by Don Vialoux, EquityClock.com

Technical Notes released yesterday at Stockcharts.com@EquityClock

Cisco $CSCO a Dow Jones Industrial Average stock moved above $54.14 extending an intermediate uptrend

IBM $IBM a Dow Jones Industrial Average stock moved above $148.38 extending an intermediate uptrend.

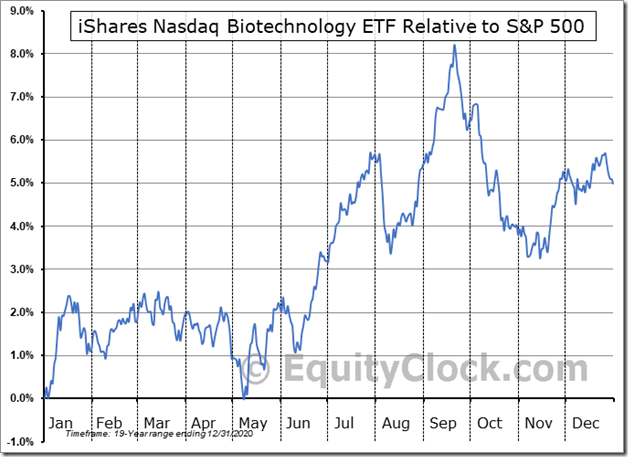

NASDAQ Biotech iShares $IBB moved above $159.37 resuming an intermediate uptrend.

Seasonal influences for NASDAQ Biotech iShares $IBB are positive on a real and relative basis between now and mid-September

Another Biotech ETF breakout! Van Eck Biotech ETF $BBH moved above $197.98 to an all-time high extending an intermediate uptrend.

Much of the gains by Biotech ETFs can be attributed to favourable news received by Biogen $BIIB on its new Alzheimer drug. Nice breakout above $363.92 to an all-time high!

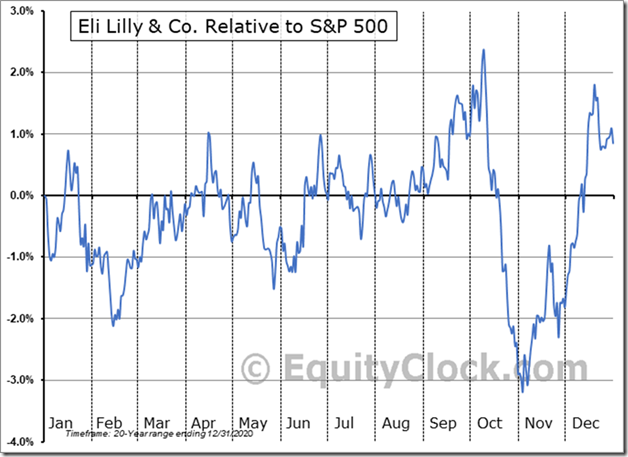

Eli Lilly $LLY an S&P 100 stock moved above $216.14 to an all-time high extending an intermediate uptrend. The company has a Phase 2 drug trial on a treatment for Alzheimer’s disease.

Seasonality on Eli Lilly $LLY is favourable on a real and relative basis (relative to the S&P 500) between now and the end of September/early October

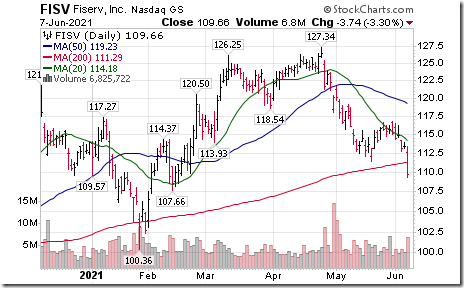

Fiserv $FISV a NASDAQ 100 stock moved below $111.41 extending an intermediate downtrend.

Illumina $ILMN a NASDAQ 100 stock moved above $426.44 resuming an intermediate uptrend.

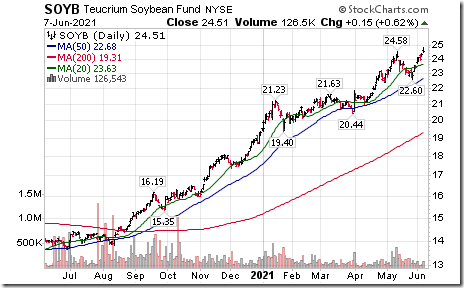

Soybean ETN $SOYB moved above $24.58 extending an intermediate uptrend.

Trader’s Corner

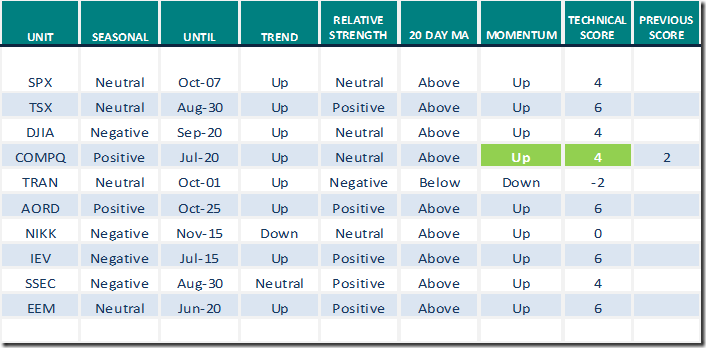

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for June 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

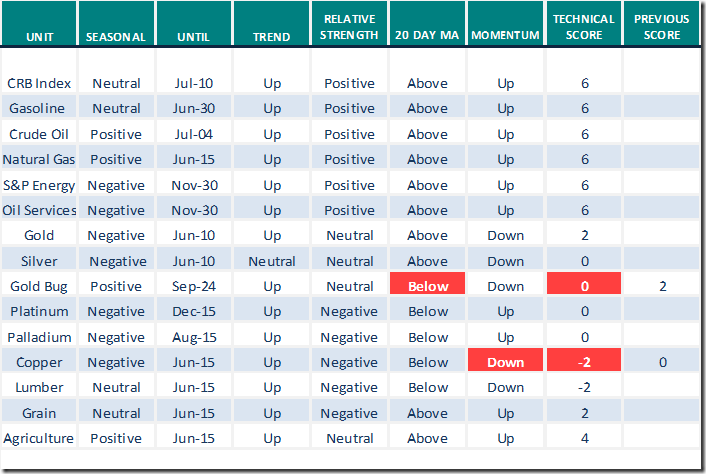

Commodities

Daily Seasonal/Technical Commodities Trends for June 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

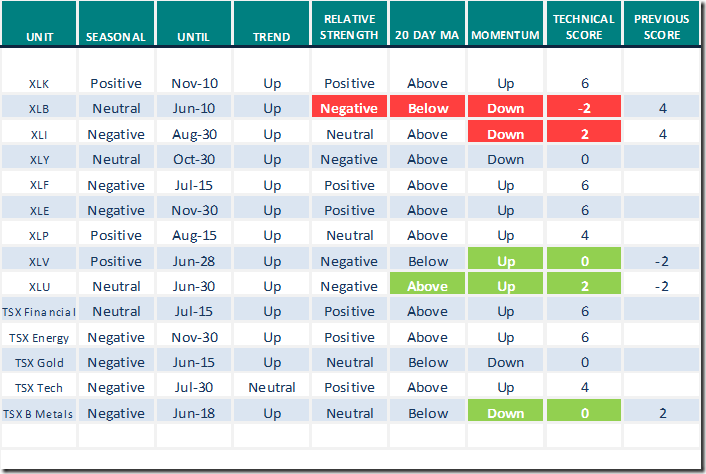

Sectors

Daily Seasonal/Technical Sector Trends for June 7th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

S&P 500 Momentum Barometers

The intermediate term Barometer fell 3.41 to 69.48 yesterday. It remains Overbought and showing early signs of turning down.

The long term Barometer eased 0.40 to 90.96 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 0.80 to 71.76 yesterday. It remains Overbought.

The long term Barometer added 1.95 to 81.48 yesterday. It changed from Overbought to Extremely Overbought on a move above 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.