by Lei Qiu, AllianceBernstein

Many businesses say they’re innovation leaders. But how can equity investors tell which hold truly disruptive powers that translate into sustainable growth and paths to long-term profitability?

As the COVID-19 crisis winds down in many countries, technological and business changes that were accelerated by the pandemic aren’t likely to reverse. And investors can now find a growing array of innovative companies across industries.

But just because a company is innovative doesn’t make it investable. Wi-fi was a gamechanger, for example, but it doesn’t translate easily into a direct long-term company investment opportunity. Likewise, early-to-market isn’t always equivalent to competitive dominance. China-based Baidu, often compared to as the Google of China, was surpassed by later-in-coming competitor Alibaba, which now boasts five times Baidu’s market cap. Having the right monetizable business model matters.

Equity investors need to spot the difference between a quick fad and a lasting breakthrough. Even then, the business model behind the innovation should have the right fundamentals for the long haul. Finding both qualities in one company is the key task for active managers.

Tech Disruption Ripples Across Industries

We live in a society where the pace of innovation is faster than ever. Technology-specific advancements are now the predominant breakthroughs in an increasingly digital society. In fact, technology-based research and development has reached a record 18% of total US capital spending in 2021, according to the Bureau of Economic Analysis.

But disruptor impact can reach far beyond the tech sector. Unique breakthroughs and applications also benefit companies in areas like healthcare, consumer retail, media, financials, energy and industrials, giving investors more inroads to novel growth opportunities.

In healthcare and medicine, for example, the cost of DNA has declined a millionfold in the span of two decides. And trends such as genome sequencing are rapidly changing the way doctors diagnose diseases and researchers discover new medicine. With the appropriate DNA, a yeast cell can produce insulin prescribed for diabetics. In a similar vein, genomic engineering can be applied to produce a limitless array of new materials. The DNA from mussels, for example, can be used to produce materials similar to adhesives. Wider adoption of synthetic biology can harness the universal factory of a cell, with DNA as the production blueprint, to produce practically anything.

Disruptors are changing the energy industry too. Tech innovation is driving down the cost of clean energy sources like solar, hydrogen and electric vehicles, for which sales have grown 500% in five years. Even the iconic Ford F-150—the world’s all-time best-selling pickup truck—now comes in an EV model more powerful than its gasoline-engine predecessors. And the future of factories will be far more efficient, powered by robotics and fully automated manufacturing processes throughout the product cycle. Fintech is one of the fastest growing markets, with new forms of digital currency and contactless payments more widely adopted globally.

However, since the pace of innovation is faster than ever, investors need to be even more careful to identify the right type of companies with durable business models. So, what makes an innovative company a good long-term investment?

Combining the Right Innovation and Company Behind It

It’s normal to want to be the first to invest in the next big thing. It’s smarter to invest in companies not just based on a creative new way of doing things, but because they carry the necessary ingredients that make sound investments. Most importantly, they should be companies that can endure further disruption over time. They never stop innovating, practically reinventing themselves at every turn.

Disruptive companies that last hold the high ground because they introduce features or attributes unquestionably different in a product, service or process. Some innovations are evolutionary, meaning new concepts that change how things work today to create a better experience or improve efficiency (think ride-sharing models or hybrid cloud infrastructure). Breakthrough innovation—or orthogonal innovation—is another, and refers to something completely revolutionary, like synthetic biology, electric vehicles or true artificial intelligence and autonomous driving.

Investable disruptors have large existing—or newly created—markets hungry for their innovations. They have highly differentiated product sets which makes their profitability more durable and better protected from competitors by high barriers to entry. Companies that benefit from network effects—the tendency to exponentially expand customer reach, which drive future monetization opportunities—are particularly attractive.

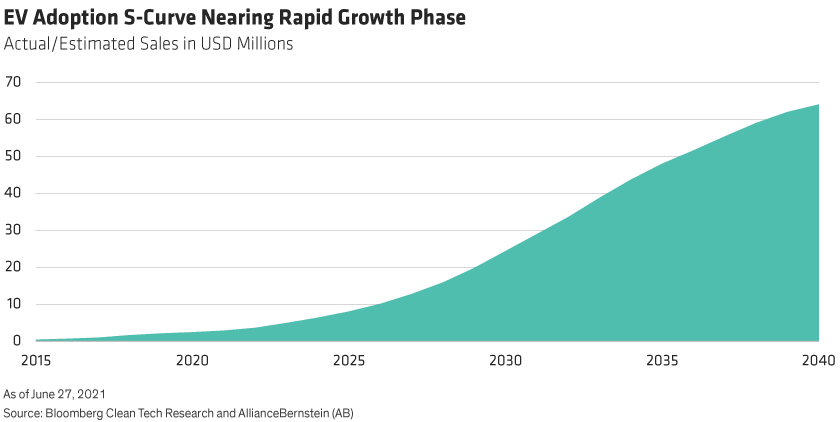

We believe sweet spots for successful investments lie in the steeper portion of the innovation s-curve—the rapid growth phase. As with many innovative phenomena, it takes time to get there, but when it happens, it’s a powerful and steep climb. This is where the growth potential is strong and lasting. We’ve seen it in smartphone adoption and streaming media and we are witnessing it in EV adoption (Display), robotics, cloud computing and digital payments.

Exceptional management teams are essential, too. And true disruptors never overlook competitive threats. Rather, they have vision and focus, remain paranoid about competition, and are willing to “self-disrupt” their own processes to stay ahead.

Investors often question the high level of valuation some innovative companies carry. We believe valuations must be justified by the company’s pace of growth, too. Innovative companies only make attractive investments when they not only offer a clear path to profitability but also prove to have built up enough of a competitive moat that will enable them to maintain high levels of profit growth over time. We don’t want to penalize a company that is making the required investments needed to reach dominant scale or maintain a competitive moat. In fact, the R&D investment ratio historically has been a good indicator for future growth in innovative companies. This means that some disruptors can look expensive at today’s prices, but if higher prices are in step with fast-growing earnings in the future, the cost of growth is reasonable, in our view.

Tomorrow’s Disruptive Frontier

We’re in a modern-day “industrial revolution” of innovation. It’s the “roaring ‘20s 2.0,” fuelled by powerful mega trends and a new economy crisscrossed by a thriving digital infrastructure. Disruptive innovation remains one of the most exciting and relevant areas of investments. However, selective investors will need a clear process for identifying disruptors that will make a huge impact across multiple industries and create global growth opportunities, especially as even more trends are bound to surface that we have not yet imagined.

Lei Qiu is a Portfolio Manager on the International Technology Portfolio and a Senior Research Analyst for Thematic & Sustainable Equities at AllianceBernstein

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..