by Don Vialoux, EquityClock.com

Technical Notes for yesterday at

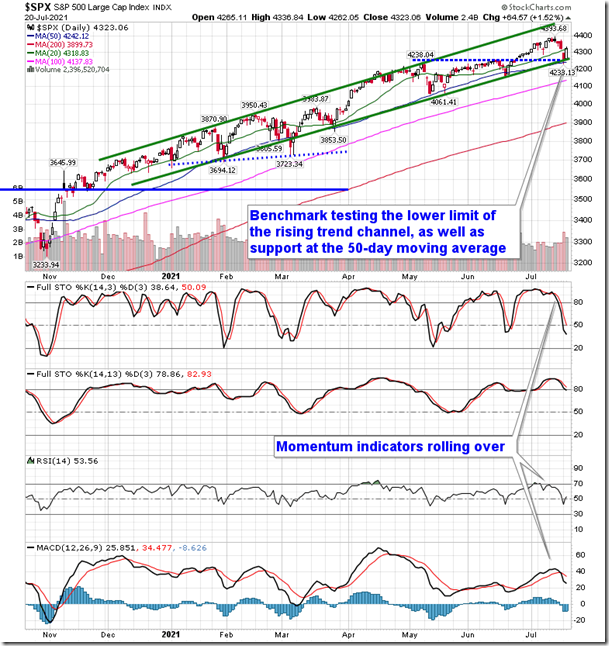

Did Tuesday’s rally really change anything? We discuss in today’s report. equityclock.com/2021/07/20/… $SPX $SPY $ES_F $DJIA $NYA $IWM $SPXEW

Morgan Stanley $MS an S&P 100 stock moved above $94.27 to an all-time high extending an intermediate uptrend.

Coffee ETN $JJOFF moved above $13.90 extending an intermediate uptrend

Trader’s Corner

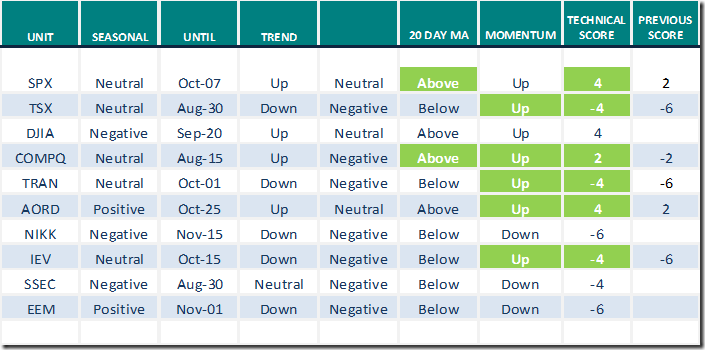

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 21st 2021

Green: Increase from previous day

Red: Decrease from previous day

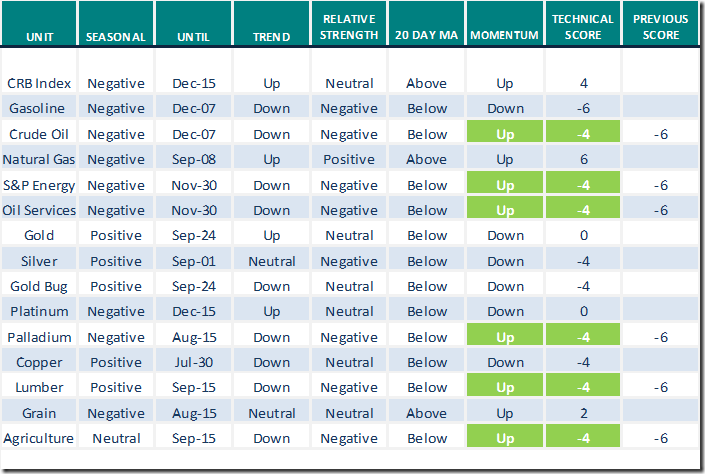

Commodities

Daily Seasonal/Technical Commodities Trends for July 21st 2021

Green: Increase from previous day

Red: Decrease from previous day

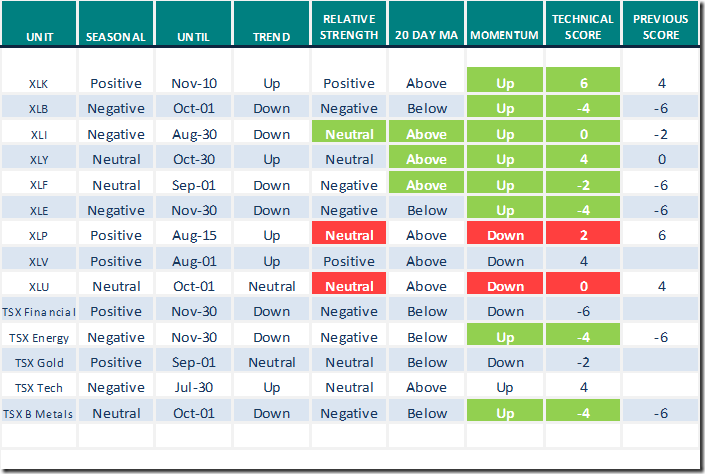

Sectors

Daily Seasonal/Technical Sector Trends for July 21st 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Notes from uncommon SENSE Investor

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for links to the following reports…

Why Growth & Slowdown Fears Are Premature & Overblown

Comments from Morgan Stanley’s Global Equity strategy team

Why Growth & Slowdown Fears Are Premature & Overblown – Uncommon Sense Investor

Experienced Manager On the Rules & Discipline Needed For Successful Investing

A video interview with Keith Richards

Market Buzz

Greg Schnell discusses a “Defensive Market Alignment”. Following is a link:

https://www.youtube.com/watch?v=Pik_cCE4goA

Seasonality Charts of the Day from www.EquityClock.com

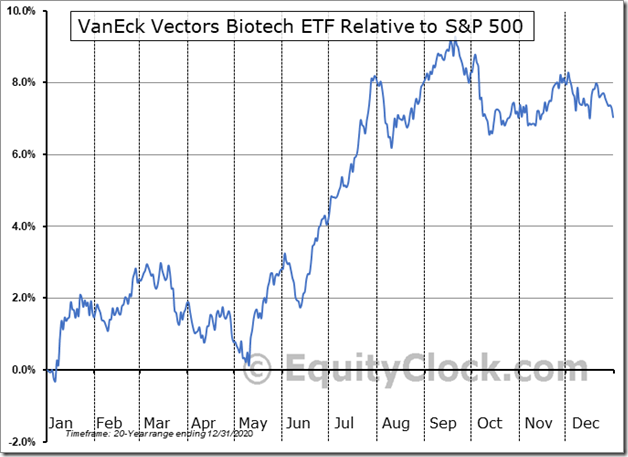

Seasonal trades in the biotech sector and related ETFs are working well this year. Nice breakout on Tuesday by VanEck Biotech ETF BBH to an all-time high! Seasonal influences are positive on a real and relative basis (relative to the S&P 500 Index) until at least mid-September.

S&P 500 Momentum Barometer

The intermediate term Barometer added 3.61 to 51.10 yesterday. It remains Neutral.

The long term Barometer added 2.00 to 88.38 yesterday. It remains Extremely Overbought.

TSX Momentum Barometer

The intermediate term Barometer added 7.55 to 50.94 yesterday. It remains Neutral.

The long term Barometer added 2.36 to 74.06 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.