by Mark Stacey, MBA, CFA® Bill DeRoche, MBA, CFA®, AGF Management Ltd.

Insights and Market Perspectives

Author: Mark Stacey

June 25, 2021

By Bill DeRoche, Mark Stacey and Grant Wang

If there is such a thing as a super indicator for timing equity market performance, Purchasing Manager Indexes (PMIs) that track manufacturing activity might be it. Not only are PMIs reliable gauges of the expansion and contraction of an economy, they are often invaluable predictors of the potential direction that financial markets take in the future. And while this goes for almost any asset class, sector, theme or factor you can think of analyzing, it may be especially true for listed infrastructure, the category of equities that is most closely tied to the structures and systems that form the connective tissue of the world’s economic framework.

In fact, based on AGFiQ research on PMIs going back to 2001, now may end up being as good an entry point as any into a portfolio of infrastructure stocks (or “infra” stock as they often called). That’s not a guarantee, of course, but in the context of the past four manufacturing cycles, here’s why it’s a fair assertion. First off, listed infrastructure has tended to follow the path of other low-beta asset classes and sectors of the market over the period we analyzed, more than likely because it exhibits similar characteristics to other low-risk investments that move more in lock-step with the broad market including stable cash flows that result in steady dividends over time. It’s not surprising then that “infra” stock performance – at least in the aggregate – has been somewhat congruent with how low-beta stocks have performed on average in relation to PMIs.

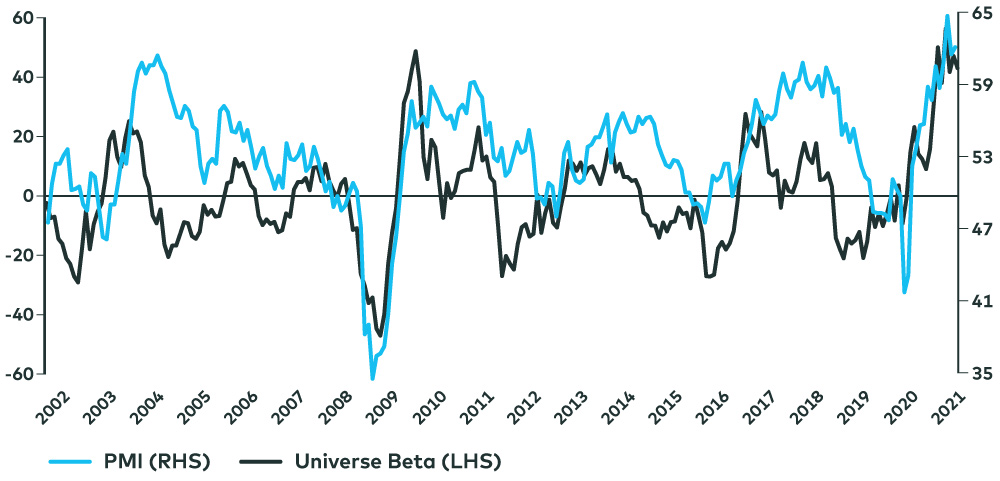

Historical Return Spread between High-Beta and Low-Beta Stocks in Relation to PMIs

Source: AGFiQ with data from FactSet and Bloomberg as of June 15, 2021. Universe Beta (grey line) refers to the nine-month rolling return spread between the top and bottom quintile of stocks within the S&P 500 Index sorted from high to low beta.Purchasing Manager Index (PMI) (black line) refers to the seasonally-adjusted Institute of Supply Management (ISM) Manufacturing PMI.

Second, whether it’s infrastructure or low-beta stocks more broadly, our analysis shows a pattern of returns that are associated with four different phases in manufacturing “scores”. Namely, we found that some listed infrastructure outperformed broader equity benchmarks such as the S&P 500 Index and S&P/TSX Composite Index when PMIs were nearing a bottom, as well as when PMIs first began to fall after an elevated period following a peak. Conversely, listed infrastructure underperformed when PMIs were moving from a bottom to a peak, but typically held their own at the peak and for as long as PMIs maintained that elevated level. This suggests that as the economic expansion moves beyond the early stages, some investors may begin to appreciate the benefits of infrastructure stocks in their portfolio.

Listed Infrastructure Performance in relation to PMIs (Previous PMI Cycles)

| Months Prior to the PMI Bottom | Bottom to Peak PMI | Elevated PMI | Months After Elevated PMI | |||||

|---|---|---|---|---|---|---|---|---|

| 12 mos. | 6 mos. | 3 mos. | 3 mos. | 6 mos. | 12 mos. | |||

| Infrastructure Equities (DJBGIT Index) | -14.5 | -12.6 | -7.8 | 17.1 | 11.1 | 1.9 | 6.0 | 8.7 |

| Global Equities (MXWD Index) | -18.3 | -11.1 | -9.4 | 23.1 | 11.6 | -4.7 | -3.1 | -0.8 |

| Canadian Equities (SPTSX index) | -22.8 | -14.3 | -13.3 | 27.4 | 13.1 | -5.9 | -1.3 | 0.0 |

| U.S. Equities (SPX Index) | -13.3 | -7.4 | -7.9 | 20.9 | 15.1 | -4.2 | -3.3 | 1.8 |

Source: AGFiQ with data from FactSet and Bloomberg as of June 15, 2021. Equity indexes used for the purposes of this table include Dow Jones Brookfield Global Infrastructure Index (DJBGI), MSCI All-Country World Index (MXWD), S&P/TSX Composite Index (SPTSX), S&P 500 Index (SPX). Purchasing Manager Index (PMI) refers to the seasonally-adjusted Institute of Supply Management (ISM) Manufacturing PMI. Dates for PMI bottoms include April 30, 2003, December 31, 2008, June 30. 2012 and January 31, 2016. Dates for PMI peaks include January 31, 2004, October 31, 2009, December 31, 2013 and February 28, 2017. Dates for End of Elevated PMIs include May 31, 2004, February 28, 2011, November 30, 2014.1

But perhaps what’s most important of all, this same pattern seems to be unfolding in the current environment much as it did in the previous four PMI cycles. Sure, there are some differences. For instance, infrastructure stocks outperformed as one might expect in the 12-month period before the latest bottom in PMIs at the end of April last year. But they underperformed against the grain in both the six-month and three-month period preceding the bottom. That may have more to do with the extraordinary circumstance of the pandemic than anything else, yet returns have been much more in line with history since then, having mostly underperformed off the bottom of the PMI scale and through to the top, which was likely reached earlier this year in March. Moreover, now that the elevated period of PMIs following a new peak seems to have started anew, the underperformance has narrowed –as if on cue – and in some cases returns have even moved ahead of those for broader indexes.

Listed Infrastructure Performance in relation to PMIs (Current Cycle)

| Months Prior to the PMI Bottom | Bottom to Peak PMI | Elevated PMI | |||

|---|---|---|---|---|---|

| 12 mos. | 6 mos. | 3 mos. | |||

| Infrastructure Equities (DJBGIT Index) | -16.0 | -12.2 | -7.9 | 11.4 | 9.3 |

| Global Equities (MXWD Index) | -12.4 | -8.5 | -6.8 | 37.6 | 6.9 |

| Canadian Equities (SPTSX index) | -18.9 | -15.3 | -14.2 | 40.2 | 11.3 |

| U.S. Equities (SPX Index) | -9.7 | -4.1 | -1.1 | 36.4 | 6.9 |

Source: AGFiQ with data from FactSet and Bloomberg as of June 15, 2021. Equity indexes used for the purposes of this table include Dow Jones Brookfield Global Infrastructure Index (DJBGI), MSCI` All-Country World Index (MXWD), S&P/TSX Composite Index (SPTSX), S&P 500 Index (SPX). Purchasing Manager Index (PMI) refers to the seasonally-adjusted Institute of Supply Management (ISM) Manufacturing PMI. Date for PMI bottom is April 30, 2020. Date for PMI peak is March 31, 2021. Elevated PMI is from PMI peak through to May 31, 2021.1

Presumably, that bodes well for infra stocks going forward; the one question being how long it will take for PMIs to start falling again so that listed infrastructure is back in its historical sweet spot again. At least in the past, it has taken 12 to 24 months for the elevated period of PMIs to run its course, but given how compressed this latest cycle has been to date, it may not take nearly as long for PMIs to begin their descent this time around.

Either way, investors shouldn’t be too fussed about getting the timing just right. While tactical adjustments including entry points are increasingly important given the speed at which equity markets trade these days, these short-term moves should not overshadow the long-term growth prospects of infra stocks or their potential to generate attractive dividend yields regularly over time.

1An investment cannot be made in an index

The commentaries contained herein are provided as a general source of information based on information available as of June 17, 2021 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or reliance on the information contained herein. Investors are expected to obtain professional investment advice.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

™ The “AGF” and “AGFiQ” logos are registered trademarks of AGF Management Limited and used under licence.

RO: 1690793

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2021 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.