by Invesco Tax & Estate team, Invesco Canada

This is a three-part series focused on the 2021 Federal Budget. In this series, we’ll cover Personal Income Tax Measures, Business Income Tax Measures, and Sales and Excise Tax Measures, International Tax Measures & Other Measures. We’ll first review the tax-specific measures and then summarize the non-tax-specific measures.

Let’s first understand the Personal Income Tax Measures.

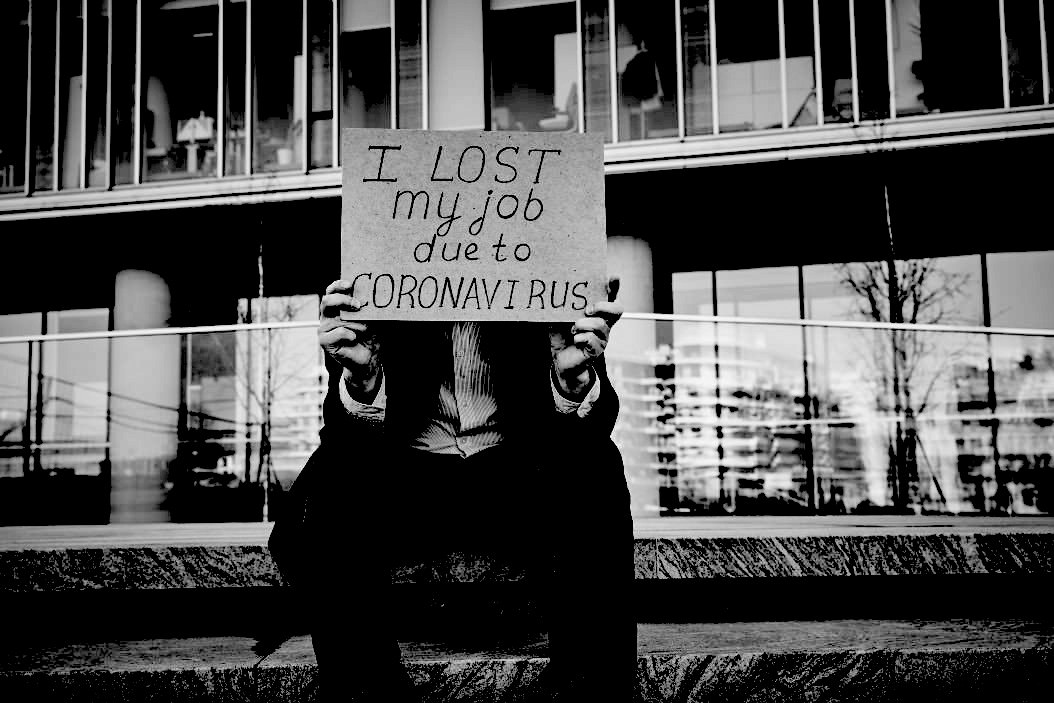

The 2021 Federal Budget was tabled by the Liberal Party on Monday April 19, 2021, by the Minister of Finance Canada, Chrystia Freeland. It was a historical event marking the first time a woman has tabled a Federal Budget in the Canadian Parliament. It was also the first Budget released since the onset of the COVID-19 pandemic and represents a massive amount of spending (over $100 billion) aimed at supporting Canada to pull through and recover from the COVID-19 pandemic.

Below is a summary of the Budget, and it is not intended to be a thorough analysis of the changes. We will focus our report on the key issues relevant to personal taxation, financial planning, investment portfolios, and related private corporation taxation.

Personal Income Tax Measures: part 1 of 3

Much speculation leading up to the Budget release was about a potential increase to the capital gains inclusion rate, including, but not limited to, discussion pertaining to the taxation of “home flippers” and access to the principal residence exemption. No such changes were announced. However, there was the introduction of a vacant non-resident homeowner tax, discussed below. Also absent was an extension on the April 30th individual tax filing deadline like the extension we got last year.

The Budget introduced no significant personal income tax changes. Here is a look at the tiered Federal tax brackets for 2021:

Increasing access to the Disability Tax Credit (DTC)

Budget 2021 aims to expand access to the DTC. The Federal government proposes to achieve this goal in two ways:

- By altering the list of mental functions of everyday life to recognize more challenges faced by individuals. That list is used to assess eligibility for the DTC, so a new list could allow more individuals to qualify.

- By expanding recognition to more activities in determining time spent on life-sustaining therapy and reducing the minimum required frequency of therapy needed to meet the eligibility requirements for the DTC.

Canada Workers Benefit (CWB)

The CWB is a refundable tax credit created to support individuals and their families who work and have a low income. At present, access to the CWB is gradually reduced if an individual’s adjusted net income exceeds $13,064 or a family’s adjusted net family income exceeds $17,348. If an individual’s adjusted net income exceeds $24,573 or until a family’s adjusted net family income exceeds $37,173, access to the CWB becomes unavailable.

Budget 2021 proposes to increase the net income threshold at which access to the CWB will be reduced to $22,944 for individuals and $26,177 for families. As well, the threshold at which access to the CWB is eliminated would be increased to $32,244 and for $42,197 for individuals and families, respectively. Budget 2021 proposes to allow secondary income earners to exclude up to $14,000 of working income from the CWB eligibility test.

Enhancing “earned income” for the purpose of generating registered retirement savings plan (RRSP) contribution room

Postdoctoral fellows are not considered students for income tax purposes. As a result, the income earned from their fellowships is taxable. Despite this treatment, that income does not currently fall under the definition of “earned income” for RRSP contribution purposes. Because an individual’s earned income in a given year generates RRSP contribution room for the following year, postdoctoral fellows were left with taxable income but were not provided additional RRSP contribution room.

Budget 2021 proposes to add postdoctoral fellowship income to the definition of “earned income”. This change will be applied in the following manner:

- Automatically to postdoctoral fellowship income earned in 2021 and future taxation years

- By submitting a request in writing to the Canada Revenue Agency (CRA) for an adjustment to be made to an individual’s RRSP contribution room in respect of postdoctoral fellowship income earned in the 2011 to 2020 taxation years

Taxation of COVID-19 benefits

Several taxable emergency benefits were introduced over the past year in the wake of the global pandemic. Those benefits included:

- Canada Emergency Response Benefit (CERB) and the related Employment Insurance Emergency Response Benefit

- Canada Emergency Student Benefits

- Canada Recovery Benefits

- Canada Recovery Sickness Benefits; and

- Canada Recovery Caregiving Benefits

Many individuals have discovered after the fact that they received emergency benefits they did not qualify for. Under the current rules, individuals who repaid those benefits in a year after the year they received them were only allowed to claim a deduction for the year of the repayment. In other words, they would still have to pay tax on the benefits for the year they received the benefits and would only get a deduction for the year they made the repayment, creating an upfront tax burden.

Budget 2021 proposes to allow individuals making emergency benefit repayments to claim a deduction for the year the benefits were received, even if the repayment was not made until a later year. It is important to note that this change will only apply if benefits are repaid in 2022 or earlier.

Budget 2021 also proposes introducing tax rules to ensure that non-resident recipients of emergency benefits will be subject to tax on that income in Canada.

Defined contribution pension plans (DCPPs) and retroactive contributions

Under the tax rules, DCPP administrators cannot accept retroactive contributions to plan members’ accounts that would be needed to correct an under-contribution error made in an earlier year. While it is possible to issue a refund to plan members where an over-contribution error has been made, it is difficult to do so under the current system.

Budget 2021 proposes introducing rules that would enable pension plan administrators to accept retroactive contributions to correct an under-contribution error made in any of the five years prior to the year of correction. It also proposes introducing a simpler method for refunding over-contribution in any of the five years following the year of the over-contribution. Any additional contributions made to correct a prior under-contribution would reduce the pension member’s RRSP contribution room in the year after the correction. Any over-contributions refunded would generally restore the individual’s RRSP contribution room in the year the refund was issued. These new rules will apply to additional contributions and refunds of over-contributions made in the 2021 taxation year and later years.

Increasing Old Age Security (OAS) for Canadians 75 and over

To help seniors manage the extra expenses incurred on staying safe during COVID-19 and the longevity risk in general, Budget 2021 proposes a two-step implementation to enhance OAS benefits for seniors 75 or older and qualify for OAS.

First, a $500 one-time payment will be made in August 2021 to seniors who will turn 75 as of June 2022. This one-time payment will not count as “income” for the purposes of determining the eligibility for Guaranteed Income Supplement.

Second, the regular OAS payments to seniors age 75 or older will increase by 10% as of July 2022. This increase will provide recipients who qualify for the full OAS benefits an additional $755 for the first year and continues to increase along with the quarter indexation of OAS benefits.

Changes in taxes applicable to mutual fund trusts or corporations as registered investments

Certain mutual fund trusts (MFTs) and mutual fund corporations (MFCs) can apply to the CRA to be “registered investments” for registered plans, such as registered retirement savings plans (RRSPs), registered retirement income funds (RRIFs), or deferred profit-sharing plans (DPSPs). Units or shares of a registered investment are considered qualified investment to be held within the plans it is registered for.

Part X.2 (of the Income Tax Act) tax can apply to an MFT or MFC that is a registered investment but whose units or shares are not sufficiently widely held. For example, if an MFT has less than 150 unitholders (investors), that MFT can only hold “qualified investments” as defined for the type of registered plans it is registered for (e.g., RRSPs). If the MFT breaches this restriction, Part X.2 tax will be charged, equals 1% of the fair market value of the non-qualified investment at the time it was acquired and for each month that the MFT holds the non-qualified investment.

Budget 2021 proposes to change the amount of Part X.2 tax to reflect the proportion of mutual fund units or shares held by investors in the applicable registered plans. For instance, if only 20% of the investors hold the units of an MFT (that is subject to Part X.2 tax) in RRSPs, and 80% of the investors hold the units in non-registered plans, the proposed rule would only charge 20% of the 1% Part X.2 tax otherwise applicable.

This measure applies to Part X.2 tax imposed with respect to the months after 2020 or any undetermined Part X.2 tax liability as of the Budget Day (April 19, 2021) with respect to months before 2021.

Electronic filing and certification of tax and information returns

Budget 2021 proposes the following measures to enhance CRA’s ability to provide more efficient, secure, and accurate services in its administration.

Default method of correspondence

Notice of assessments: Without obtaining approval from recipients, CRA will be able to send notice of assessments electronically to individuals who file their income tax returns electronically, either by themselves or through a tax preparer. Individuals who file their tax returns in paper format will continue to receive a paper notice of assessment.

Correspondence with business: CRA’s default method of correspondence will be changed to electronic for businesses who use the CRA’s My Business Account portal. However, businesses still have the option to receive paper correspondence.

Information returns

Issuers of T4A and T5 information returns will be able to provide them electronically without issuing a paper copy and without taxpayers’ authorization to do so.

Electronic filing thresholds

Tax preparers: Professional tax preparers will be required to file electronically if they prepare more than five income tax returns for corporations or five income tax returns for individuals (including trusts). The old threshold was ten returns for each type of return, excluding trust returns. Tax preparers will be allowed to file a maximum of five paper returns for each type of return per calendar year.

Filer of information returns: Individuals, partnerships, and corporations who file more than five information returns of a particular type for a calendar year will be required to file them electronically. The threshold was lowered from fifty to five for each type of information return.

Corporations and GST/HST registrants: Most corporations and Goods and Services Tax/Harmonized Sales Tax (GST/HST) registrants will be required to file electronically, as the electronic filing threshold is being eliminated. This measure applies to tax years or reporting periods that begin after 2021 for corporations and GST/HST registrants, respectively.

Electronic payments

Certain online payments required to be made at financial institutions are clarified under Budget 2021. Electronic payments are required for remittances over $10,000 under the Income Tax Act. The threshold for certain mandatory remittances made at a financial institution under the GST/HST portion is lowered from $50,000 to $10,000. This measure applies to payments made on or after January 1, 2022.

Handwritten signatures

Budget 2021 proposes to eliminate handwritten signature requirements for certain prescribed forms, for example:

- T183, Information Return for Electronic Filing of an Individual’s Income Tax and Benefit Return;

- T183CORP, Information Return for Corporations Filing Electronically; and

- T2200, Declaration of Conditions of Employment.

Tax measures subject to consultations

Digital Services Tax

To address the digital business models that engage online users, Budget 2021 proposes a Digital Services Tax (DST) effective January 1, 2022 as an interim measure imposed on certain domestic and foreign online businesses until a multilateral approach can be determined. Some key features are summarized below:

- The DST is equal to 3% of revenue from digital services reliant on Canadian users’ engagement, data, and content contributions. Revenue does not include value-added tax or sales taxes collected.

- “In-scope revenue” from online marketplaces, social media, online advertising, and sale or licensing of user data will be subject to the DST.

- Various business entities including corporations, trusts, and partnerships with €750 million or more global revenue from all sources and over $20 million in-scope revenue associated with Canadian users are subject to the DST. The DST applies to in-scope revenue associated with Canadian users over the $20 million threshold. A group-level calculation will be used, and large firms are the focus of the DST.

- In-scope revenue is determined based on the revenue’s association with users in Canada where tracing is possible. Where tracing is not possible, a specified formulaic allocation will be used, depending on the nature of revenue.

- User location can be based on either the ordinary location or the real-time location of a user. Entities are generally expected to use a consistent approach in determining user location, subject to data availability for different types of services.

The deductibility of the DST for income tax purposes is consistent with the general principles governing other non-income taxes, for example, whether it is incurred for the purpose of earning the entity’s income subject to Canadian income tax. The DST is not eligible for a credit against Canadian income tax payable. It is proposed that entities subject to the DST are required to file an annual return based on the calendar year. The consultation period for the DST is open until June 18, 2021.

Tax on unproductive use of Canadian housing by foreign non-resident owners – more details to come

Budget 2021 proposes a new national 1% tax on the value of residential real property owned by non-resident and non-Canadian, starting in 2022.

Under the proposal, all owners of residential property in Canada, who are not Canadian citizens or permanent residents, would be required to file an annual declaration with CRA for the prior calendar year with respect to each Canadian residential property they own. The declaration requires disclosure of the property address, value, and the owner’s interest in the property. Exemptions will be available, one of them being for property leased to a qualified tenant in relation to the owner for a minimum period during the year. Absent an exemption, the owner is required to calculate the amount of tax payable and remit it to CRA by the filing due date. Failure to file the declaration will result in the loss of any available exemptions, along with penalties and interest. There is no limit to the assessment period.

The government will release more details in the coming months for public consultation. For more information on the 2021 Federal Budget, click here.

This post was first published at the official blog of Invesco Canada.