by Don Vialoux, EquityClock.com

Pre-opening Comments for Wednesday July 21st

U.S. equity index futures were higher this morning. S&P 500 futures were up 8 point in pre-opening trade.

Chipotle advanced $68.86 to $1,641.21 after reporting higher than consensus second quarter revenues and earnings.

Netflix added $2.15 to $533.20 after the company announced plans to enter the gaming industry.

Canadian National Railway slipped $0.40 to US$101.90 after reporting slightly less than consensus second quarter earnings.

Coca Cola added $1.19 to $57.02 after reporting higher than consensus second quarter revenues and earnings. The company also raised guidance.

EquityClock’s Daily Comment

Following is a link:

http://www.equityclock.com/2021/07/20/stock-market-outlook-for-july-21-2021/

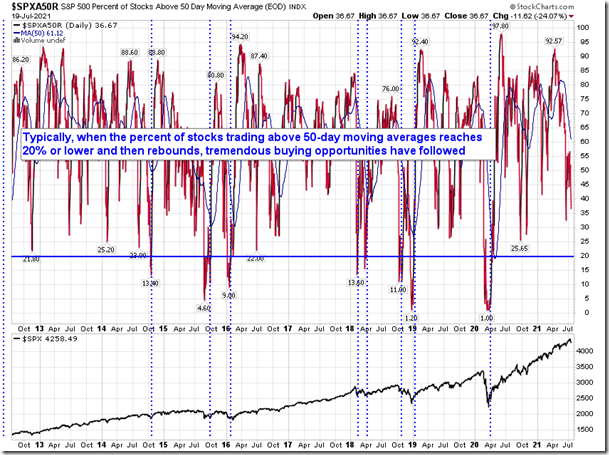

Technical Notes released yesterday at

More and more stocks are trading below their 50-day moving averages, but, as we near an oversold extreme, we have to be prepared to buy. equityclock.com/2021/07/19/… $SPX $SPY $ES_F $STUDY

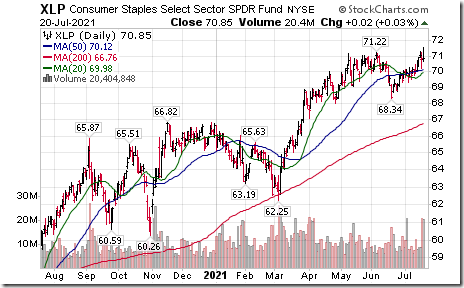

Consumer Staples SPDRs $XLP moved above $71.22 to an all-time high extending an intermediate uptrend.

Biotech ETF $BBH moved above $203.62 to an all-time high extending an intermediate uptrend.

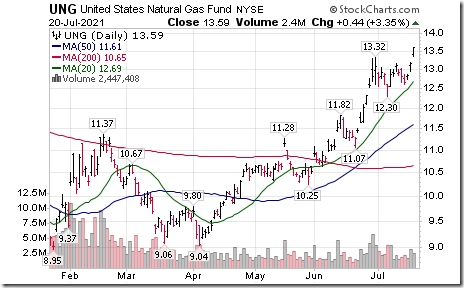

Natural gas ETN $UNG moved above $13.32 extending an intermediate uptremd

Philip Morris $PM an S&P 100 stock moved below $95.83 and $94.68 setting an intermediate downtrend.

Gilead $GILD a NASDAQ 100 stock moved above $69.39 extending an intermediate uptrend.

Pfizer $PFE a Dow Jones Industrial Average stock moved above $40.72 extending an intermediate uptrend.

Trader’s Corner

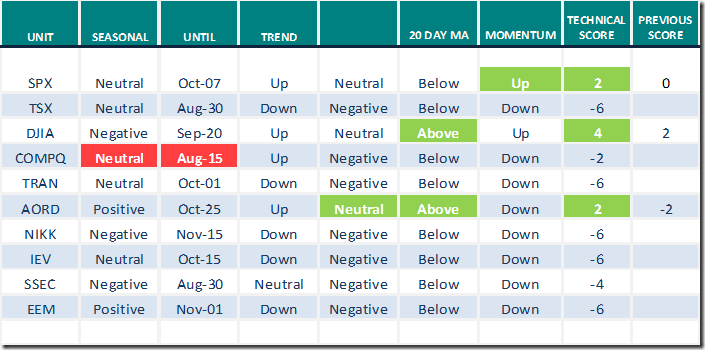

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

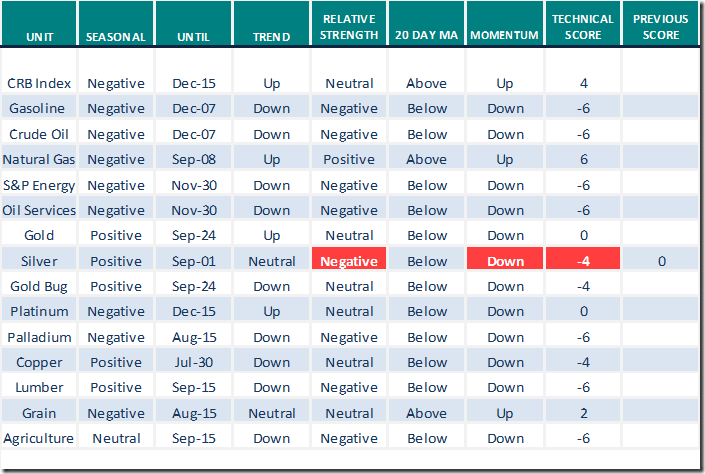

Commodities

Daily Seasonal/Technical Commodities Trends for July 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

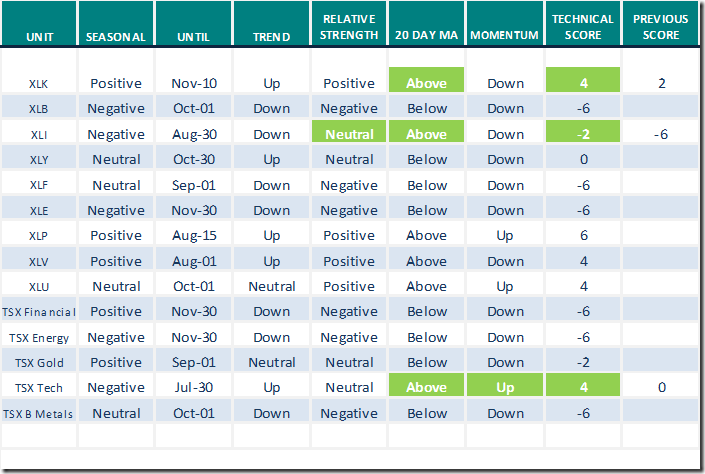

Sectors

Daily Seasonal/Technical Sector Trends for July 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

The Canadian Technician

Greg Schell comments on “The Valley of Fear”. Following is a link:

The Valley Of Fear | The Canadian Technician | StockCharts.com

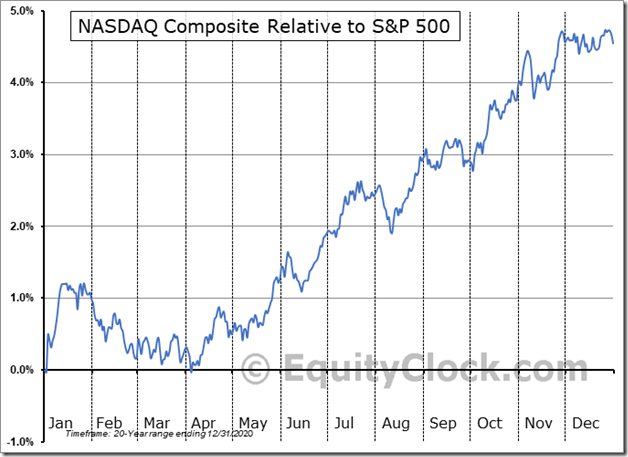

Seasonality Chart of the Day from www.EquityClock.com

NASDAQ Composite Index has a history of changing from Positive to Neutral on a real and relative basis (relative to the S&P 500 Index) between July 20th and August 15th. Thereafter, it returns to Positive.

S&P 500 Momentum Barometers

The intermediate Barometer jumped 10.82 to 47.49 yesterday. It changed from Oversold to Neutral on a recovery above 40.00.

The long term Barometer gained 5.21 to 86.37 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer advanced 6.95 to 43.40 yesterday. It changed from Oversold to Neutral on a move above 40.00.

The long term Barometer added 1.60 to 71.70 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2021/07/clip_image0015_thumb-5.png)

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/2021/07/clip_image0024_thumb.png)

![clip_image003[4] clip_image003[4]](https://advisoranalyst.com/wp-content/uploads/2021/07/clip_image0034_thumb.png)

![clip_image004[4] clip_image004[4]](https://advisoranalyst.com/wp-content/uploads/2021/07/clip_image0044_thumb.png)