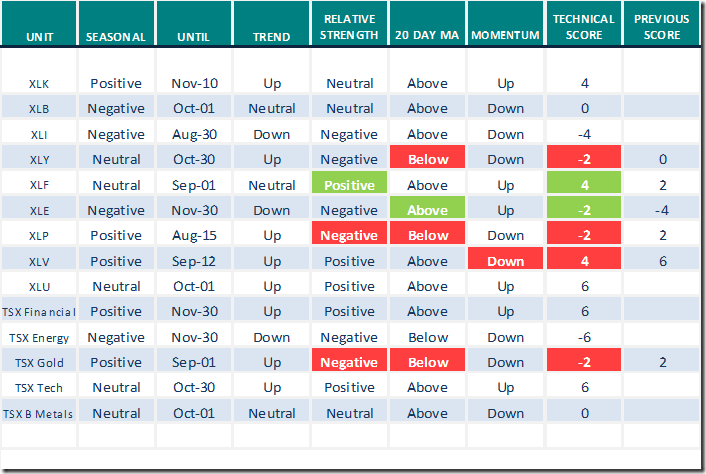

Sectors

Daily Seasonal/Technical Sector Trends for August 6th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

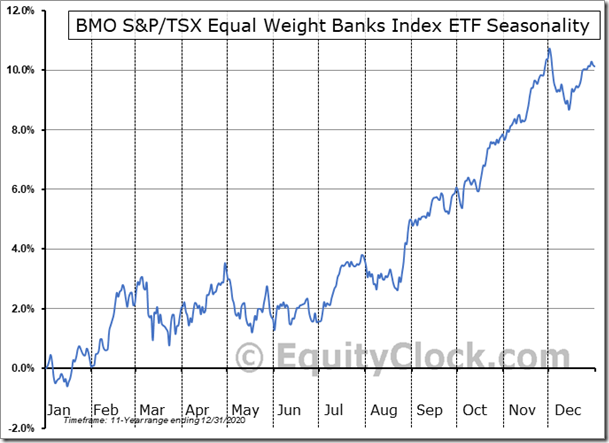

Seasonality Chart of the Day

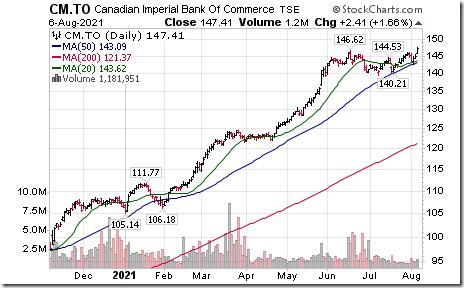

Canadian bank stocks also responded favourably on Friday to the encouraging U.S. July employment reports. Commerce Bank and Royal broke to all-time highs. Related ETFs (e.g. ZEB.TO) responded accordingly. ZEB.TO is an equal weight ETF consisting of Canada’s top six banks. Seasonal influences are positive on a real and relative basis (relative to the S&P 500 and TSX Composite) from mid-August to the end of November.

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for a link to the following video entitled, “Canadian Investors Are Like Eeyore. Here’s Why”.

Video includes comments on Canada’s banks offered by BMO’s chief strategist, Brian Belski

Canadian Investors Are Like Eeyore. Here’s Why. – Uncommon Sense Investor

Mark Bunting and www.uncommoninvestor.com also offered a link to an interesting comment on the favourable long term outlook for the commodity sector offered in The Felder Report:

Generational Opportunity in Commodities Part Two – Uncommon Sense Investor

Technical Notes for Friday at

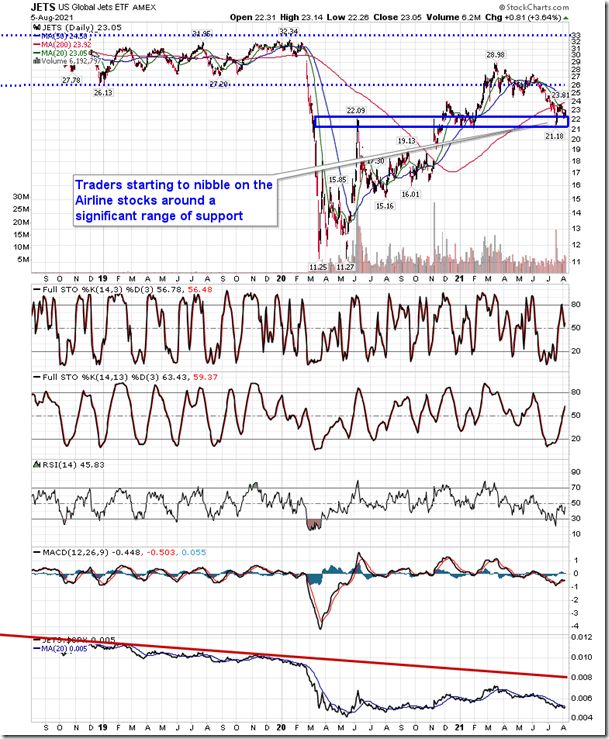

Traders starting to nibble at Airline stocks around a significant zone of support. equityclock.com/2021/08/05/… $JETS $UAL $AAL $LUV $DAL

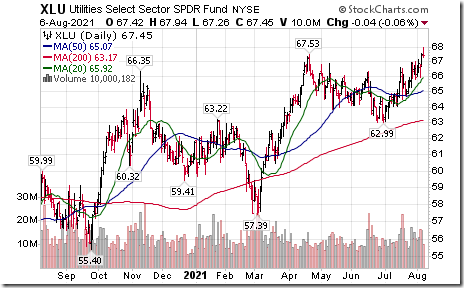

Utilities SPDRs $XLU moved above $67.53 to an all-time high extending an intermediate uptrend.

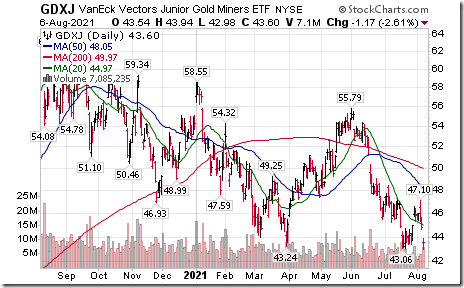

Junior Gold ETF $GDXJ moved below $43.06 extending an intermediate downtrend

U.S. Insurance iShares $IAK moved above intermediate resistance at $78.57 to resume an intermediate uptrend.

Goldman Sachs $GS a Dow Jones Industrial Average stock moved above $393.26 to an all-time high extending an intermediate uptrend.

Another U.S. Financial Services breakout! Capital One $COF an S&P 100 stock moved above $166.76 to an all-time high extending an intermediate uptrend.

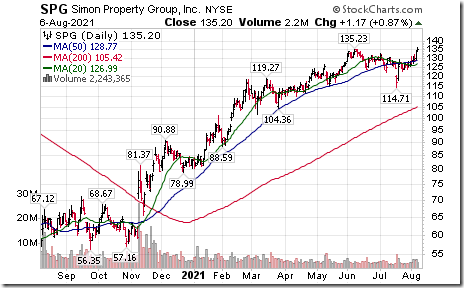

Simon Property Group $SPG an S&P 100 stock moved above $135.42 extending an intermediate uptrend.

Royal Bank $RY.CA a TSX 60 stock moved above $128.29 to an all-time high extending an intermediate uptrend.

Commerce Bank $CM.CA a TSX 60 stock moved above $146.62 to an all-time high extending an intermediate uptrend.

Canadian National Railway $CNR.CA moved above Cdn$136.27 setting an intermediate uptrend.

Telus $T.TO a TSX 60 stock moved above $28.30 to an all-time high extending an intermediate uptrend.

Fortis $FTS.CA a TSX 60 stock moved above $57.32 to an all-time high extending an intermediate uptrend.

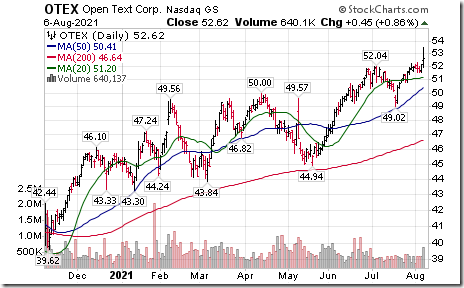

Open Text $OTEX a TSX 60 stock moved above US$52.04 to an all-time high extending an intermediate uptrend.

S&P 500 Momentum Barometers

The intermediate term Barometer advanced 6.61 on Friday and 7.02 last week to 63.33. It changed from Neutral to Overbought on a move above 60.00.

The long term Barometer added 0.60 on Friday, but dropped 3.41 last week to 84.57. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.49 on Friday and dropped 4.93 last week to 53.40. It remains Neutral.

The long term Barometer slipped 0.49 on Friday and dropped 4.15 last week to 73.30. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.