by Talley Leger, Investment Strategist, Invesco Canada

After a year of weakening business fundamentals, earnings may be kicking into high gear. What does this mean for stocks?

In the first year of this new market cycle, U.S. stocks enjoyed strong returns alongside expanding price-to-earnings (P/E) multiples and deteriorating business fundamentals. Naturally, investors wondered how U.S. stocks could do so well when earnings were so bad?

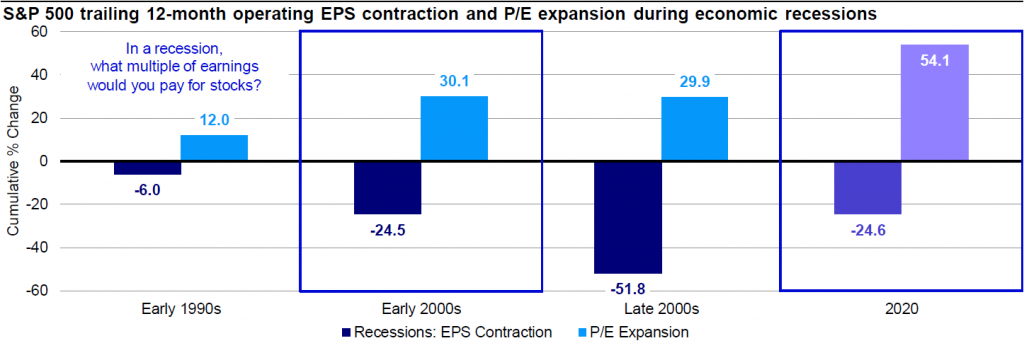

However, the combination of expanding P/E ratios and contracting earnings is far from unusual. Like clockwork, corporate profits fell and multiples rose during each of the last four recessions, including this one (Figure 1).

Figure 1. Like clockwork, U.S. earnings fell and multiples rose during each of the last three recessions, and this one was no exception.

Why? One explanation is it’s a denominator effect. When earnings (E) decrease, they cause the P/E ratio to increase. Another explanation is that stocks, which are leading indicators of business activity, anticipate corporate profits by three to six months. Near major lows in the business cycle, stock prices (P) tend to look across the valley to better times ahead, as they’ve done over the past year.

Aren’t stocks overvalued?

In the second year of this new market cycle, investors are now concerned about lofty stock market valuations with seemingly little room for further gains.

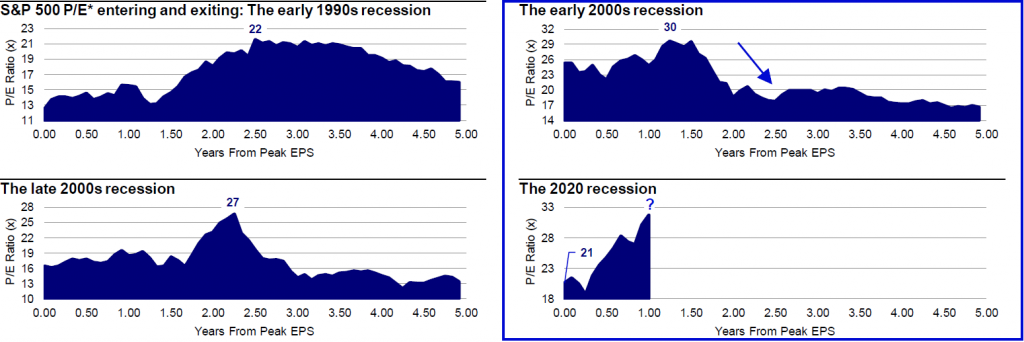

Nonetheless, history informs us that U.S. stocks grew into their multiples after every recession since the early 1990s. In each case, it was just a matter of how soon that process began. In the early 2000s, P/Es peaked a little more than a year after earnings peaked.

Currently, we think the stock market is nearing the end of its transition from peak earnings to peak multiples (Figure 2).

Figure 2. U.S. stocks may be on the verge of growing into their multiple, which they did after each recession since the early 1990s.

What’s better for stocks? Multiple expansion or earnings growth?

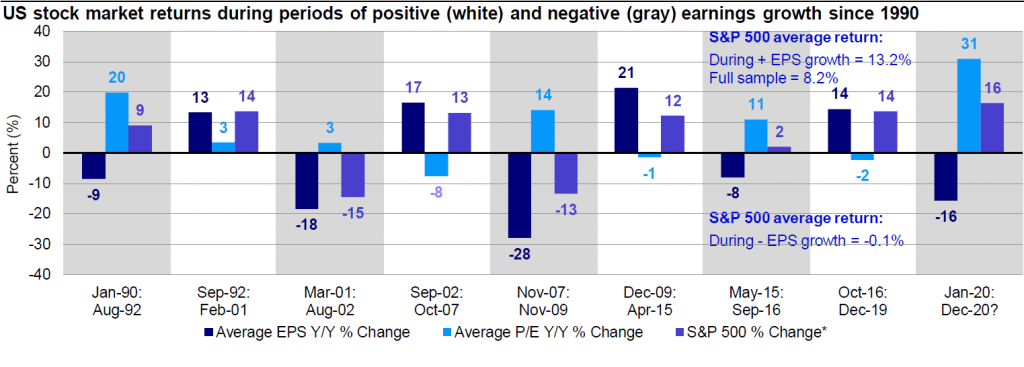

More importantly, my research shows that stocks produced consistent double-digit returns during periods of positive earnings growth over the past 31 years, regardless of what multiples did.

While the stock market did very well last year, the combination of rising P/Es and falling profits hasn’t always been good for stocks. Since 1990, negative earnings growth and expanding multiples actually produced below-average (i.e., flat) stock market returns.

True, multiple expansion helped generate positive single-digit returns in the early 1990s and 2015-2016. But that wasn’t the case in the early or late 2000s, when returns were deeply negative (Figure 3).

Figure 3. Multiple expansion helps, but U.S. stocks did best during periods of positive earnings growth, regardless of what multiples did.

After a year of deteriorating business fundamentals, what’s the outlook for earnings?

The good news is that unsmoothed earnings growth is already showing nascent signs of bottoming, much like it did in the relatively short and shallow economic recession of 2001.

At first blush, terrorism and pandemics have little in common. Another look reveals that both the 2001 and 2020 economies were struck by endogenous shocks, leading to fear and shutdowns, which gave way to rapid recoveries in confidence, mobility and business conditions.

Looking ahead, my framework of leading indicators signals that a V-shaped recovery in earnings growth greater than 20% may be imminent!

As Frank Sinatra once sang, “Out of the tree of life I just picked me a plum. You came along and everything’s startin’ to hum. Still, it’s a real good bet, the best is yet to come.”

To see more visual representations of my stock market outlook, click here.

This post was first published at the official blog of Invesco Canada.