by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

S&P/TSX Technology iShares $XIT.CA moved above Cdn$53.88 to an all-time high extending an intermediate uptrend.

Editor’s Note: Units are heavily weighted in Shopify.

Shopify $SHOP.CA a TSX 60 stock moved above Cdn$1,974.99 to an all-time high extending an intermediate uptrend.

The price of Bitcoin continues to trade within a descending triangle pattern. Find out how to trade it in today’s report. equityclock.com/2021/07/21/… $BTC.X $BTC_F $BCH.X $GBTC #Bitcoin

NASDAQ Biotech iShares $IBB moved above $165.79 extending an intermediate uptrend. Seasonal influences also are positive until at least mid-September

Honeywell $HON a Dow Jones Industrial Average stock moved above $234.02 to an all-time high extending an intermediate uptrend.

Autodesk $ADSK a NASDAQ 100 stock moved above $303.69 extending an intermediate uptrend.

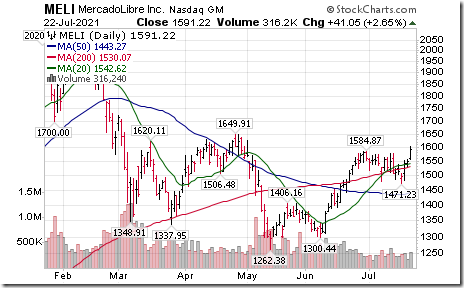

Mercadolibre $MELI a NASDAQ 100 stock moved above $1,584.87 extending an intermediate uptrend.

eBay $EBAY a NASDAQ 100 stock moved above $70.76 to an all-time high extending an intermediate uptrend

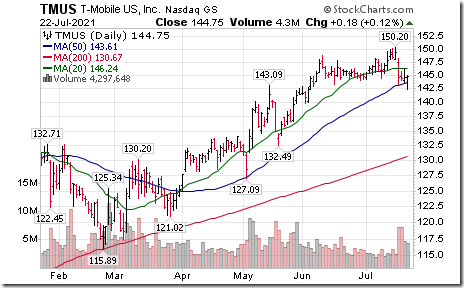

T Mobile $TMUS a NASDAQ 100 stock moved below intermediate support at $143.10.

Kinross Gold $K.CA a TSX 60 stock moved below Cdn$7.56 extending an intermediate downtrend.

Trader’s Corner

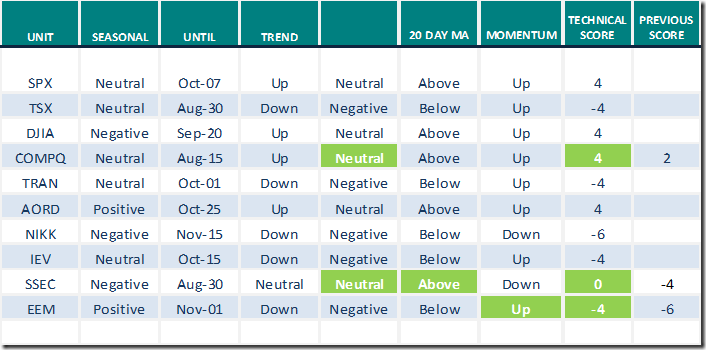

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

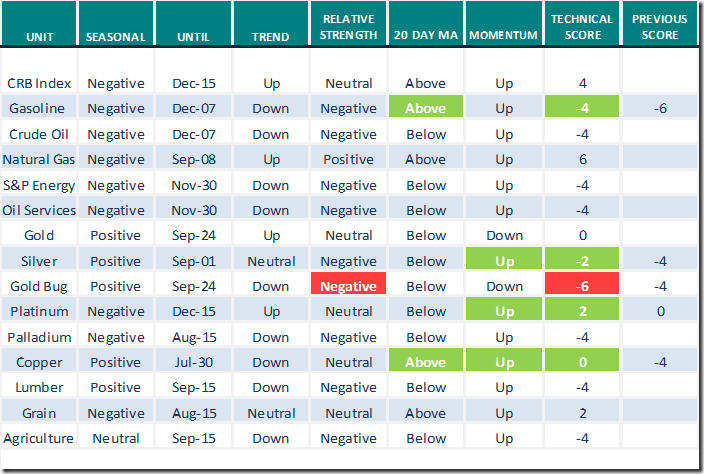

Commodities

Daily Seasonal/Technical Commodities Trends for July 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

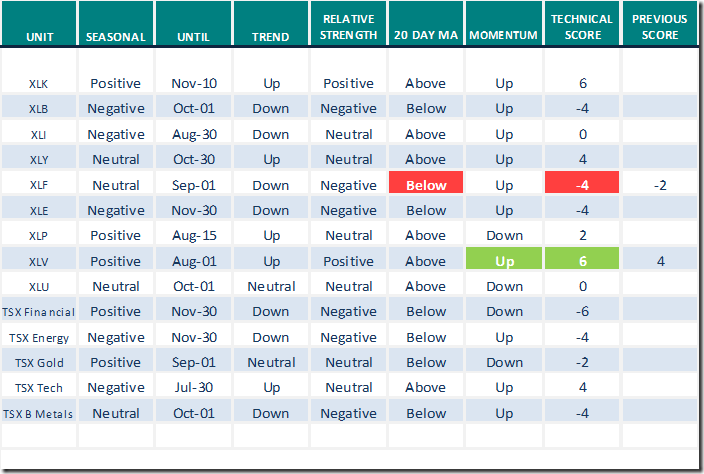

Sectors

Daily Seasonal/Technical Sector Trends for July 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.