by Invesco, Invesco Canada

Recent developments in the S&P 500 are an important reminder of the wisdom of the timeless adage: avoid putting all your eggs in one basket. Since its low on March 23, 2020, the S&P 500 has notched record gains1 and closed at a record high on Dec. 31, 2020,2 but a closer look reveals a more nuanced picture.

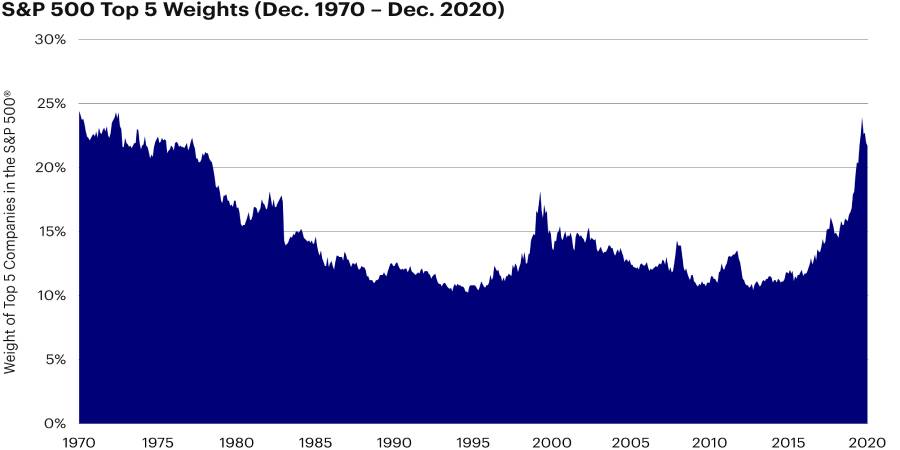

As a market capitalization-weighted index, the S&P 500 typically has a heavy concentration in a few names, and as its top five holdings as of Dec. 14, 2020 — Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG/GOOGL), and Facebook (FB) — have zoomed ever higher in 2020, they have come to dominate the Index’s performance. While the S&P 500 ostensibly measures 500 companies, the five largest companies have grown to account for nearly 22.0% of its weighting, a significant rise from 16.8% at the end of 2019.3

Past performance is no guarantee of future results. Index returns do not represent Fund returns. An investor cannot invest directly in an index.

As the S&P 500 has grown ever more top-heavy, many investors in products tied to the Index have found themselves facing historic levels of concentration risk, the likes of which passive investors have not seen since 1970 — half a century ago.4

Such a high concentration in the S&P 500’s top five holdings potentially leaves investors vulnerable in the event that the companies’ current high valuations fall back to earth. Indeed, it’s worth keeping in mind what history has taught — that companies with seemingly unassailable positions can and do fade from the scene as their business models are disrupted or they fall victim to economic forces.

For example, in 1970 the top five holdings in the S&P 500 were IBM, AT&T, General Motors, Standard Oil of New Jersey, and Eastman Kodak.5 By 2000, the top five holdings had dramatically shifted, consisting of GE, ExxonMobil, Pfizer, Citigroup, and Cisco.6 Today, none of the aforementioned companies are even present in the top 10.

Take the concentration out of the S&P 500 with an equal weight approach

An equal weight approach can help address concerns about the growing concentration risk in traditional market cap-weighted indexes. It can provide diversification benefits and reduce concentration risk by weighting each constituent company equally, so that a small group of companies does not have an outsized impact on the index.

Invesco S&P 500® Equal Weight Index ETF (EQL) takes an equal weight approach to the S&P 500, with each of its 500 constituent companies allocated approximately a 0.2% weighting in the portfolio.

EQL’s equal weight approach to the S&P 500 may offer a number of potential benefits. By reducing the heavy weightings allocated to the largest companies, EQL seeks to reduce the concentration risk of the S&P 500. With quarterly rebalances to maintain equal weightings, EQL’s methodology imposes a strict “buy low/sell high” discipline, trimming allocations to companies that have grown (sell high) and increasing allocations to companies that have underperformed (buy low).

The bottom line

As the largest companies in the S&P 500 have grown, traditional market capitalization-weighted approaches have left investors exposed to historic levels of concentration risk. An equal weight approach with EQL can potentially take the concentration out of the S&P 500.

Learn how to strike the right investment balance in your portfolio with the Invesco S&P 500 Equal Weight Index ETF.

1 Source: William Watts, “The stock market hasn’t seen a 100-day gain this strong since 1933,” MarketWatch, Dow Jones, Aug. 13, 2020

2 Source: William Watts, “S&P 500, Nasdaq close at records as stocks post modest gains,” MarketWatch, Dow Jones, Dec. 8, 2020

3 Source: S&P Global, as of Dec. 22, 2020

4 Source: S&P Dow Jones LLC, as of Dec. 22, 2020

5 Source: Michael Johnston, “Visual History of the S&P 500,” ETF Database, Dec. 14, 2012

6 Source: S&P Global, as of Dec. 22, 2020

This post was first published at the official blog of Invesco Canada.