by Don Vialoux, EquityClock.com

Responses to the FOMC announcement at 2:00 PM EDT

Yesterday, the Federal Reserve chose to maintain the Fed Fund Rate at 0.00%-0.25% and to continue an accommodative monetary policy. Impacts on markets were as follows:

S&P 500 Index recovered initially, but closed virtually unchanged.

The U.S. Dollar Index ETN initially moved higher, but moved lower to the close.

Yield on 10 year bonds was up slightly.

Industrial commodity prices moved slightly lower.

Gold ETN moved higher

Bitcoin initially moved higher, but closed near unchanged

Technical Notes released yesterday at

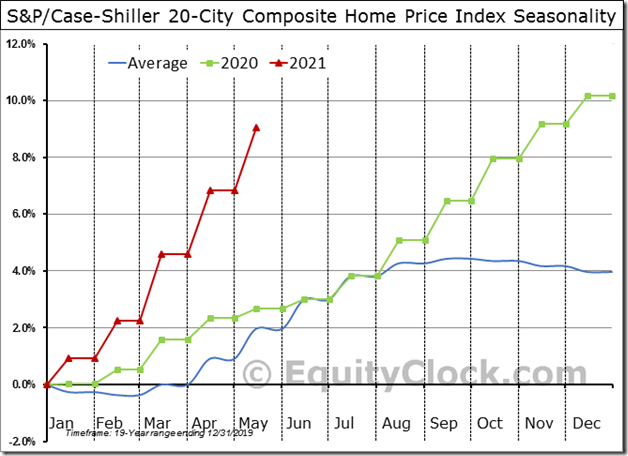

The year-to-date change of home prices in the US remains record setting, which bodes well for the economy longer-term. equityclock.com/2021/07/27/… $SPX $SPY $STUDY #Housing #Economy

Israel iShares $EIS moved above $70.59 to an all-time high extending an intermediate uptrend.

Pharmaceutical ETF $PPH moved above $74.71 to an all-time high extending an intermediate uptrend.

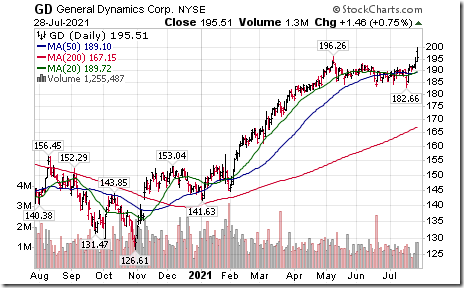

General Dynamics $GD an S&P 100 stock moved above $196.26 extending an intermediate uptrend.

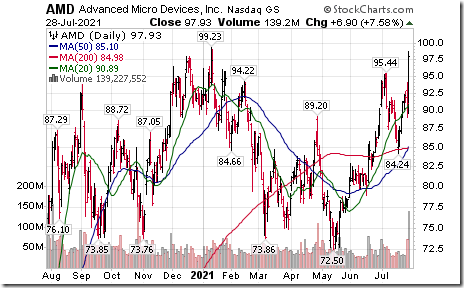

Advanced Micro Devices $AMD a NASDAQ 100 stock moved above $95.44 extending an intermediate uptrend.

Another copper stock responding to rising copper prices! Southern Copper $SCCO, one of the world’s largest copper producer stocks moved above $65.50 setting an intermediate uptrend

Trader’s Corner

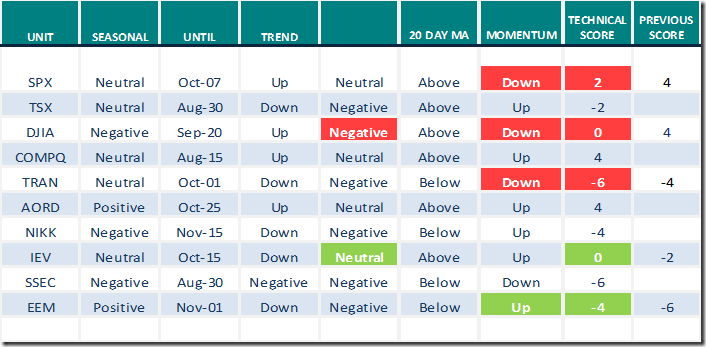

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

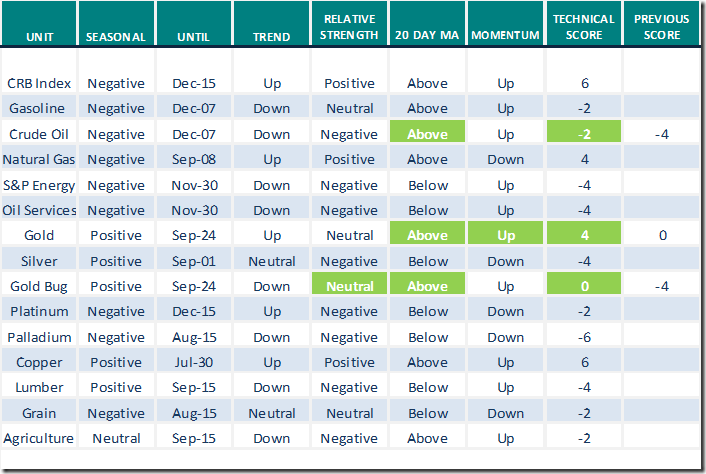

Commodities

Daily Seasonal/Technical Commodities Trends for July 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

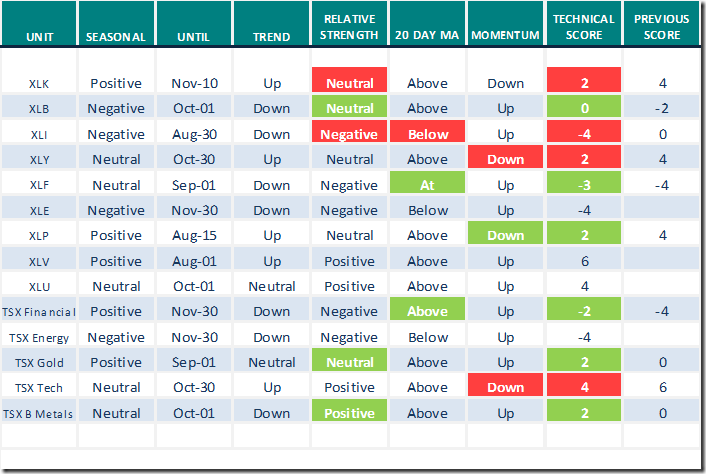

Sectors

Daily Seasonal/Technical Sector Trends for July 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Notes and video from uncommon Sense Investor

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for a link to the following comments and video. Topic is “Three things you need to know about investing in ETFs”.

https://uncommonsenseinvestor.com/three-things-you-need-to-know-about-investing-in-etfs/

Market Buzz

Greg Schnell discusses commodities. Following is a link:

https://www.youtube.com/watch?v=OBlPr3daPKU

The Pitch

Outlook comments by three technical analysts from www.stockcharts.com including Greg Schnell (with a favourable comment on Southern Copper).

https://www.youtube.com/watch?v=dMRVHpacUZc

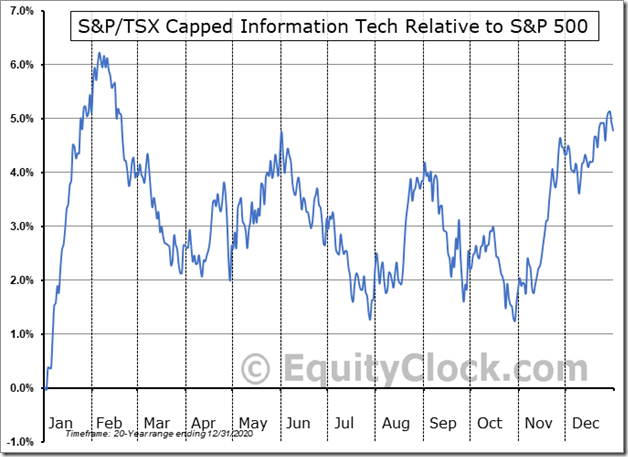

Seasonality Chart of the Day

Ratings on a real and relative basis for the TSX Info Tech sector change from Negative to Neutral at the end of July. The sector usually performs well in the month of August followed by weakness into September and October. An important seasonal low is reached at the end of October.

S&P 500 Momentum Barometers

The intermediate term Barometer slipped 1.80 to 54.31 yesterday. It remains Neutral.

The long term Barometer was unchanged at 89.78 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.23 to 51.94 yesterday. It remains Neutral.

The long term Barometer added 1.33 to 75.24 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.