by Don Vialoux, EquityClock.com

Pre-opening Comments for Friday May 21st

U.S. equity index futures were higher this morning. S&P 500 futures were up 16 points in pre-opening trade.

The Canadian Dollar was virtually unchanged at US83.06 cents following release of Canadian March Retail Sales at 8:30 AM EDT. Consensus was an increase of 3.7% versus a gain of 1.2% in February. Actual was an increase of 3.6%.

Home Depot added $1.75 to $317.65 after announcing a $20 billion share repurchase program after the close yesterday.

Applied Materials (AMAT $130.31) slipped $1.81 to $128.50 despite reporting higher than consensus quarterly revenues and earnings, a dividend increase and an extended share repurchase program The company also raised guidance.

Deere gained $3.78 to $359.00 after reporting higher than consensus fiscal second quarter sales and earnings. The company also raised guidance.

EquityClock’s Daily Comment

Following is a link:

http://www.equityclock.com/2021/05/20/stock-market-outlook-for-may-21-2021/

Barrick Gold on Cramer’s Mad Money last night

Barrick Gold’s CEO Mark Bristow was interviewed last night. The stock was higher in overnight trading. Comments were favourable. Following is a link:

Next Tech Talk report

Next report is released on Monday despite the Victoria Day holiday in Canada.

Technical Notes released on Friday at StockTwits.com@EquityClock

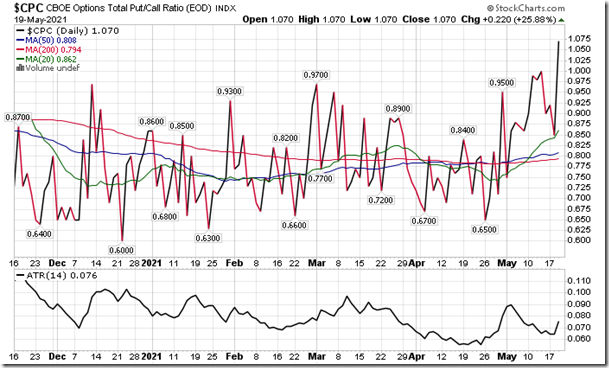

The elimination of excess is placing the market on a firmer footing. equityclock.com/2021/05/19/… $CPC $STUDY $BTC.X $LB_F $CL_F

Cisco $CSCO a Dow Jones Industrial Average stock moved below intermediate support at $50.29 and below its 20 and 50 day moving averages.

Bristol-Myers Squibb $BMY an S&P 500 stock moved above $66.93 and $67.03 to an all-time high extending an intermediate and long term uptrend.

Intuit $INTU a NASDAQ 100 stock moved above $422.77 and $423.13 to an all-time high extending an intermediate uptrend.

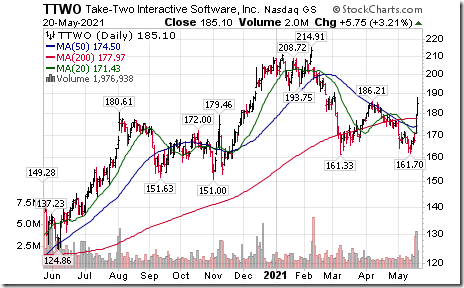

Take Two Interactive $TTWO a NASDAQ 100 stock moved above intermediate resistance at $186.21

Silver equities and $SIL are moving higher. First Majestic Silver $AG moved above US$17.66 and US$17.72 resuming an intermediate uptrend.

Trader’s Corner

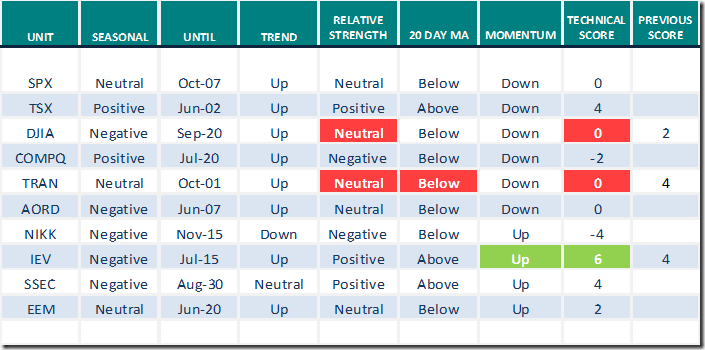

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for May 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

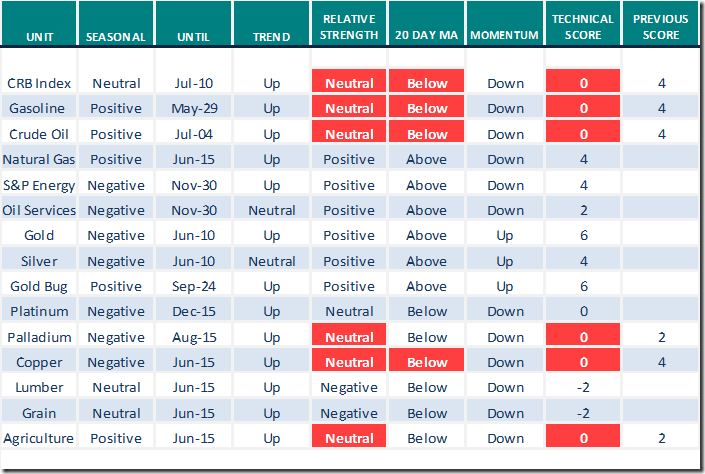

Commodities

Daily Seasonal/Technical Commodities Trends for May 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

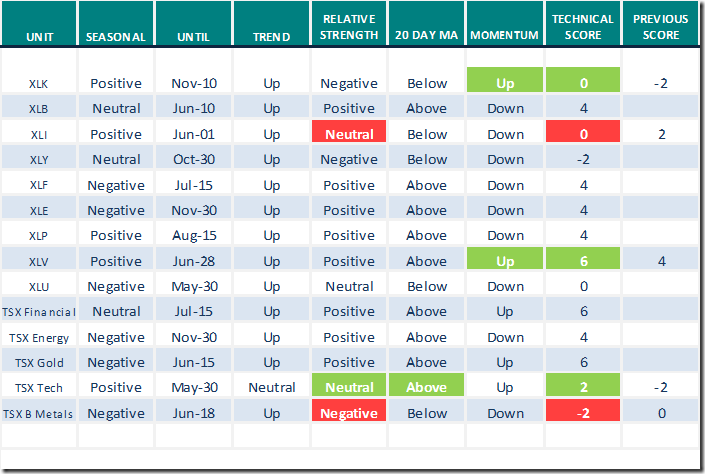

Sectors

Daily Seasonal/Technical Sector Trends for May 20th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Comments by Tom McClellan on CNBC last night

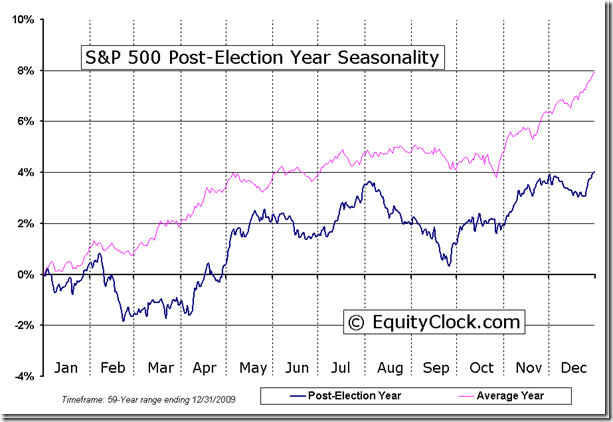

Tom took a bullish intermediate term stance on U.S. equity markets based on favourable seasonal influences. He noted that the S&P 500 Index has a history of moving slightly lower between now and mid-June followed by a move higher from mid-June to the end of July during Post-Presidential Election Years. The following EquityClock chart confirms his call on seasonal influences.

Following is a link to his comments.

S&P 500 Momentum Barometers

The intermediate term Barometer added 3.81 to 70.74 yesterday. It remains Overbought.

The long term Barometer added 2.00 to 92.38 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate Barometer added 1.25 to 66.67 yesterday. It remains Overbought.

The long term Barometer added 1.30 to 78.87 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/2021/05/clip_image0011_thumb-5.png)

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/2021/05/clip_image0021_thumb-8.png)

![clip_image003[1] clip_image003[1]](https://advisoranalyst.com/wp-content/uploads/2021/05/clip_image0031_thumb-6.png)