by Invesco Fixed Income, Invesco Canada

As the economy grows, inflation fears are rising. Invesco Fixed Income shares its view of inflation for 2021 and 2022.

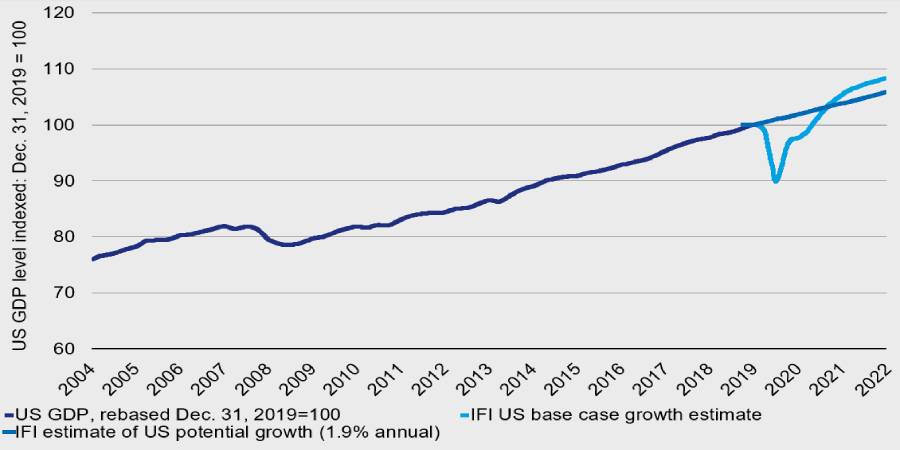

The U.S. economy has been growing at a remarkable pace, as consumers engage in a post-pandemic return to a more normal life. Invesco Fixed Income believes this is likely to continue throughout this year and we expect the U.S. economy to grow more than 7% for 2021 in its entirety – this would be a remarkable outcome, driven by aggressive policy support and the inspirational work to quickly develop a vaccine. We expect the U.S. economy to surpass its 2019 size in the second quarter and return to its pre-pandemic growth trend by the end of this year.

It is increasingly looking like 2022 will also be a year of strong growth, as fiscal and monetary policy are expected to keep pushing the economy forward. If growth has returned to trend and the economy has achieved full employment by the end of this year (which we expect), shouldn’t strong growth next year generate inflation? If not then, when?

Figure 1: In our base case, U.S. exceeds trend GDP growth by end 2021

A near-term bump in inflation is likely

Forecasting inflation over the next two years is complicated by the fact that, in the near term, we are virtually certain to get a substantial bump in inflation. Why? The decline in inflation last year during the pandemic shutdown will drop out of the annual comparisons in the coming quarter. We will likely see increases in both headline and core inflation as a result. On top of this so-called “base effect,” temporary supply chain issues are also driving prices up on a whole range of goods, from lumber to energy. We are likely to see higher inflation in the next two quarters than we have seen for some time, with headline year-over-year consumer price inflation in the U.S. potentially reaching above 3%, in our view.

The inflation outlook for 2022 is harder to predict

Looking ahead to next year, the outlook for inflation is less clear.

- On one hand, the U.S. Federal Reserve (Fed) had indicated that it expects any rise in inflation to be transitory as we move forward. Inflation breakevens indicate that the market is expecting a near-term peak in inflation, with a retreat afterward. Inflation expectations have proven to be very well-anchored and seem likely to need more than a one-year bounce-back in inflation to push them higher. History indicates that inflation expectations are quite sticky. This should anchor longer-term inflation and help ensure that near-term inflation is transitory.

- On the other hand, the pandemic, recent growth, and the extraordinary stimulus may prove enough to change past economic behaviours and relationships. Large increases in money supply and easy interest rates are clearly supporting higher prices in financial assets. In time, they may support higher prices in the real economy as well.

Keeping an eye on wages

In our view, the key thing to watch over the next year to gauge the likelihood of persistent inflation will be wages. Past recoveries have been unable to generate persistent wage increases, even at low unemployment rates. The sheer momentum of this recovery and size of policy stimulus may mean it will be different this time. By our estimate, the U.S. economy should be close to full employment at the end of this year, with the economy growing well above trend. Rising wages would likely feed through into persistent inflation. As the U.S. economy returns to full employment, we believe wages will be a key indicator to watch to understand the risk of persistent inflation.

How the Fed would react to upside inflation momentum is difficult to know. It has gone out of its way to emphasize that it will not raise rates until inflation is above 2% and expected to remain above 2% for a period of time. This implies that the Fed would be slow to respond to inflationary pressure. In that situation, we may see the return of the bond vigilantes and see bond yield curves steepen to price in a Fed that is well behind the curve. Stock and bond markets have been in a sweet spot in recent quarters, with strong growth momentum and extremely easy policy. Any signs of persistent inflation in the second half of this year should be a warning sign that stock and bond markets may move from a sweet spot to a rougher patch.

The post The grand reopening continues apace, but what about inflation? appeared first on Invesco Canada blog.

This post was first published at the official blog of Invesco Canada.