by Don Vialoux, EquityClock.com

Technical Notes for Thursday April 22nd

Danaher (DHR), an S&P 100 stock moved above $248.62 to an all-time high extending an intermediate uptrend.

Visa (V), a Dow Jones Industrial Average stock moved above $228.23 to an all-time high extending an intermediate uptrend.

AT&T (T), an S&P 100 stock moved above $31.81 and $30.99 resuming an intermediate uptrend.

Israel iShares (EIS) moved above $67.89 to an all-time high extending an intermediate uptrend.

Observation

Responses to first quarter S&P 500 company reports released Wednesday and yesterday are flashing a warning sign. In most cases, sales and earnings exceeded consensus estimates. When companies reported positive “blowout” first quarter results (e.g. Mattel, Sketchers, AT&T), their stock prices responded accordingly. However, most companies that merely reported higher than consensus first quarter results saw their share price decline. Examples include Chipotle, Biogen, Blackrock, Southwest Airlines, Intel, Verizon, United Rental, Halliburton, Union Pacific and Dow. Companies that reported lower than consensus results saw their share price hit hard (e.g. Las Vegas Sands)

Trader’s Corner

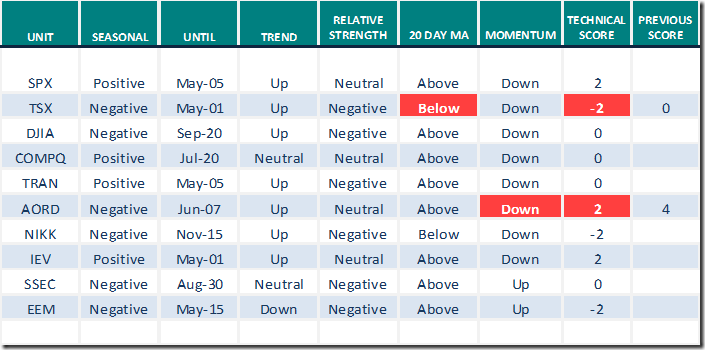

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for April 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

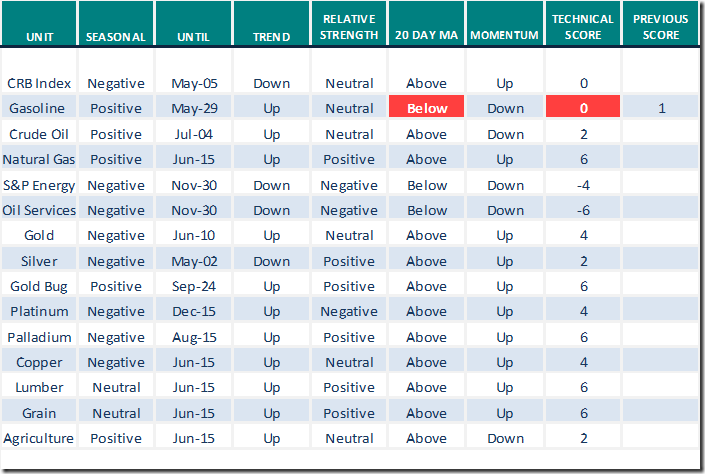

Commodities

Daily Seasonal/Technical Commodities Trends for April 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

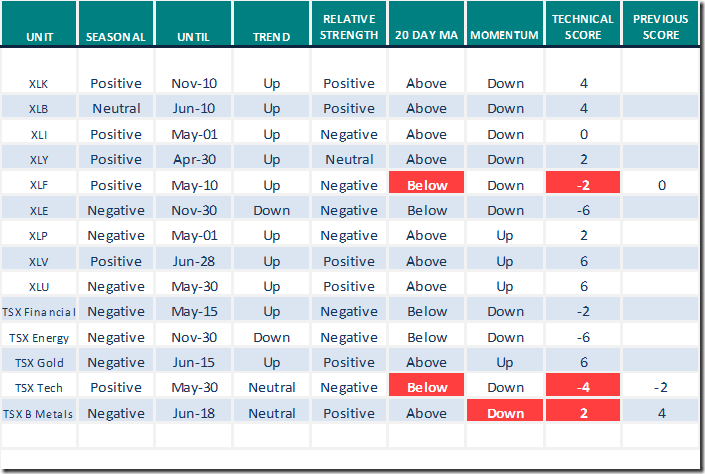

Sectors

Daily Seasonal/Technical Sector Trends for April 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

S&P 500 Momentum Barometers

The intermediate Barometer slipped 3.41 to 83.77 yesterday. It remains Extremely Overbought.

The long term Barometer slipped 0.20 to 96.79 yesterday. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate term Barometer slipped 1.50 to 73.00 yesterday. It remains Overbought.

The long term Barometer fell 2.50 to 79.50 yesterday. It changed from Extremely Overbought to Overbought on a drop below 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.