by Invesco Tax & Estate team, Invesco Canada

Income tax considerations – Gifts to adult children

Our last blog post discussed gifting assets to a spouse. In this blog, we talk about the income tax implications of gifting assets to adult children.

Transferring ownership of property to an adult child, in whole or in part, is generally a taxable disposition. The transfer is usually done at fair market value (FMV) resulting in a capital gain or loss to the parent.

For example, when a parent adds an adult child as a 50 percent joint owner on his or her own investment account, the parent is generally deemed to have disposed of half of the account at the time of transfer, realizing half of the capital gains or losses accumulated in the account.

After the transfer, the child can share the tax liability on income generated from the assets in the account with the parent. Unlike spouses, there is no income attribution between parents and adult children. A child is considered to be an “adult” for income tax purposes (as it particularly relates to the minor income attribution rules) as of the beginning of the year in which he or she turns 18.

An exception to the general rule is when the parent retains beneficial ownership over the entire account and only adds the child as a titleholder (also referred to as “legal owner”). As taxation follows beneficial ownership, no taxable disposition will result from adding the child as a legal owner only. The parent continues to pay tax on all income generated on the account during his or her lifetime.

A taxable deemed disposition of the entire account is triggered upon the parent’s death, with the resulting capital gains or losses reported on the parent’s terminal tax return. The surviving child listed on the account as a joint holder will generally receive the entire account (assuming it is a joint tenancy arrangement, which is unavailable in Quebec) with an adjusted cost basis (ACB) equivalent to the FMV at the parent’s death.

The child’s entitlement to the account is contingent on any claims under the common law presumption of resulting trust doctrine, which will be discussed in further detail in our next blog post, along with other concepts such as legal and beneficial ownership.

For now, let’s focus on the income tax consequences using the following example.

Example

Jay is 88 years old. He has a son, Don, who is 50 years old. Jay has $150,000 in his Invesco non-registered investment account, with an ACB of $100,000. He hopes to gift this account to Don, either during his lifetime or upon his death, depending on whether he still needs some money from the account.

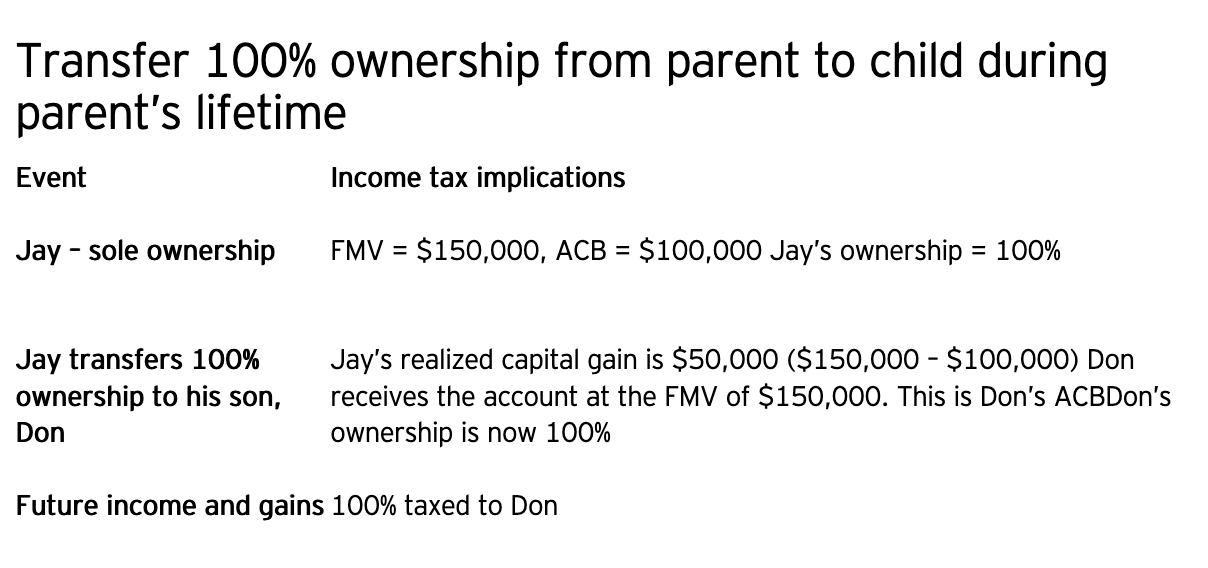

If Jay transfers the entire account to Don inter vivos (while alive), the gift will trigger a taxable disposition for Jay immediately upon the transfer. A $50,000 capital gain will be realized (calculated as $150,000 – $100,000), half of which ($25,000) is taxed to Jay in the year of transfer.

Don receives the account with an ACB of $150,000, which is equal to the FMV at the time of the transfer. Don is responsible for all future income or capital gain taxes related to this investment account.

If Jay instead wishes to add Don as a joint owner (under a joint tenancy with right of survivorship arrangement) on his account so that Don can take over the account upon his death, he can do it in one of the following two ways.

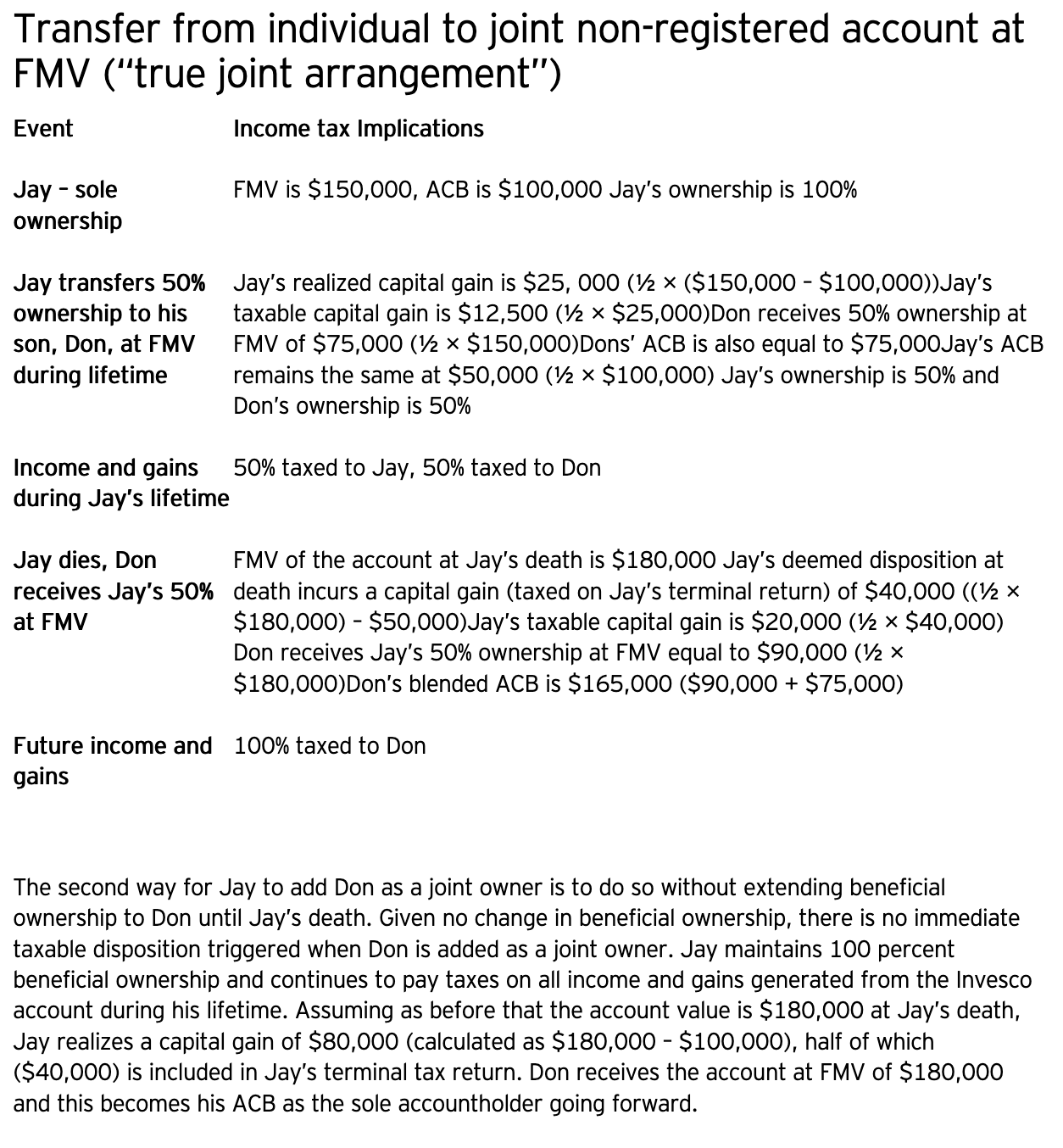

The general way is for Jay to gift 50 percent of the account to Don right away, meaning that Jay is disposing of 50 percent of his account ownership upon the creation of the joint account. This is often referred to as creating a “true joint arrangement.” He would realize a capital gain of $25,000 (calculated as 1/2 × ($150,000 – $100,000)). Half of the capital gain ($12,500) is taxable to Jay at his marginal tax rate in the same year. As Jay retains half of the account for himself, his ACB for the retained shares remains $50,000 (calculated as 1/2 × $100,000) with an FMV of $75,000. Don, receiving 50 percent of the account as a gift, has an ACB of $75,000 (calculated as 1/2 × $150,000), which is equal to the FMV of the half of the account that was gifted to him at the time of the transfer. Until Jay passes away, Jay and Don will share equally in the tax liability for any income generated from the assets in the Invesco account.

When Jay passes away, he is deemed to have disposed of his 50 percent remaining share in the account. The difference between the FMV of the investment and his ACB is reported as a capital gain or loss on Jay’s final tax return. Assuming the account value increases to $180,000 (half of which is attributed to Jay and the other half to Don), Jay incurs a capital gain of $40,000 (calculated as (1/2 × $180,000) – $50,000), half of which ($20,000) is taxable as income on Jay’s final return. Don receives Jay’s 50 percent ownership as the surviving joint tenant (accountholder), with the ACB of Jay’s portion bumped up to the FMV at Jay’s death, namely $90,000 (calculated as 1/2 × $180,000). As a result, Don has a “blended ACB” of $165,000 (the total of $75,000 and $90,000). Going forward, Don will be the sole accountholder on this Invesco account.

Note that in our example, we assume there are no income distributions or other transactions that would increase or decrease the ACB for both Jay and Don. In reality, their respective ACBs will likely change over time depending on the account activities. Also, as you can tell, Jay and Don have different ACBs, but usually the financial institution will only keep track of one ACB at the account level. This means that the ACB will not account for partial ownership transfers or deemed dispositions. Therefore, it is crucial that each individual joint owner keep track of his/her own ACB that reflects the arrangement.

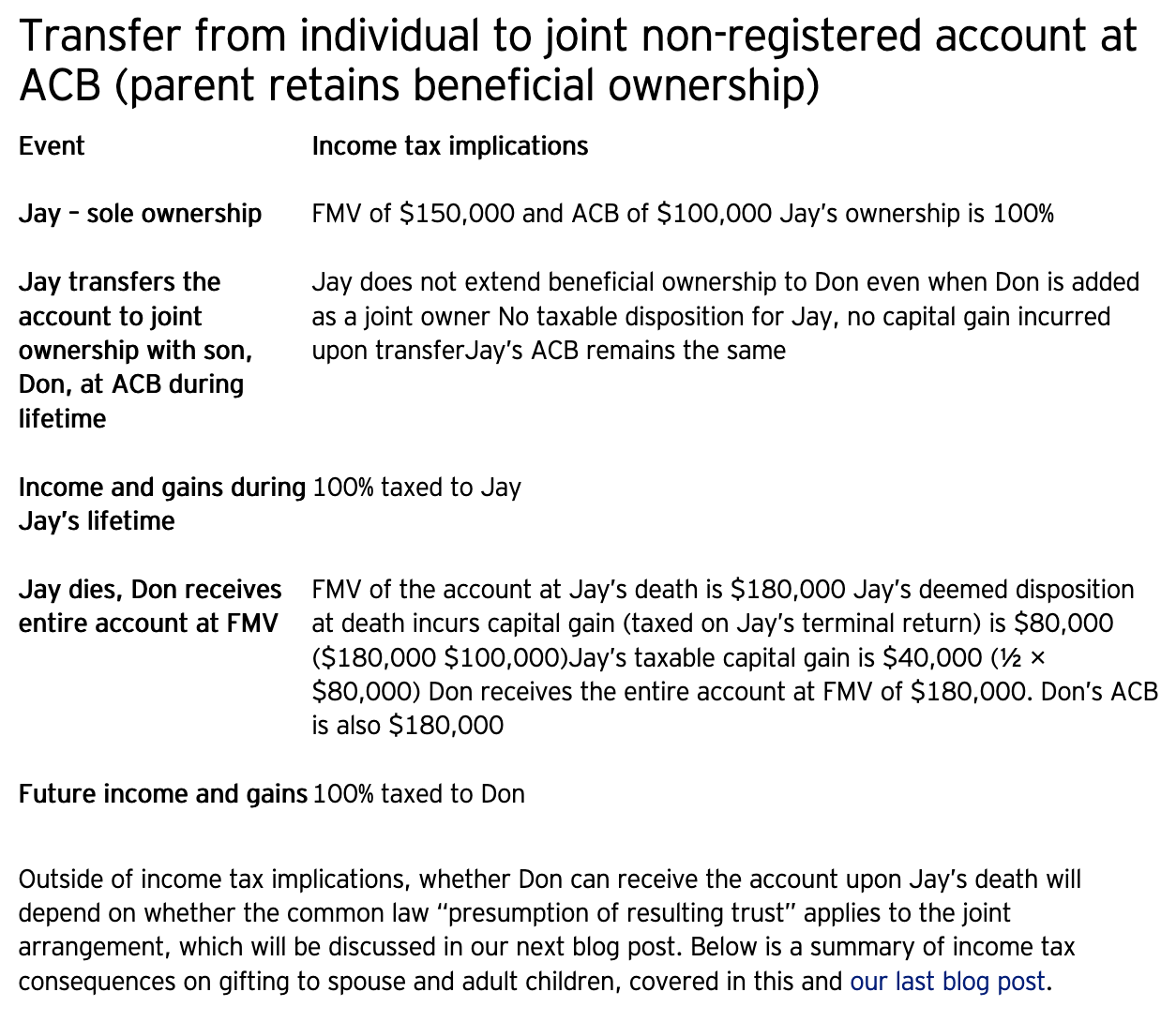

The second way for Jay to add Don as a joint owner is to do so without extending beneficial ownership to Don until Jay’s death. Given no change in beneficial ownership, there is no immediate taxable disposition triggered when Don is added as a joint owner. Jay maintains 100 percent beneficial ownership and continues to pay taxes on all income and gains generated from the Invesco account during his lifetime. Assuming as before that the account value is $180,000 at Jay’s death, Jay realizes a capital gain of $80,000 (calculated as $180,000 – $100,000), half of which ($40,000) is included in Jay’s terminal tax return. Don receives the account at FMV of $180,000 and this becomes his ACB as the sole accountholder going forward.

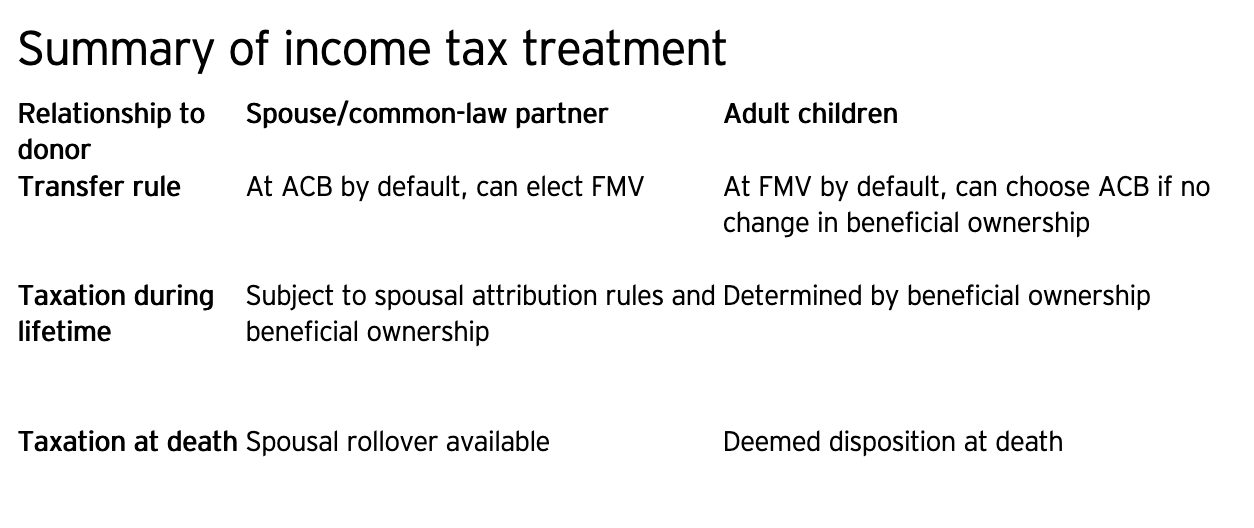

Outside of income tax implications, whether Don can receive the account upon Jay’s death will depend on whether the common law “presumption of resulting trust” applies to the joint arrangement, which will be discussed in our next blog post. Below is a summary of income tax consequences on gifting to spouse and adult children, covered in this and our last blog post.

The post Tax and estate planning: What you need to know about gifting to family members (Part two) appeared first on Invesco Canada blog.

This post was first published at the official blog of Invesco Canada.