by Don Vialoux, EquityClock.com

Technical Notes for Thursday March 25th

Nike, a Dow Jones Industrial Average stock dropped below $129.19 extending an intermediate downtrend after China announced a sales boycott of its products.

Darden Restaurants, an S&P 100 stock advanced $10.97 to $144.90 after announcing higher than consensus fiscal third quarter sales and earnings. The company also announced an additional share repurchase program and offered positive fiscal fourth quarter sales and earnings guidance.

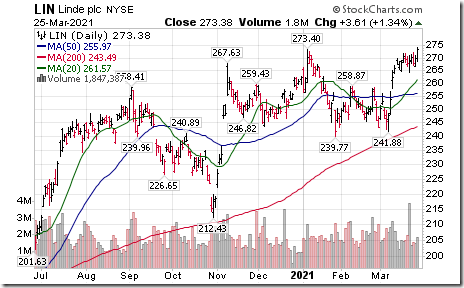

Linde (LIN), an S&P 100 stock moved above $273.40 to an all-time high extending an intermediate uptrend.

Rite Aid (RAD) plunged $4.71 to 18.53 after the company reported lower than consensus sales and earnings.

Baidu (BIDU), a NASDAQ 100 stock moved below $226.78 completing a Head & Shoulders pattern.

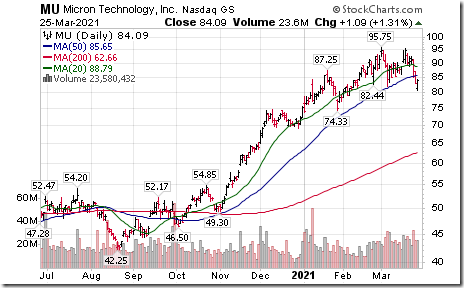

Micron (MU), a NASDAQ 100 stock moved below $81.85 completing a double top pattern.

Twitter (TWTR), a NASDAQ 100 stock moved below $61.52 setting an intermediate downtrend.

Intuit (INTU), a NASDAQ 100 stock moved below $367.78 setting an intermediate downtrend.

Zoom (ZM), a NASDAQ 100 stock moved below $309.00 extending an intermediate downtrend.

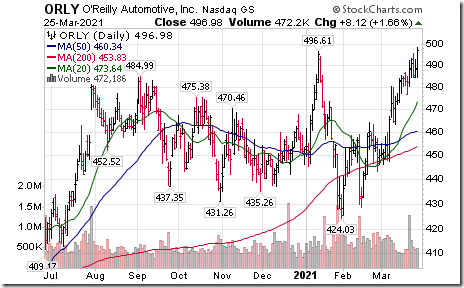

O’Reilly Automotive (ORLY), a NASDAQ 100 stock moved above $496.61 to an all-time high extending an intermediate uptrend.

Silver ETN (SLV) moved below $23.05 extending an intermediate downtrend.

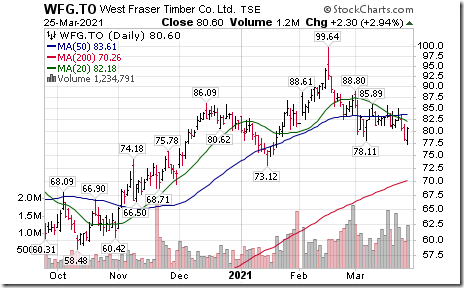

Another forest product stock breakdown! West Fraser Timber (WFG) moved below Cdn$78.11 setting an intermediate downtrend.

Trader’s Corner

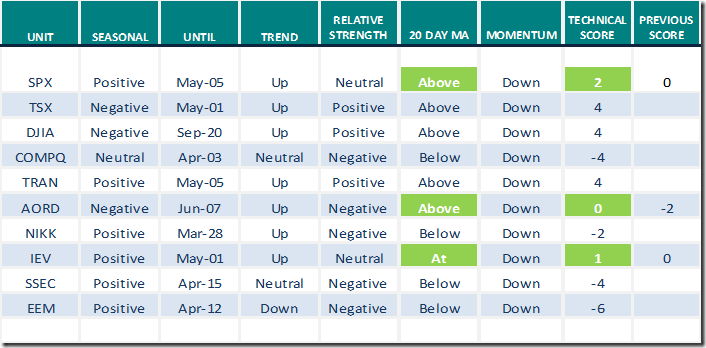

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

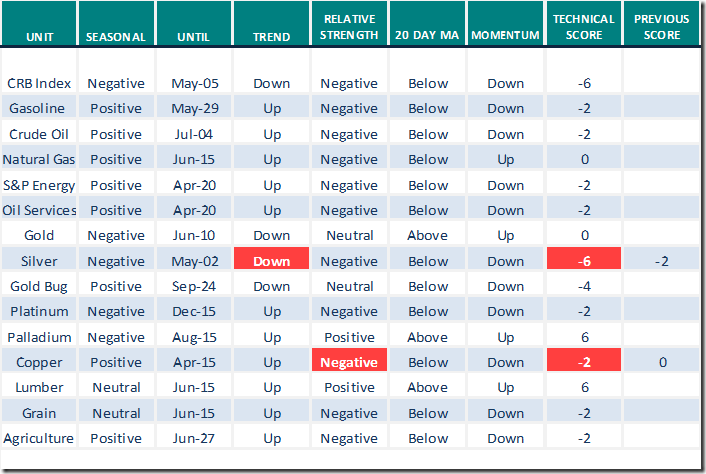

Commodities

Daily Seasonal/Technical Commodities Trends for March 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

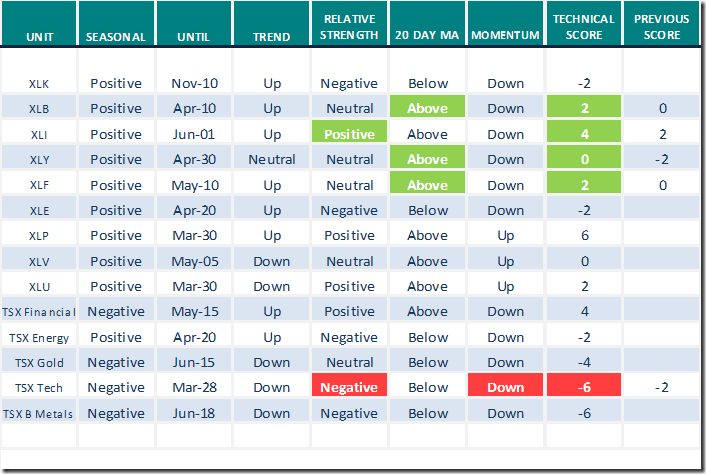

Sectors

Daily Seasonal/Technical Sector Trends for March 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.