by Brian Resnick, Director, Senior Investment Strategist, Alternatives & Multi-Asset, AllianceBernstein

For decades, income investors could rely confidently on high-quality, core bonds to provide efficient income—high income with robust downside cushion. But with interest rates at historically low levels, that’s no longer the case. Building efficient income portfolios today requires careful asset selection and thoughtful portfolio construction.

The Income Investor’s Dilemma

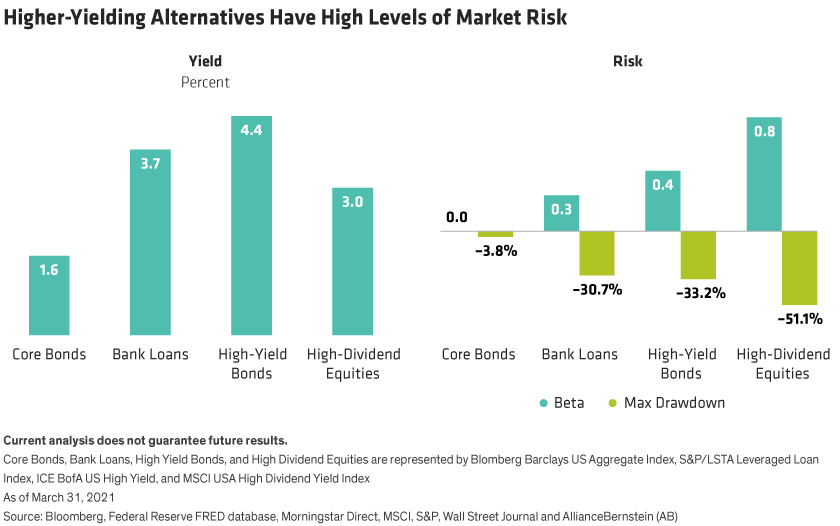

In today’s low-yield landscape, income investors find themselves depending on higher-yielding investments such as bank loans, high-yield bonds and dividend-paying equities. While these investments can play a valuable role in a portfolio, they carry more risk than traditional core bonds—as seen in their higher equity market beta and bear market drawdowns (Display).

To make matters worse, those drawdowns are likely to happen during an equity downturn, so if investors also include traditional equities in their overall portfolio, it compounds the pain.

Reaching for yield can be especially dangerous for income investors because of sequence risk—the risk of a significant drawdown within 10 years of retirement. After such large market declines, investors’ fixed withdrawal amounts tap a larger percentage of remaining portfolio assets. This predicament can shrink the portfolio at the very time it needs asset growth to recoup losses, permanently impairing income investors’ resources. Even if investors don’t fully deplete their funds, they might need to curtail their lifestyles and downsize or eliminate philanthropic and legacy plans.

Building a More Efficient Income Portfolio

How can investors generate income in the current low-yield environment without taking on too much downside risk? The key to an efficient income portfolio is selecting the most impactful building blocks and assembling them with the proper risk balance.

Despite a meager current yield, interest rate exposure via high-quality core bonds still plays an essential role. When stocks and high-yield bonds are selling off during a bear market, high-quality bond prices tend to rise, acting as ballast for the portfolio and smoothing the ride. However, fear of rising rates has caused many investors to shift this safe part of their portfolios into low-duration bond funds, unconstrained bond funds and cash. We think this poses a sizable risk: the rates building block performs a critical portfolio role as a countercyclical asset that rallies when risk assets are selling off.

Rates can provide a downside cushion, but investors must embrace credit to generate income. While some investors focus on US high yield alone, we believe this segment should be part of a diversified allocation to global multisector credit. Investing in a strategy like this—combining global high-yield, emerging-market (EM) debt, securitized credit, and bank loans—gives investors a much broader set of opportunities to generate excess income and alpha. Most important, global multisector bonds have outperformed US high-yield bonds over the past 20 years, winning 82% of the time based on three-year rolling periods.

A Barbell of Rates and Credit Exposure

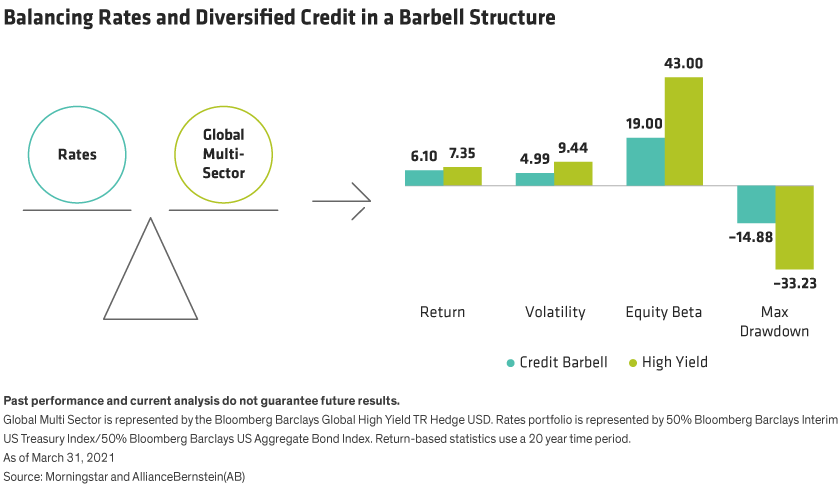

Pairing high-quality bonds with global multisector credit in a risk-balanced allocation creates an effective credit barbell that can generate efficient income throughout the market cycle.

How does this approach work? There’s a negative correlation between high-quality core bonds and high- yield bonds. When the price of one goes up, the other tends to go down, keeping the portfolio value relatively stable. Meanwhile, both sides of the barbell generate income. In our view, a credit barbell with global multisector bonds on one side and core bonds on the other embodies an efficient income portfolio.

Over time, a simple asset-weighted credit barbell, split evenly between core bonds and global multi-sector credit, has delivered the bulk of the yield and return of US high yield with about half the risk—as measured by volatility, maximum drawdown and equity beta (Display).

Income—with a Dose of Growth Potential

Income investors who want more growth potential might consider bringing stocks into the mix. However, a traditional equity allocation lowers a portfolio’s yield and increases risk in exchange for that growth. Investors looking to add growth without sacrificing income should consider global high-dividend stocks, global real estate, and EM equities as building blocks with growth potential.

These investments have supplied high income, strong total return and diversification benefits over the long run. While these asset classes increase potential growth and deliver income, they also have more risk than the barbell structure, so investors should ensure that adding these assets to a portfolio aligns with their risk preferences.

Interest rates are likely to remain lower for longer, forcing income investors to embrace higher-risk portfolios. We believe investors can get the efficient income they need by combining global multisector credit and core bonds in a balanced credit barbell. This strategy also can incorporate building blocks with more growth potential to suit individual needs and risk tolerances.

Brian Resnick, CFA, is a Director and Senior Investment Strategist for Alternatives and Multi-Asset at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post was first published at the official blog of AllianceBernstein..