by Invesco Tax & Estate team, Invesco Canada

This is part two of a three-part series focused on the 2021 Federal Budget. Picking up from the first blog post on Personal Income Tax Measures, we’ll cover Business Income Tax Measures.

Business Income Tax Measures

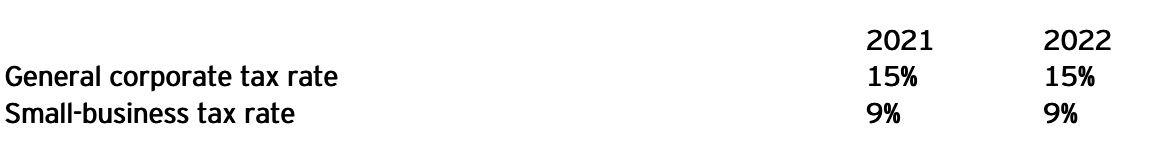

The 2021 Federal Budget proposed no changes to the corporate income tax rates, including the small business income limit ($500,000) for Canadian-controlled private Corporations (CCPC). Below are the corporate tax rates.

Extending the Canada Emergency Wage Subsidy (CEWS)

A Canadian employer who has seen a drop in revenue due to the COVID-19 pandemic may be eligible for a subsidy in order to cover part of their employee wages. CEWS intends to preserve and protect the jobs of Canadians by ensuring employers have sufficient support to keep employees on the payroll and incentive to re-hire laid-off employees.

Currently, the wage subsidy program is set to expire in June 2021. However, to help Canadians transition through the rest of the COVID-19 crisis to recovery, Budget 2021 proposes to extend the wage subsidy until September 25, 2021. Budget 2021 also proposes to gradually decrease the subsidy rate, beginning July 4, 2021, to ensure an orderly phase-out of the program as the economy reopens. An analysis of Canada’s economic and public health situation will be made at a later date, and if required, the government will seek the legislative authority to further extend the CEWS program until November 20, 2021.

To further support workers, Budget 2021 proposes that any publicly listed corporation receiving CEWS and found to be paying its top executives more in 2021 than in 2019 will be required to repay, the equivalent in wage subsidy amounts received for any qualifying period starting after June 5, 2021, and until the end of the wage subsidy program.

Extending the Canada Emergency Rent Subsidy (CERS) and Lockdown Support

Starting September 27, 2020, Canadian businesses, charities, or non-profit organizations who have seen a drop in revenue during the COVID-19 pandemic may be eligible for a subsidy, known as the CERS, to cover part of their commercial rent or property expenses. The CERS provides payments directly to qualifying renters and property owners with direct and easy-to-access rent support without requiring the participation of landlords. To date, the CERS and Lockdown Support have helped more than 154,000 organizations with rent, mortgage, and other expenses. Currently, this program is set to expire in June 2021. However, like the CEWS, Budget 2021 proposes to extend CERS and Lockdown Support until September 25, 2021. In addition, Budget 2021 proposes to gradually decrease the rate of the rent subsidy, beginning July 4, 2021, to ensure the CERS program is phased out in an orderly fashion as vaccinations are completed, and the economy reopens.

The government may seek legislative authority to further extend the CERS program until November 20, 2021, based on Extending the Canada Emergency Business Account (CEBA)

In order to combat the severe economic impacts of the COVID-19 virus, the Government of Canada partnered with Export Development Canada (EDC) to launch the Canada Emergency Business Account (CEBA) for small businesses. Prior to December 2020, CEBA provided interest-free loans of up to $40,000 to small businesses and not-for-profits in order to help them cover their operating costs during a period where business revenues were down. In December 2020, the government increased the value of the CEBA loan from $40,000 to $60,000. If the loan is repaid by December 31, 2022, up to a third ($20,000) of the $60,000 loan will be eligible for complete forgiveness without any penalty. Otherwise, the term loan will be extended for an additional three years with a 5% annual interest rate.

To further recognize the ongoing pandemic and challenges faced by a small number of business (including Indigenous and rural businesses), the Government of Canada recently extended the application deadline for CEBA to June 30, 2021, and for Regional Relief and Recovery Fund and the Indigenous Business Initiative to June 30, 2021.

Enhancing Employment Insurance (EI) regular benefits

Temporarily Waiving One-week Waiting Period for EI Claims

EI is a program administered under the federal Employment Insurance Act and aims to provide financial assistance to individuals who lost their jobs through no fault of their own. Generally, before an individual starts receiving EI benefits, there may be one week for which that person will not be paid. To address ongoing restrictions in many parts of Canada this winter, the Government of Canada announced waiving the waiting period for EI beneficiaries who establish a new claim between January 31, 2021, and September 25, 2021. The temporary change allows individuals who apply for benefits to be paid their first week of unemployment, thus easing their financial stress.

Additional Weeks of Recovery Benefits and EI Regular Benefits

The Government of Canada acknowledged that self-employed workers, gig workers, Canadians who have small amounts of part-time work, and those who cannot take jobs due to the pandemic did not qualify for EI regular benefits needed for support during the pandemic. After creating the Canada Emergency Response Benefit (CERB) on March 25, 2020, the Government of Canada transitioned the support to a dual system under which individuals may receive either EI benefits or the new Canada Recovery Benefit (CRB), depending on their eligibility. In addition, the Government of Canada introduced the Canada Recovery Caregiving Benefit (CRCB), which provided income support to employed and self-employed individuals who needed to care for their children or family member, and the Canada recovery Sickness Benefit (CRSB), which provided income support to employed and self-employed individuals who were unable to work caused by sickness or self-isolation due to COVID-19. In February 2021, the Government of Canada increased the number of weeks available under the CRB and CRCB by 12 weeks to a total of 38 weeks, the number of weeks available under the CRSB from two weeks to four weeks, and the number of weeks of EI regular benefits from 24 weeks to a maximum of 50 weeks.

To ensure continued support for Canadian workers in difficult times, Budget 2021 proposes to provide up to 12 additional weeks of CRB to a maximum of 50 weeks. The first four of these additional 12 weeks will be paid at $500 per week. However, as the economy reopens, the government intends to reduce CRB payments for the remaining eight weeks of this extension to be paid at a lower rate of $300 per week. New CRB claimants after July 17, 2021, would also receive the $300 per week benefit, which is available until September 25, 2021. Budget 2021 also proposes to extend the CRCB an additional four weeks, to a maximum of 42 weeks, at $500 per week. The extension is to address events where caregiving options, especially for those supporting children, are not sufficiently available in the short term as the economy begins to reopen.

Ensuring Flexible Access to EI Benefits

As the job market begins to improve, Budget 2021 proposes a suite of legislative changes to make EI more accessible and simpler for Canadians. These changes involve maintaining uniform access to EI benefits across all regions, including a 420-hour entrance requirement for regular and special benefits, a 14-week minimum entitlement for regular benefits, and a new common earnings threshold for fishing benefits. For individuals who hold multiple jobs and those who switch jobs to improve their situation during the recovery, Budget 2021 also proposes to ensure that all insurable hours and employment count towards a claimant’s eligibility, as long as the last job separation is found to be valid. In addition, these changes will allow claimants to start receiving EI benefits sooner by simplifying rules around the treatment of severance, vacation pay, and other monies paid on separation. Extended temporary enhancements to Work-Sharing programs have also been proposed to establish longer work-sharing agreements and a more streamlined application process, which will continue to help employers and workers avoid layoffs. Work-Sharing is an adjustment program designed to help employers and employees avoid layoffs when there is a temporary reduction in the normal level of business activity beyond the employer’s control. The program provides income support to employees eligible for EI benefits who work a temporarily reduced work week as their employer recovers.

Canada Recovery Hiring Program

To assist the hardest-hit businesses’ pivot back to growth, Budget 2021 proposes a new Canada Recovery Hiring Program for eligible employers that continue to experience qualifying declines in revenues compared to pre-pandemic times. Eligible employers may be provided with a subsidy of up to 50 percent on the incremental remuneration paid to eligible employees between June 6, 2021, and November 20, 2021. It is important to note that an eligible employer would be permitted to claim either the hiring subsidy or the CEWS for a particular qualifying period, but not both.

To qualify for a hiring subsidy in a qualifying period, an eligible employer would have to have experienced a decline in revenues sufficient to qualify for the CEWS in that qualifying period. For qualifying periods where the CEWS is no longer in effect, an eligible employer would have to have experienced a decline in revenues of more than 10 percent. Therefore, an eligible employer’s decline in revenues would have to be more than:

- 0 percent, for the qualifying period between June 6, 2021, and July 3, 2021; and

- Ten percent for qualifying periods between July 4, 2021, and November 20, 2021.

The method used to determine an employer’s decline in revenues would be the same as under the CEWS. A comparison is made with respect to the employer’s revenues in a current calendar month with its revenues in the same calendar month, pre-pandemic. An alternative approach to the aforementioned method compares the employer’s monthly revenues relative to the average of its January 2020 and February 2020 revenues. A deeming rule provides that an employer’s decline in revenues for any particular qualifying period is the greater of its decline in revenues for the particular qualifying period and the immediately preceding qualifying period.

Employers eligible for CEWS would generally qualify for the subsidy under the Canada Recovery Hiring Program. However, a for-profit corporation would only be eligible for the hiring subsidy if it is a Canadian-controlled private corporation (CCPC). Other eligible employers for the hiring subsidy include non-profit organizations, individuals, registered charities, and certain partnerships. Corporations and trusts ineligible for the CEWS because they are public institutions would not be eligible for the hiring subsidy. Public institutions include municipalities and local governments, wholly-owned municipal corporations, Crown corporations, public universities, colleges, schools, and hospitals. Furthermore, eligible employers or their payroll service providers would be required to have a payroll account open with the Canada Revenue Agency (CRA) on March 15, 2020.

Eligible employees must be employed primarily in Canada by an eligible employer throughout a qualifying period (or the portion of the qualifying period throughout which the eligible employer employed the individual. The hiring subsidy would not be available for a furloughed employee who is on leave with pay. Furloughed employees are remunerated by the eligible employer but do not perform any work for the employer.

Certain types of remuneration eligible for the CEWS would also be eligible for the hiring subsidy under the Canada Recovery Hiring Program. Eligible remuneration will generally include salary, wages, and other remuneration for which employers are required to withhold or deduct amounts on account of the employee’s income tax obligations. Eligible remuneration does not include severance pay, stock option benefits, or the personal use of a corporate vehicle. The remuneration for employees would be based solely on remuneration paid with respect to the qualifying period.

The difference between an employer’s total eligible remuneration paid to eligible employees for the qualifying period and its total eligible remuneration paid to eligible employees for the baseline period is known as incremental remuneration. In both the qualifying and baseline periods, eligible remuneration for each eligible employee would be subject to a maximum of $1,129 per week. The eligible remuneration for a non-arm’s length employee for a particular week cannot exceed their baseline remuneration determined for that week.

Growing Zero-emission Technology Manufacturing

As more countries continue to achieve net-zero emissions, the demand for zero-emission technology will only grow. To take advantage of this opportunity, Canada’s manufacturing sector must be strengthened while creating additional well-paying jobs to ensure a resilient and competitive middle class. To create jobs and support the growth of clean technology manufacturing in Canada, Budget 2021 proposes to reduce the general corporate and small business income tax rates for businesses that manufacture zero-emission technologies by 50 percent. The reduction will come into effect on January 1, 2022, and will be gradually phased out starting January 1, 2029, and eventually eliminated by January 1, 2032. The Department of Finance Canada will continue to review new technologies that may be eligible in consultation with key stakeholders such as Environment and Climate Change Canada, Natural Resources Canada, and Sustainable Development Technology Canada. Examples of zero-emission technology in Canada include, but are not limited to:

- Manufacturing of wind turbines, solar panels, and equipment used in hydroelectric facilities

- Manufacturing of electric cars, busses, trucks, and other vehicles.

- Manufacturing of batteries and fuel cells for electric vehicles

- Manufacturing of geothermal energy systems

Capital Cost Allowance (CCA) for Clean Energy Equipment

CCA is an annual deduction allowed under the Canadian Income Tax Act (ITA) that can be claimed on depreciable assets, such as a building, furniture, or equipment, in computing an individual’s income for each taxation year. When an individual acquires a depreciable capital property, such as a building or equipment, the cost of the property cannot be deducted in the year the cost was incurred but can be depreciated over time. The CRA has placed capital assets into various classes of depreciable property with different depreciation rates, which determine the maximum amount of CCA that can be claimed each year. All capital property under the same class is grouped together for CCA calculation purposes. A specific rate of CCA generally applies to each class.

Under the current CCA regime, Classes 43.1 and 43.2 of Schedule II to the Income Tax Regulations provide accelerated CCA rates (30 percent and 50 percent, respectively) for investments in specified clean energy generation and energy conservation equipment. Furthermore, property in these classes acquired after November 20, 2018, and becomes available for use before 2024 is eligible for immediate expensing under CCA, while property that becomes available for use after 2023 and before 2028 is subject to a phase-out from these immediate expensing rules. The accelerated CCA is an exception to the general practice of setting CCA rates based on the useful life of assets and provides a financial benefit by deferring taxation.

Suppose the majority of tangible property in a project is eligible for inclusion in Class 43.1 or 43.2. In that case, certain intangible project start-up expenses such as engineering, design work, and feasibility studies are treated as Canadian Renewable and Conservation Expenses, which can be deducted in full in the year incurred, carried forward indefinitely for use in future years, or transferred to investors using flow-through shares.

To support investment in clean technologies, budget 2021 proposes to expand and include the following to Classes 43.1 and 43.2:

- pumped hydroelectric storage equipment;

- electricity generation equipment that uses physical barriers or dam-like structures to harness the kinetic energy of flowing water or wave or tidal energy;

- active solar heating systems, ground source heat pump systems, and geothermal energy systems that are used to heat water for a swimming pool;

- equipment used to produce solid and liquid fuels (e.g., wood pellets and renewable diesel) from specified waste material or carbon dioxide;

- a broader range of equipment used for the production of hydrogen by electrolysis of water; and

- equipment used to dispense hydrogen for use in hydrogen-powered automotive equipment and vehicles.

Accelerated CCA would be available to the properties above if, at the time the property becomes available for use, the requirements of all Canadian environmental laws, by-laws, and regulations applicable with respect to the property have been met.

The eligibility criteria for specific systems under Classes 43.1 and 43.2, such as systems that burn fossil fuels and waste fuels to produce either electricity or heat, have not been modified since they were introduced many years ago. To ensure that the incentive provided by Classes 43.1 and 43.2 is consistent with the government’s environmental objectives, Budget 2021 proposes changes to the eligibility criteria for the following types for the following equipment (by mainly removing or severely restricting these capital assets from Classes 43.1 & 43.2)

- fossil-fuelled cogeneration systems

- fossil-fuelled enhanced combined cycle systems

- specified waste-fuelled electrical generation systems with an electrical capacity greater than 3 megawatts

- specified waste-fuelled heat production equipment for which more than one-quarter of the total fuel energy input is from fossil fuels

- producer gas generating equipment for which more than one-quarter of the total fuel energy input is from fossil fuels.

Avoidance of Tax Debts

The Income Tax Act has specific anti-avoidance rules intended to prevent taxpayers from avoiding their tax liabilities by transferring their assets to non-arm’s length persons for insufficient consideration. If caught under these rules, the transferee will be jointly and severally liable with the transferor for tax debts of the transferor for the current or any prior taxation year, to the extent that the value of the property transferred exceeds the amount of consideration given for the property. In an attempt to circumvent the tax debt avoidance rule, some taxpayers are engaging in complex transactions that seek to avoid anti-avoidance rules by arranging for the transferor to be dealing at arm’s length with the transferee at the time of the property transfer, arranging for a tax debt to crystallize after the end of the taxation year when the property transfer occurs, or using a series of transactions to strip out net asset value of the transferor, which does not breach the point-in-time valuation test for the property transferred and consideration is given. Additionally, aggressive tax plans that attempt to eliminate the underlying tax liability of the transferor to prevent CRA from collecting the tax debt due to the indebted taxpayer being stripped of their assets may be undertaken by the unethical individual.

Budget 2021 proposes several anti-avoidance measures while implementing a penalty for those who engage in such schemes to address the concerns discussed above. These rules would apply to transfers of property that occur after Budget Day (April 19, 2021). The proposals are discussed in further detail below.

Deferral of Tax Debts

For the tax debt avoidance rule, a tax debt would be deemed to have arisen before the end of the taxation year in which a transfer of property occurs if the transferor (or a person who does not deal at arm’s length with the transferor) knew that there would be a tax amount owing by the transferor that would arise after the end of the taxation year. Furthermore, one of the purposes for the transfer of property must have been made to avoid the payment of the future tax debt.

Avoidance of Non-Arm’s Length Status

For the tax debt avoidance rule, a transferor and transferee that, at the time of a transfer of property, would be considered to be dealing with each other at arm’s length would be deemed to have not been dealing with each other at arm’s length at that time if the following two conditions are met:

- at any time within a series of transactions or events that includes the transfer, the transferor and transferee do not deal at arm’s length; and

- it is reasonable to conclude that one of the purposes of a transaction or event (or series of transactions or events) within that series was to cause the transferor and transferee to deal at arm’s length at the time of transfer.

Valuations and Penalty

For transfers of property that are a part of a series of transactions or events, a rule would be introduced so that the overall result of the series would be considered in determining the values of the property transferred and the consideration given for the property instead of using the values at the time of transfer. Furthermore, a penalty would also be introduced for planners and promoters of tax debt avoidance schemes. The penalty would be equal to the lesser of:

- 50 percent of the tax that is attempted to be avoided; and

- $100,000 plus the promoter’s or planner’s compensation for the scheme

This post was first published at the official blog of Invesco Canada.