by Don Vialoux, EquityClock.com

Radio interview on “Wolf on Bay Street”

Don Vialoux was interviewed by Wolf on Bay Street about second half 2021 North American equity prospects. The interview can be heard on Corus Radio 640 at 7:00 PM EDT on Saturday.

Technical Notes Released Yesterday at

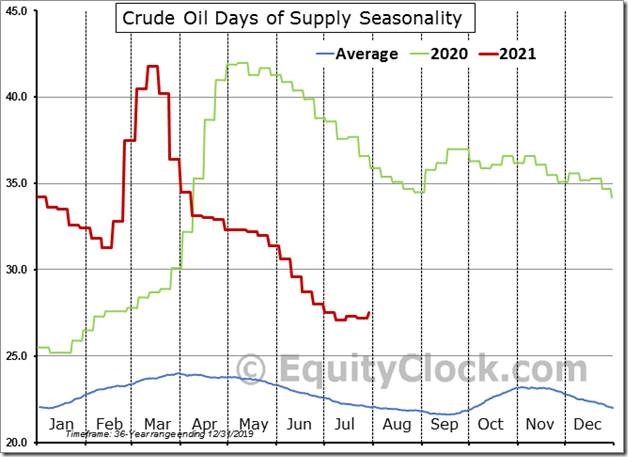

Days of supply of oil is curling higher, abnormal for the summer season. equityclock.com/2021/08/04/… $CL_F $USO $XLE $XOP #Oil

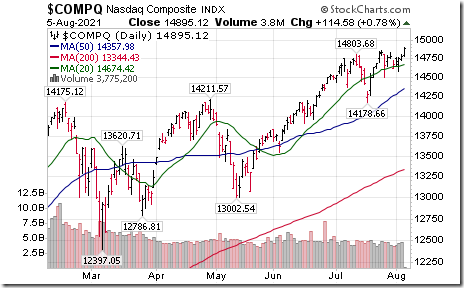

NASDAQ Composite Index $COMPQ moved above $14,863.65 to an all-time high extending an intermediate uptrend.

eBay $EBAY a NASDAQ 100 stock moved below intermediate support at $67.28

Splunk $SPLK a NASDAQ 100 stock moved above $146.45 completing a reverse Head & Shoulders pattern.

CCL Industries $CCL.B.CA a TSX 60 stock moved above $72.27 to an all-time high extending an intermediate uptrend

Trader’s Corner

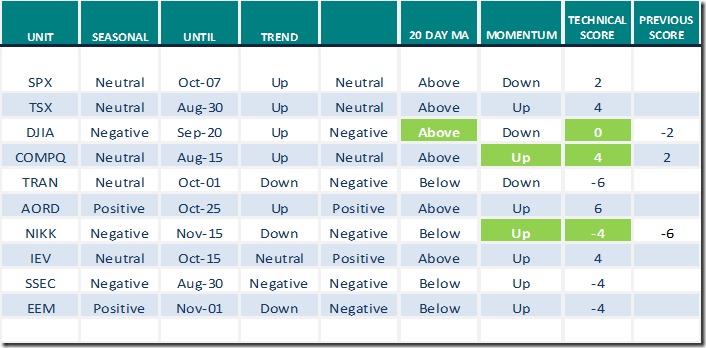

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for August 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

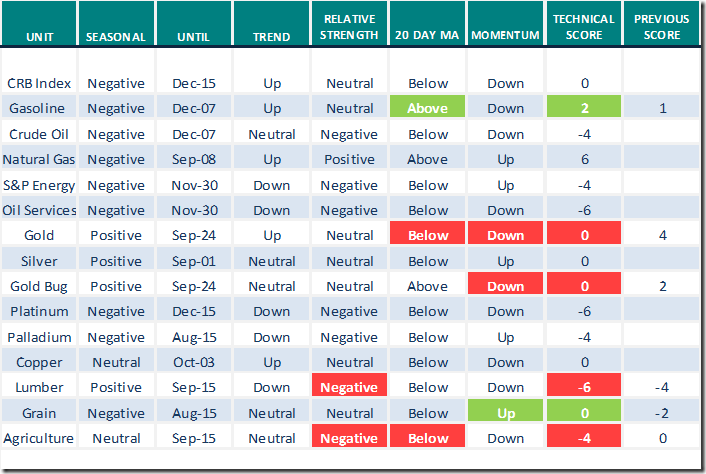

Commodities

Daily Seasonal/Technical Commodities Trends for August 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

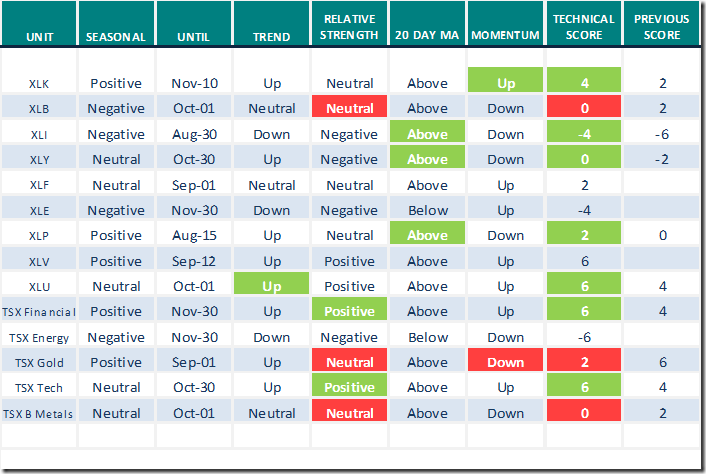

Daily Seasonal/Technical Sector Trends for August 5th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

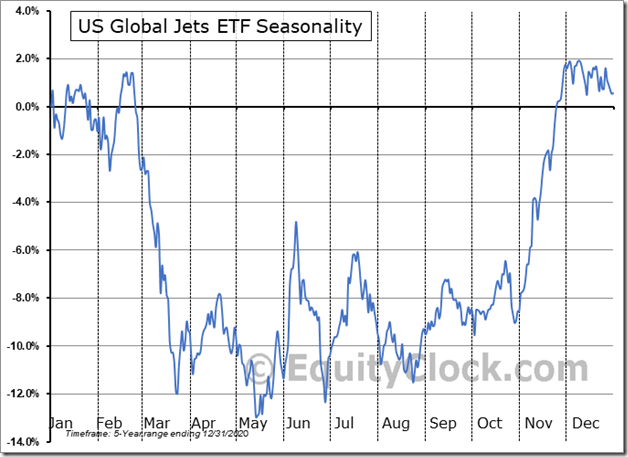

Seasonality Chart of the Day

Optimal time to own U.S. Global Jets ETF (Symbol: JETS) on a real and relative basis (relative to the S&P 500 Index) is from August 23rd to December 8th

Intermediate technicals remain bearish: Intermediate trend is down and units trade below their 20, 50 and 200 day moving averages. However, short term technicals including daily Stochastics, RSI and MACD have bottomed and have started to turn up. Units are highly sensitive to news on U.S. COVID infections.

Suggestion: Watch technicals closely for a possible entry point for a seasonal trade if and when intermediate technicals turn positive (most likely in September).

S&P 500 Momentum Barometers

The intermediate Barometer added 2.81 to 56.71 yesterday. It remains Neutral.

The long term Barometer added 0.40 to 83.97 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate Barometer slipped 1.24 to 53.88. It remains Neutral.

The long term Barometer added 0.62 to 73.79 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.