by Don Vialoux, EquityClock.com

Notes for Michael Campbell interview

July 3rd 2021

The following notes were developed prior to my interview on Michael Campbell’s Money Talks radio show on CKNW on Saturday.

Trader’s outlook for North American equity markets

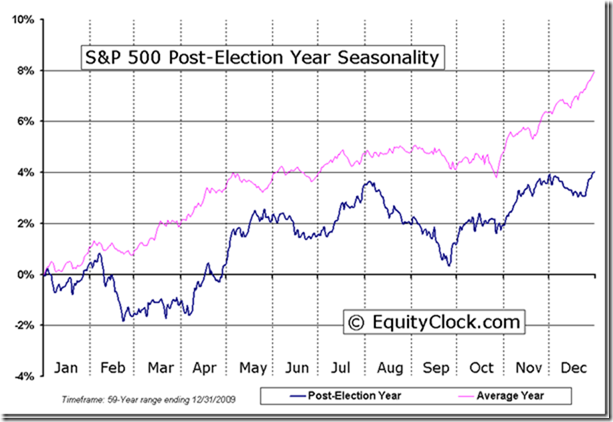

Seasonal influences for North American equity markets are positive in the month of July (particularly in a Post-U.S. Presidential Election year). Strength is Post-U.S. Presidential Election years is related to a “honey moon” period when investors anticipate launch of a new mandate by the President.

Prospects for North American equity markets are particularly favourable this July

· Second quarter earnings by major U.S. and Canadian companies will be substantially higher relative to the same period last year when U.S. and Canadian economies were significantly impacted by COVID 19. Consensus for S&P 500 companies calls for a 63.6% year-over increase from last year. In addition, many companies are expected to increase their dividends and announce share buybacks when they release second quarter results.

· The top 23 U.S. financial institutions are a focus when they start to report second quarter results in mid-July. Last week, the Federal Reserve announced that all 23 U.S. commercial Banks passed their stress test. Previously, the Banks were not allowed to increase dividends or to resume share buyback programs until they passed their stress test. After the Federal Reserve’s announcement, several financial institutions including Goldman Sachs, Wells Fargo and Morgan Stanley announced substantial dividend increases. In addition, Morgan Stanley announced a $20 billion share buyback program. Look for more announcements when second quarter reports are released during the next two weeks.

· The U.S. government recently announced increased financial benefits to low and middle income U.S. citizens. The latest benefit is an increase in tax credits to parents with children. For 2021, the Child Tax Credit provides a credit of up to $3,600 per child under age 6 and $3,000 per child from ages 6 to 17. The credit will also be available periodically throughout the year starting as early as July 15th, rather than as a lump sum at tax time. Prior law provided a Child Tax Credit of up to $2,000 per child age 16 and younger. The benefit is available to couples earning less than $150,000 per year. The additional tax credit is expected to boost retail sales starting in mid-July. Equity prices are expected to respond accordingly.

· Negotiations toward a bi-partisan infrastructure agreement by U.S. Congress and President Biden continue and are likely to be reached by the end of July. The proposed agreement includes spending of up to $1.2 trillion on infrastructure programs over the next eight years. Equities related to the program are expected to move higher if and when an agreement is reached.

North American equity market prospects beyond the beginning of August are less promising.

· Seasonal influences during a Post-U.S. Presidential election historically have turned negative from early August to early October. Investors realize that full support of the President’s mandate is unlikely.

· Expanding COVID 19 infections could become an issue this summer. Re-emergence of the virus has occurred whenever government restrictions are relaxed. That’s what happened in the U.K when the Delta version of the virus appeared. After restrictions in the U.K. were relaxed at the beginning of June, infections rose dramatically and the U.K. government recently extended restrictions. Australia, Indonesia, Japan and most of Africa have recorded a similar experience.

· Spikes in infections tend to occur within two weeks after a major event with a large audience is held. Scheduled events with large audiences during the month of July include the U.S. Independence Day holiday on July 4th. Stanley Cup finals during early July, European Cup football playoffs in early July, Olympic Games starting in the third week in July and record temperatures that are prompting an earlier than usual trip to the beach and cottage country.

Interesting side note: Record temperatures in western Canada and U.S. prompted the price of natural gas in the U.S. to jump 50% from the beginning of April to the end of June. Natural gas frequently is the fuel used by utilities to generate power for air conditioning. Last week, power generation by western Canadian and U.S. utilities reached an all-time high due to record high temperatures. Last Monday natural gas prices in the U.S. broke above $3.40 MBtu to a 30 month high. Canadian “gassy” stocks such as Advantage Oil and Gas, ARC Resources, Tourmaline and Birchcliff Energy moved sharply higher.

What to do

Enjoy current upside momentum by North American equity securities and related Exchange Traded Funds into the month of July. Look for opportunities to take trading profits near the end of July if and when daily technical indicators (e.g. Stochastics, RSI, MACD) turn lower.

The Bottom Line

Most world equity indices moved higher last week. Greatest influences on North American equity markets are possibility of a fourth wave by COVID 19 (negative) and continued expansion of distribution of a vaccine (positive).

Observations

Short term short term indicators for U.S. equity indices and sectors (20 day moving averages, short term momentum indicators) remained elevated last week.

Intermediate term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) was virtually unchanged last week. It remained Neutral. See Barometer charts at the end of this report.

Long term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 200 day moving average) was virtually unchanged last week. It remained Extremely Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors moved slightly lower last week.

Intermediate term technical indicator for Canadian equity markets moved slightly higher last week. It remained Overbought. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (i.e. Percent of TSX stocks trading above their 200 day moving average) moved slightly higher last week. It remained Overbought. See Barometer charts at the end of this report.

Consensus estimates for earnings by S&P 500 companies continued to increase from our report last week. According to www.FactSet.com earnings in the second quarter on a year-over-year basis are expected to increase 63.6% (versus previous estimate at 62.8%) and revenues are expected to increase 19.6% (versus previous estimate at19.5%). Earnings in the third quarter are expected to increase 23.6% (versus previous estimate at 23.2%) and revenues are expected to increase 12.3% (versus previous estimate at12.1%. Earnings in the fourth quarter are expected to increase 18.1% (versus previous estimate at 17.7%) and revenues are expected to increase 9.2% (versus previous estimate at 9.1%). Earnings for all of 2021 are expected to increase 35.5% (versus previous estimate at 34.2%) and revenues are expected to increase 12.4% (versus previous estimate at 12.3%).

Economic News This Week

June ISM Services to be released at 10:00 AM EDT on Tuesday are expected to slip to 63.0 from 64.0 in May.

June Canadian Employment to be released at 8:30 AM EDT on Friday is expected to drop 20,000 versus a decline of 68,000 in May. June Unemployment Rate is expected to remain unchanged from May at 8.2%.

Selected Earnings News This Week

Nil

Trader’s Corner

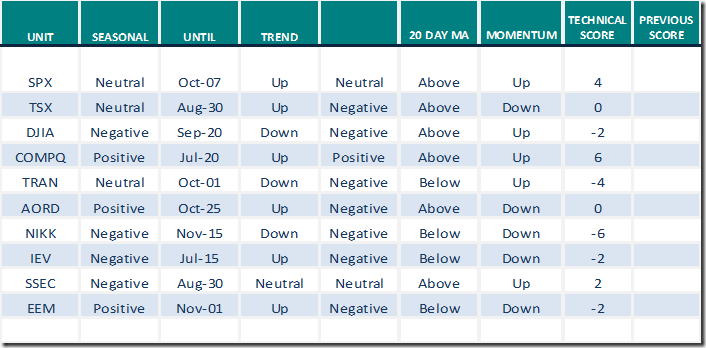

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for July 2nd 2021

Green: Increase from previous day

Red: Decrease from previous day

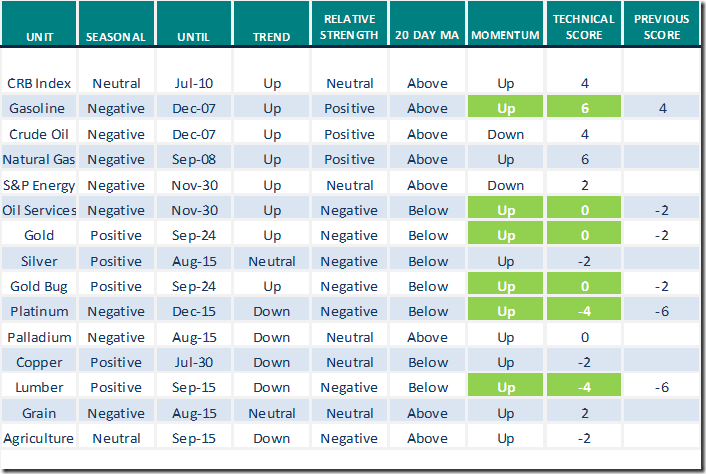

Commodities

Daily Seasonal/Technical Commodities Trends for July 2nd 2021

Green: Increase from previous day

Red: Decrease from previous day

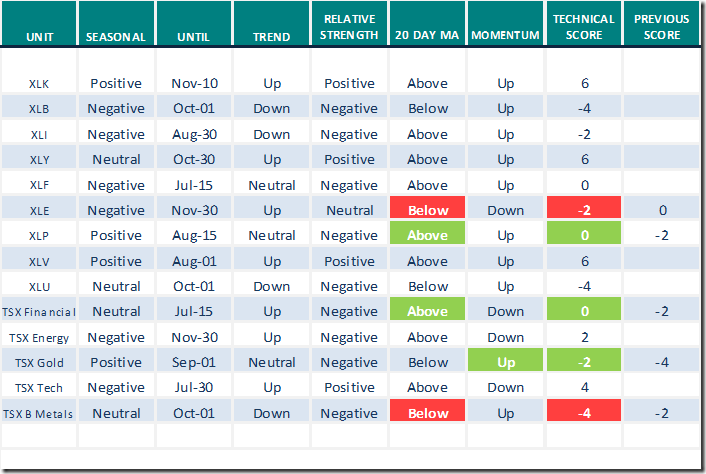

Sectors

Daily Seasonal/Technical Sector Trends for July 2nd 2021

Green: Green: Increase from previous day

Green: Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

The Canadian Technician

Greg Schnell says, “My rear view mirror is clear”. Greg reviews how markets performed in the first half of 2021. Following is the link:

My Rear View Mirror Is Clear | The Canadian Technician | StockCharts.com

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment:

Link to follow.

Articles from “uncommon SENSE Investor”

Thank you to Mark Bunting and www.uncommonsenseinvestor.com for a link to the following article entitled “10 Reasons to Own These Types of Stocks in the Second Half”. Following is the link:

10 Reasons to Own These Types of Stocks in the Second Half – Uncommon Sense Investor

Also included is a link to Mark’s article and video with John O’Connell, CEO of Davis Rea entitled “Bitcoin equals anarchy and that’s not what people want”: Following is the link:

Bitcoin Equals Anarchy & That’s Not What People Want – Uncommon Sense Investor

Please send comments and questions to:

info@uncommonsenseinvestor.com

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes released on Friday at

TSX Composite Index $TSX.CA moved above $20,295.18 to an all-time high extending an intermediate uptrend.

Consumer Discretionary SPDRs $XLY moved above $179.89 to an all-time high

U.S. Treasury 7-10 year Bond iShares $IEF moved above $115.71 extending an intermediate uptrend.

IBM $IBM a Dow Jones Industrial Average stock moved below $140.92 completing a Head & Shoulders pattern.

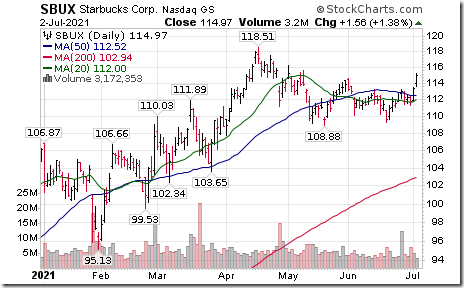

Starbucks $SBUX a Dow Jones Industrial Average stock moved above intermediate resistance at $114.62

Blackrock $BLK an S&P 100 stock moved above $890.00 to an all-time high extending an intermediate uptrend.

S&P 500 Momentum Barometers

The intermediate Barometer slipped 0.20 on Friday, but gained 0.60 last week. It remains Neutral.

The long term Barometer added 0.40 on Friday and 0.20 last week. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer added 1.99 on Friday and 2.17 last week. It remains Overbought.

The long term Barometer slipped 1.72 on Friday and 1.15 last week. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.