The Northern Trust Economics team shares its outlook for the U.S. economy.

by Carl R. Tannenbaum, Ryan James Boyle and Vaibhav Tandon, Northern Trust

It’s been great to see the economy reopen, releasing a tremendous surge of energy. But anxieties remain: Will the economy overheat? Are we on a course toward runaway inflation? Will the workforce return to its former size? While these are all good questions, current worries about the economy should be kept in context. These doubts are only arising because of a phenomenal rate of recovery.

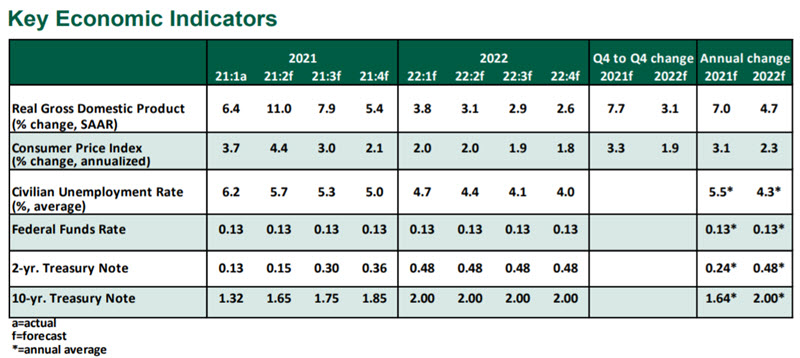

The challenge before us is sorting the transient effects from more permanent changes to the economy. We continue to believe the foundation is in place for an historic year of growth, and any complications, like elevated inflation, will prove transitory. We also cannot entirely discount the risk of a renewed wave of infections that causes more lockdowns, but the effectiveness of vaccines against new variants thus far makes this less of a worry.

Influences on the Forecast

- The U.S. added 559,000 jobs in May, with the unemployment rate declining to 5.8%. While the absolute gain is high, the widespread reopening had raised hopes of even better jobs growth. We expect this to be the first in a string of high employment readings, leading to continual improvement in the labor market.

- Details of the employment report were a mixed bag. Hiring was strongest in pandemic-damaged sectors including hospitality and child care, and wages grew broadly by 2.0% year-over-year. However, 7.6 million people remain sidelined, and the labor force participation rate declined slightly.

- Fear of COVID-19 exposure, uncertain childcare arrangements and extended unemployment insurance have worked in combination to slow some workers’ return to the labor force. All of these concerns will prove temporary, with 25 states now rescinding extended unemployment benefits ahead of the scheduled federal expiration in September. Initial unemployment claims have declined for months and are approaching their pre-pandemic levels, while job openings have reached record highs.

- Inflation remains a primary concern: The consumer price index grew by 5.0% year-over-year in May. As in April, higher prices in specific categories like travel and used cars led the headline increase. On a monthly basis, prices increased less in May than they did in April, suggesting price pressures will prove transitory. The Fed’s preferred measure, the personal consumption expenditures price index excluding food and energy, leaped to 3.1% year-over-year in April, a reading distorted by base effects from the April 2020 lockdowns.

- Personal income fell 13.1% month-over-month in April, after most $1,400 stimulus payments were disbursed in March. This is likely to be the end of lump-sum government support to individuals; however, the expanded child tax credit direct monthly payments starting in July will support families’ incomes.

- House prices have been on a tear, with the Case-Shiller and Federal Housing Finance Agency price indices both gaining over 13% year-over-year in March. These rapid gains are not sustainable; we expect a return to more normal appreciation over the course of the year. Limited supply is keeping upward pressure on house prices, while input costs are raising the prices of new construction. However, mortgage underwriting standards remain conservative, and demand will fall as households settle into post-pandemic, work-from-home lifestyles.

- Negotiations around potential infrastructure spending continue, with top-line price estimates and prospects for tax increases both falling with each iteration. Our forecast assumes a smaller package is passed later in 2021, with costs and gains that will play out over a prolonged period.

- In public comments, several governors of the Federal Reserve have suggested that tapering asset purchases will be discussed at some point in the not-too-distant future. We expect the Fed to announce a tapering plan late this year and gradually reduce asset purchases over the course of 2022. The effort will be well-signaled and should not disrupt markets. As long as the Fed is making any asset purchases, even at a slower rate, it is still accommodative.

- With more than half the country vaccinated, and even more people carrying natural immunity from prior infections, this report no longer needs to start with statistics about COVID-19. Outreach efforts to accommodate more unvaccinated people and redirect vaccines to contain the global spread of the virus will help keep this risk in check.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2021 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.