by Don Vialoux, EquityClock.com

Technical Notes released yesterday at

Spot natural gas prices in the U.S. $UNG moved above $3.40 per MBtu to a 30 month high. Natural gas is used by utilities to generate power used by air conditioners. Record temperatures have been recorded in the western part of Canada and the U.S.

Biotech ETF $BBH moved above $201.15 to an all-time high extending an intermediate uptrend. Also, NASDAQ Biotech ETF $IBB moved above $163.69

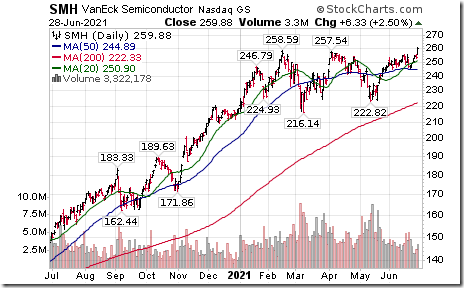

Semiconductor ETF $SMH moved above $258.59 to an all-time high extending an intermediate uptrend.

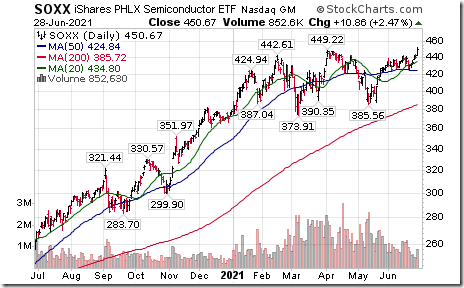

Semiconductor iShares $SOXX moved above $449.22 to an all-time high extending an intermediate uptrend.

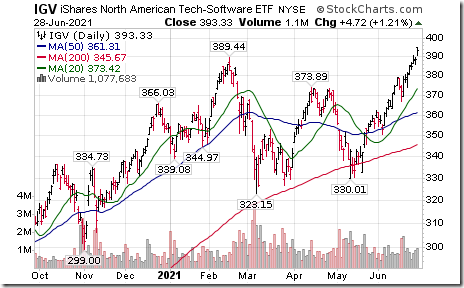

Editor’s Note: Software stocks and related ETFs also moved higher, mirroring strength in the semi-conductors stocks and ETFs. Software iShares moved above 389.44 to an all-time high extending an intermediate uptrend.

Coffee ETN $JJOFF moved above $13.12 to a 33 month high extending a long term uptrend.

Ctrip $TCOM a NASDAQ 100 stock moved below $34.84 completing a double top pattern.

Marriott $MAR a NASDAQ 100 stock moved below $135.35 extending an intermediate downtrend.

Peloton $PTON a NASDAQ 100 stock moved above $124.80 extending an intermediate uptrend.

Editor’s Observation

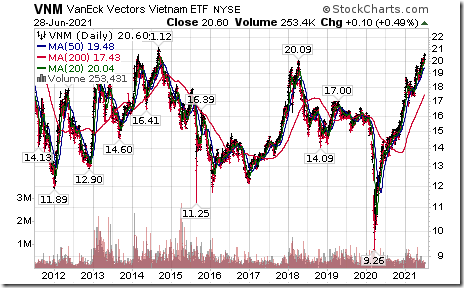

Far East Equity markets (ex Japan) including China, South Korea, Taiwan and Vietnam recently have shown exceptional strength relative to North American and European equity markets. Strength could be related to celebration of China’s 100th anniversary later this week. The Vietnam ETF moved above $20.09 to a six year high.

Trader’s Corner

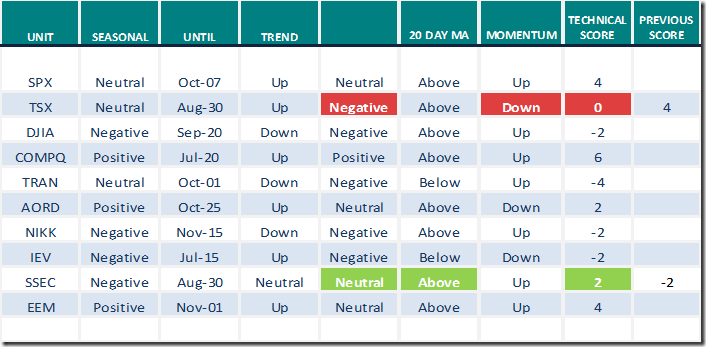

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

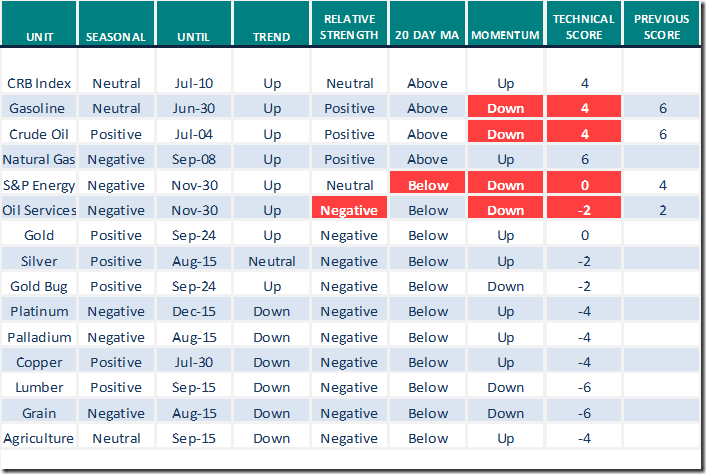

Commodities

Daily Seasonal/Technical Commodities Trends for June 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

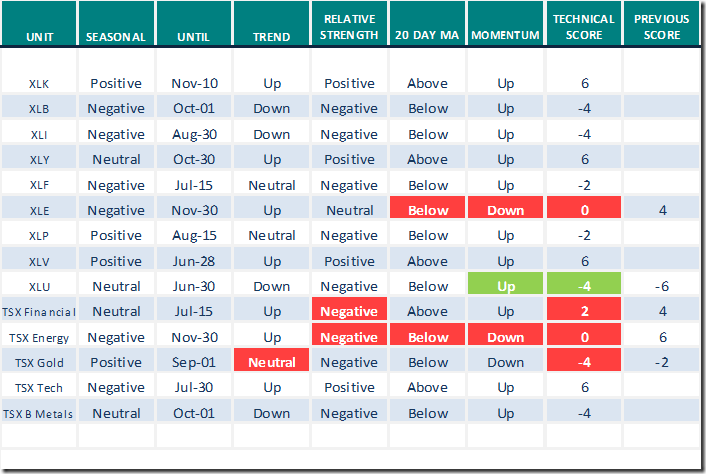

Sectors

Daily Seasonal/Technical Sector Trends for June 28th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 5.81 to 49.30 yesterday. It remains Neutral.

The long term Barometer added 0.22 to 92.38 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer dropped 2.75 to 58.26 yesterday. It changed from Overbought to Neutral on a slip below 60.00.

The long term Barometer eased 1.38 to 75.69 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.