by Donald W. Dony, The Technical Speculator

Sector performance within the present bull market has largely replicated an historical pattern. Over the past 12 years, the rise and eventual outperformance over the benchmark indexes (i.e. TSX and S&P 500), of specific industry groups has developed starting with technology and consumer discretionary sectors in 2009 and carrying through to the current sector of base metals.

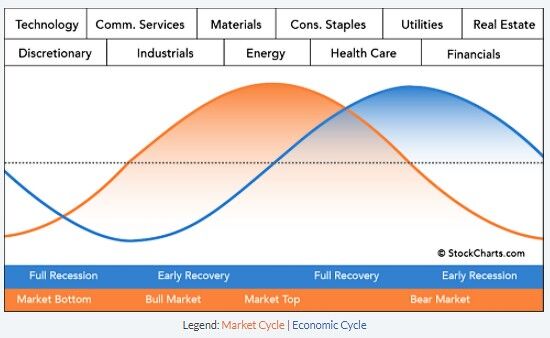

The normal progression of performance in industry groups, beginning with a bear market low, through a gradual recovery and into a full bull market and then with a final cresting high, is illustrated in Chart 1.

Starting with the early performing sectors of technology and consumer discretionary followed by communication services, brokers, automobiles, industrials, and as the bull market reaches a mid-point, communication equipment, base metals and energy begin to outperform.

Starting with the early performing sectors of technology and consumer discretionary followed by communication services, brokers, automobiles, industrials, and as the bull market reaches a mid-point, communication equipment, base metals and energy begin to outperform.

As the stock market begins to peak, the precious metals, consumer staples, health care and utilities sectors start advancing.

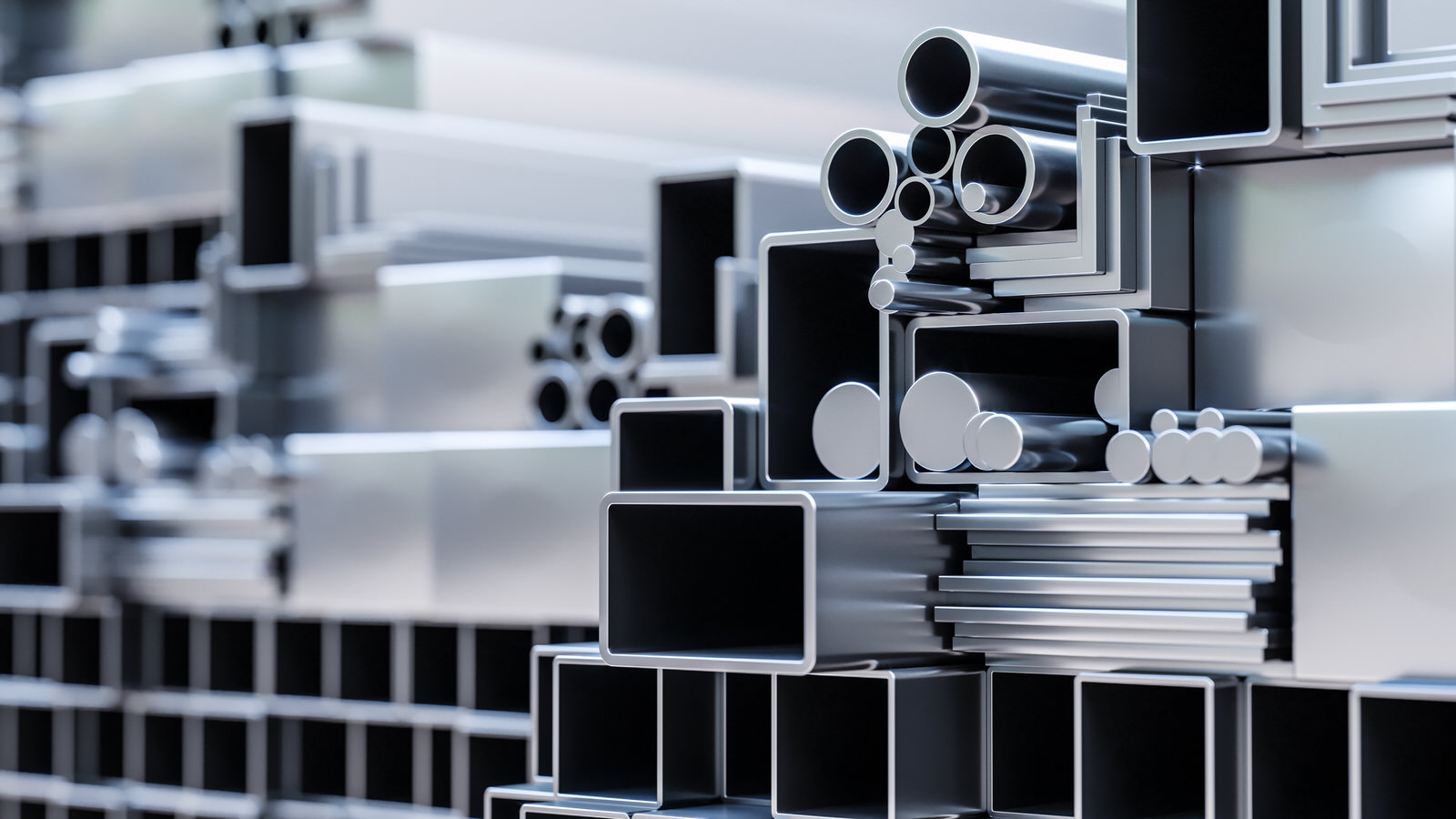

At the stock markets' current phase, the industrial metals sector is outperforming both the TSX and the S&P 500. The breakout in relative performance developed in September on the Canadian index and October on the U.S. index (Chart 2).

The iShares S&P/TSX Global Base Metals Index (XBM) is comprised of 34 companies in Canada, U.S., Australia, U.K. and four other countries.

Bottom line: The current bull market is now 12 years old. Over the past 125 years, the duration of the rise has been about 18 years. This suggests that the stock market rise is expected to continue advancing for another 5 to 7 more years. And with the recent breakout in performance of the base metals sector (XBM) in late 2020, the duration of the stock market rise is about 2/3rds complete. The energy sector should be the next industry group to outperform.

Copyright © The Technical Speculator