by Hamish Chamberlayne, CFA, Head of Global Sustainable Equities | Portfolio Manager, Janus Henderson Investors

Portfolio Manager and Head of Global Sustainable Equities Hamish Chamberlayne explains why the transition from a fossil analog economy to a renewable electric digital economy is at the heart of the transition toward global decarbonization.

Key Takeaways

- Digitalization, electrification and decarbonization (the “DED nexus”) are powerful agents of positive change for societal and environmental sustainability goals.

- As technology improves and connectivity progresses, the fossil analog economy will transition toward a renewable electric digital economy.

- We consider this to be the Fourth Industrial Revolution and view decarbonization as a generational investment trend that will have a profound impact on almost every sector of the global economy.

For the last 250 years, since the beginning of the Industrial Revolution, humankind has made tremendous progress using a fossil fuel-driven economic growth engine. Unfortunately, tremendous industrial progress has not come without consequences for the environment, and today, the world today relies heavily on the use of carbon-emitting processes in everyday life, such that it would be hard to live without them. In essence, the fossil economy has been woven into our global economic system and detangling the web of carbon-emitting processes is no easy feat.

A Decade of Transformational Change

But the transition to a low-carbon economy seems finally to be accelerating, and we believe we are entering a decade of transformational change. Much of it will be driven by the convergence of two powerful trends: electrification and decarbonization. As electrification continues to develop, everything will become “smart” and connected, blurring the lines between sectors and industries.

Electrification of the global automotive fleet is one area we are particularly excited about. As battery and computing technology continue to improve and associated costs decrease, we expect to see mass production and adoption of electric vehicles.

This is often referred to as the S-curve. When plotted on a chart, the S-curve illustrates the innovation of a technology from its slow early beginnings as it is developed, to an acceleration phase as it matures and, finally, to its stabilization over time.

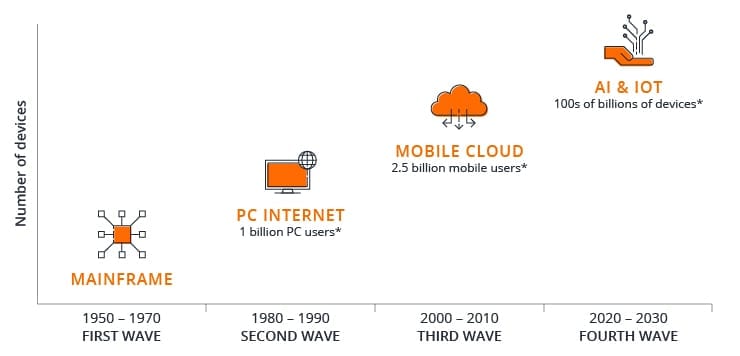

In our view, we are standing at the beginning of a decade of transformational change that will induce multiple S-curves across many different industries as technology improves and connectivity progresses. Traditional analogue products will make way for the new era of cloud computing and the Industrial Internet of Things. This shift has already started happening in smart cars, smart watches and even smart fridges. We consider this to be the Fourth Industrial Revolution, as illustrated in the graphic below.

The Fourth Industrial Revolution: Merging Industrial and Technological Economies

Source: Janus Henderson Investors, 2021. *Citi Research, as at 31 December 2016. Note: AI = artificial intelligence, IOT = Internet of Things.

The Fourth Industrial Revolution is enabling us to move from a fossil analog economy toward a renewable electric digital economy. We refer to the trio of digitalization, electrification and decarbonization (DED) as the “DED nexus.” Combined, they represent powerful agents of positive change for both societal and environmental sustainability goals.

We view decarbonization as a generational investment trend that will have a profound impact on almost every sector and every corner of the global economy. Investors should carefully consider the implications of these changes on their portfolios as we enter the period of critical transformation that lies ahead.

Copyright © Janus Henderson Investors