by Don Vialoux, EquityClock.com

The Bottom Line

North American equity indices were mixed/slightly lower last week. Greatest influences on North American equity markets remain evidence of a possible third wave of the coronavirus (negative) and continued expansion of distribution of a vaccine (positive).

Observations

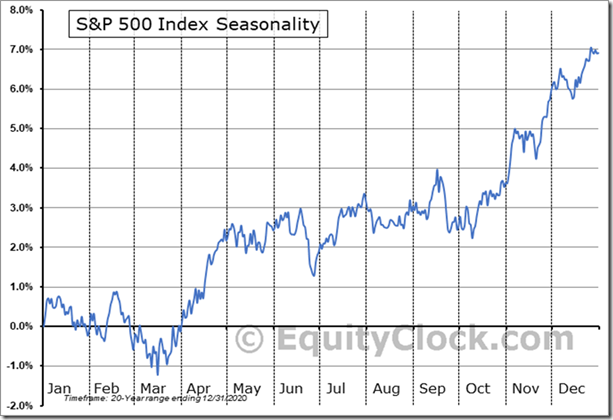

The S&P 500 Index extended gains last week by reaching another all-time high, typical of performance during its strongest eight week period of seasonal strength for the year from mid-March to the first week in May. Now, the Index has moved into a mixed, choppy period of seasonal performance between early May and the second week in October

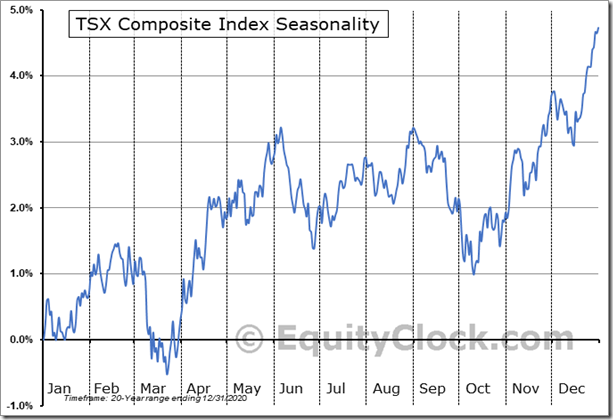

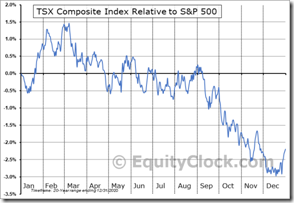

The TSX Composite Index has a history of moving higher on a real basis and outperforming the S&P 500 Index on a relative basis between now and early June.

Short term short term indicators for U.S. equity indices, commodities and sectors (20 day moving averages, short term momentum indicators) deteriorated slightly again last week, but remained at elevated levels.

Intermediate term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved lower again last week. It remained Extremely Overbought and shows signs of passing its peak. See Barometer chart at the end of this report.

Long term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 200 day moving average) also moved lower again last week. It remained Extremely Overbought. See Barometer chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors were virtually unchanged last week.

Medium term technical indicator for Canadian equity markets moved lower last week. It remained Overbought and trending down. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (i.e. Percent of TSX stocks trading above their 200 day moving average) moved slightly lower last week. It changed from Extremely Overbought to Overbought on a move below 80.00 and shows early signs of trending down. See Barometer chart at the end of this report.

Consensus estimates for earnings by S&P 500 companies continued to increase last week. Sixty percent have reported results to date with 86% reporting higher than consensus earnings estimates and 78% reporting higher than consensus revenue estimates. According to www.FactSet.com earnings in the first quarter of 2021 on a year-over-year basis are expected to increase 45.8% (versus previous estimate at 33.8% last week) and revenues are expected to increase 9.1% (versus previous estimate at 7.5% last week). Earnings in the second quarter are expected to increase 58.3% (versus previous estimate at 55.4%) and revenues are expected to increase 18.1% (versus previous estimate at 17.4%). Earnings in the third quarter are expected to increase 21.7% (versus previous estimate at 20.3%) and revenues are expected to increase 11.2% (versus previous estimate at 10.6%). Earnings in the fourth quarter are expected to increase 16.7% (versus previous estimate at 15.6%) and revenues are expected to increase 8.2% (versus previous estimate at 7.8%). Earnings for all of 2021 are expected to increase 31.7% (versus previous estimate at 29.0%) and revenues are expected to increase 10.9% (versus previous estimate at 10.3%)

Economic New This Week

March Construction Spending to be released at 10:00 AM EDT on Monday is expected to increase 2.0% versus a decline of 0.8% in February.

April Manufacturing ISM to be released at 10:00 AM EDT on Monday is expected to increase to 65.0 from 64.7 in March.

March Canadian Trade Balance to be released at 8:30 AM EDT on Tuesday is expected to versus a surplus of 1.04 billion in February.

March Factory Orders to be released at 10:00 AM EDT on Tuesday are expected to increase 1.1% versus a drop of 0.8% in February.

April Non-Manufacturing ISM to be released at 10:00 AM EDT on Wednesday is expected to increase to 64.3 from 63.7 in March.

First quarter Non-farm Productivity to be released at 8:30 AM EDT on Thursday is expected to drop 3.5% versus a decline of 4.2% in the fourth quarter 2020.

April Non-farm Payrolls to be released at 8:30 AM EDT on Friday are expected to increase to 950,000 from 916,000 in March. April Unemployment Rate is expected to drop to 5.7% from 6.0% in March. April Hourly Earnings are expected to increase 0.1% versus a decline of 0.1% in March.

April Canadian Employment to be released at 8:30 AM EDT on Friday is expected to versus a gain of 303,100 in March. April Unemployment Rate is expected to increase to 8.0% from 7.5% in March.

Selected Earnings News This Week

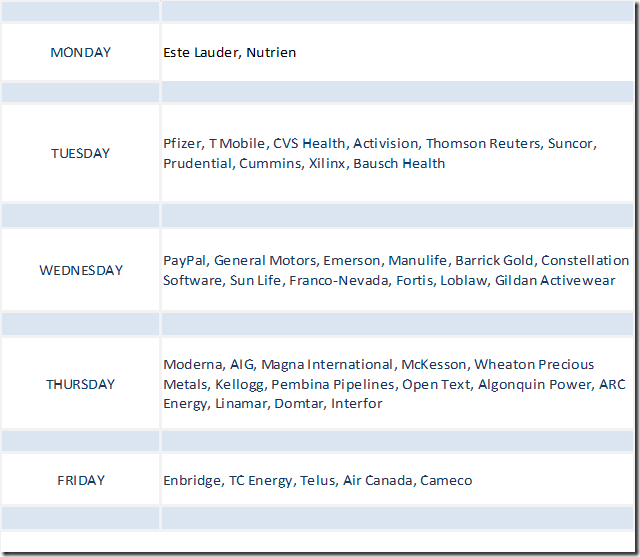

Frequency of quarterly corporate reports passed its peak for S&P 500 companies last week. Another 133 companies are scheduled to release quarterly results this week (including three Dow Jones Industrial Average companies)

Frequency of quarterly corporate reports for TSX 60 companies reaches a peak this week.

Trader’s Corner

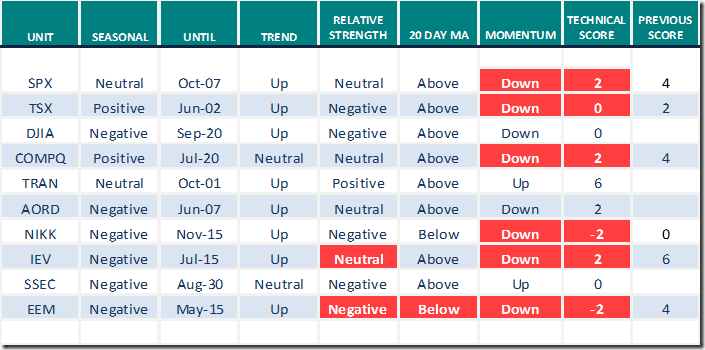

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

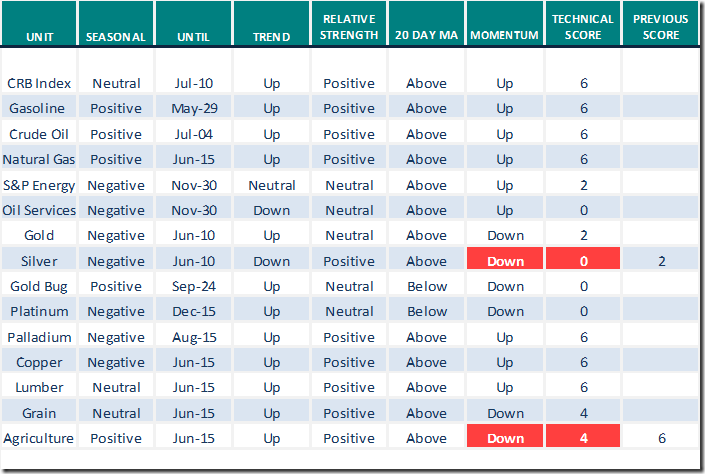

Commodities

Daily Seasonal/Technical Commodities Trends for April 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

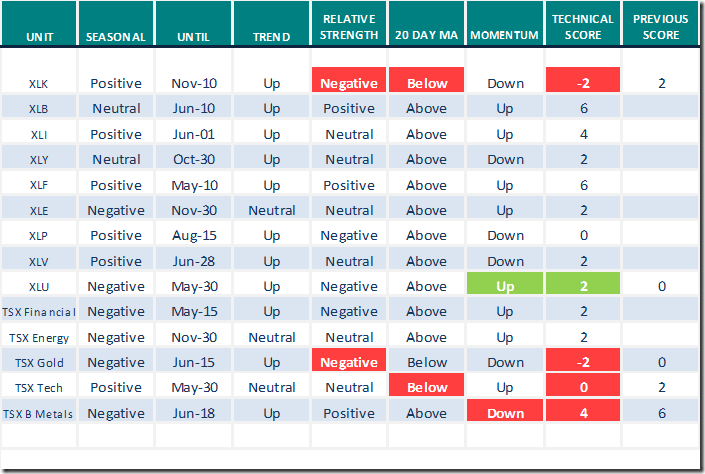

Sectors

Daily Seasonal/Technical Sector Trends for April 30th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly report:

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday April 30th

Seagen (SGEN), a NASDAQ 100 stock moved below $134.51 extending an intermediate downtrend.

Fiserv (FISV), a NASDAQ 100 stock moved below $118.54 completing a double top pattern.

S&P 500 Momentum Barometers

The intermediate term Barometer dropped 3.21 on Friday and 3.21 last week to 84.57. It remains Extremely Overbought and shows signs of a peak at 92.57 set on April 15th

The long term Barometer slipped 0.42 on Friday and 1.60 last week to 94.79. It remains Extremely Overbought

TSX Momentum Barometers

The intermediate term Barometer dropped 7.00 on Friday and 7.87 last week to 65.50. It remains Overbought and trending down.

The long term Barometer slipped 1.00 on Friday and dropped 2.40 last week to 78.50. It changed from Extremely Overbought to Overbought on a move below 80.00 and shows early signs of trending down.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.