by Don Vialoux, EquityClock.com

Technical Notes released yesterday at StockTwits.com@EquityClock

Nil

Trader’s Corner

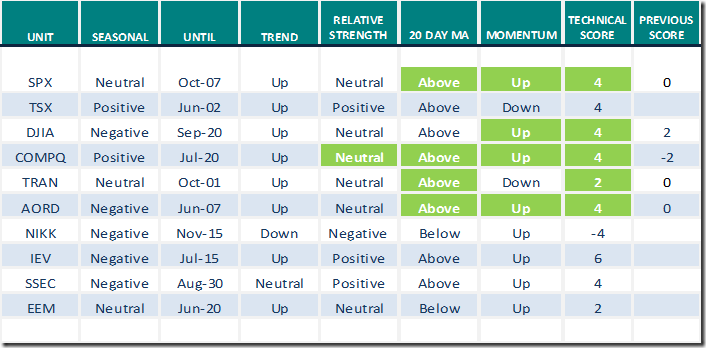

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for May 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

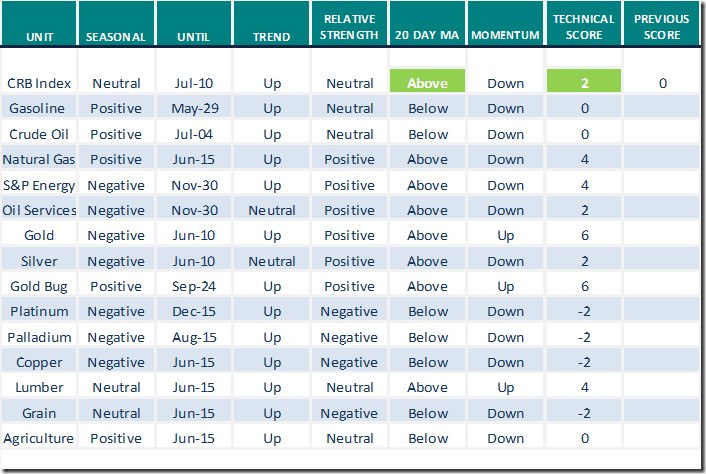

Commodities

Daily Seasonal/Technical Commodities Trends for May 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

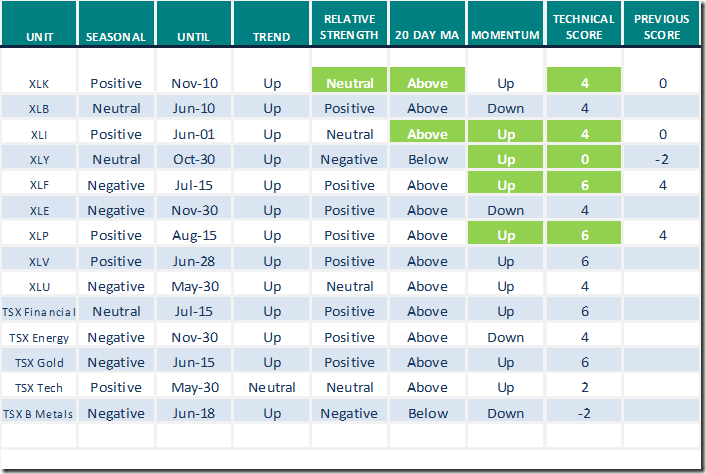

Sectors

Daily Seasonal/Technical Sector Trends for May 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Scans to help you stay nimble

Technical tools offered by Greg Schnell on StockCharts.com. Following is the link:

https://www.youtube.com/watch?v=r9_jcbgtrKY

Market Buzz

Greg offers “Clean Tech Wreck Review 2.0. Following is the link:

https://www.youtube.com/watch?v=JfEZqa7C81Q

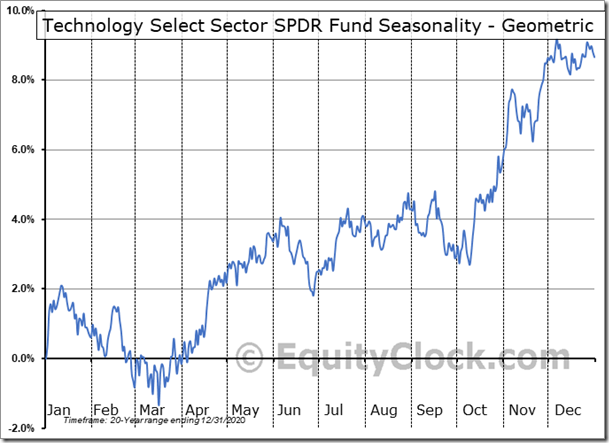

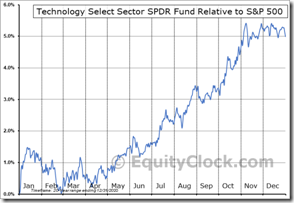

Technicals for the NASDAQ Composite Index and Technology SPDRs

Their technical profiles improved significantly yesterday: They moved above their 20 and 50 day moving averages, their short term momentum indicators (Stochastics, RSI, MACD) turned higher and strength relative to the S&P 500 Index changed from negative to neutral.

Seasonality influences of both indices are virtually identical and are Positive on a real and relative basis until at least mid-July.

Technology Select Sector SPDR Fund (NYSE:XLK) Seasonal Chart

S&P 500 Momentum Barometers

The intermediate term Barometer added 4.41 to 73.75 yesterday. It remains Overbought.

The long term Barometer added 0.40 to 91.78 yesterday. It remains Extremely Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.