by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

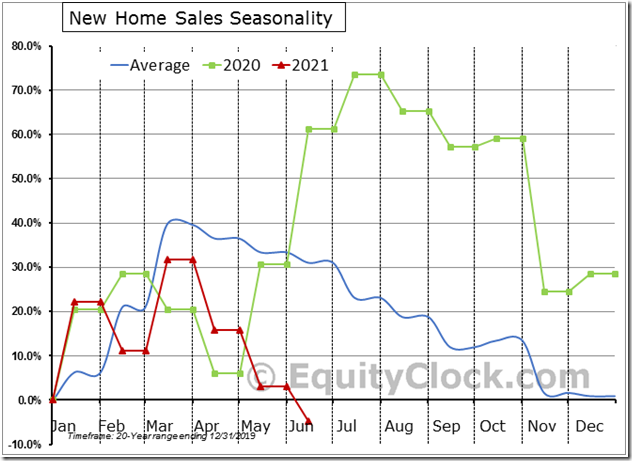

A shocking report on new home sales in the US pours cold water on the fundamental prospects for the home construction industry. equityclock.com/2021/07/26/… $ITB $XHB $PHM $LEN $DHI $STUDY #Economy #Housing

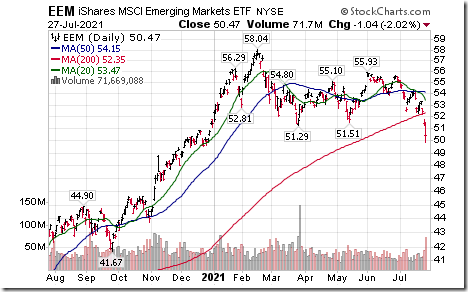

Emerging Markets iShares $EEM moved below $51.51 and $51.19 setting an intermediate downtrend.

Hong Kong iShares $EWH moved below $25.49 extending an intermediate downtrend. Responding to the crackdown on selected sectors by the Chinese government

United Parcel Service $UPS an S&P 100 stock moved below $195.47 completing a double top pattern despite reporting higher than consensus second quarter results

FedEx $FDX an S&P 100 stock moved below $73.20 completing a double top pattern

Paccar $PCAR a NASDAQ 100 stock moved below $85.01 extending an intermediate downtrend.

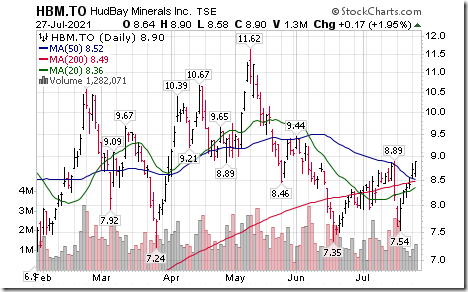

Base metal stocks are responding to higher copper prices. HudBay Minerals $HBM.CA moved above $8.89 setting a short term uptrend.

Trader’s Corner

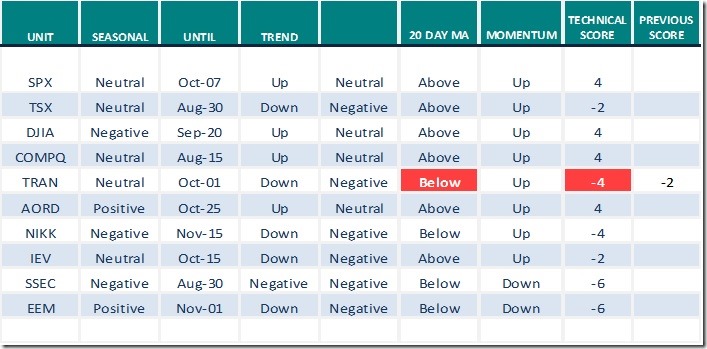

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

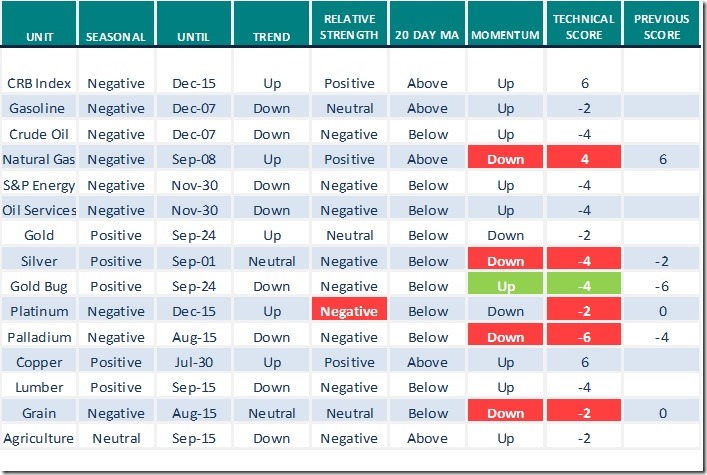

Commodities

Daily Seasonal/Technical Commodities Trends for July 26th 2021

Green: Increase from previous day

Red: Decrease from previous day

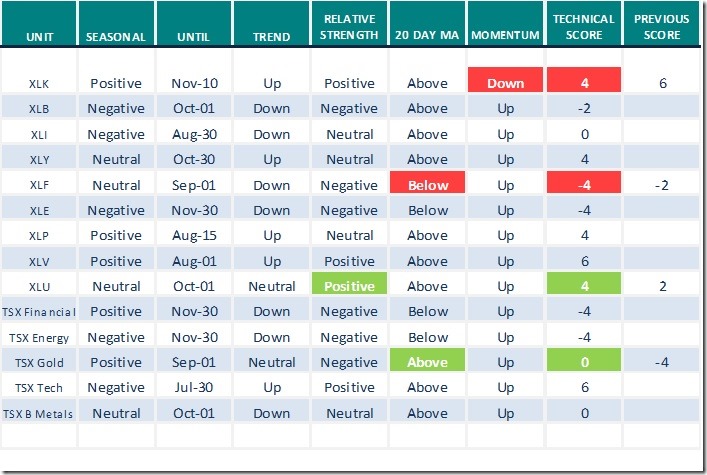

Sectors

Daily Seasonal/Technical Sector Trends for July 27th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

S&P 500 Momentum Barometers

The intermediate term Barometer added 1.60 to 56.11 yesterday. It remains Neutral.

The long term Barometer was unchanged at 89.78 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 0.25 to 52.17 yesterday. It remains Neutral.

The long term Barometer slipped 0.61 to 73.91 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.