by Don Vialoux, EquityClock.com

Technical Notes for Wednesday March 24th

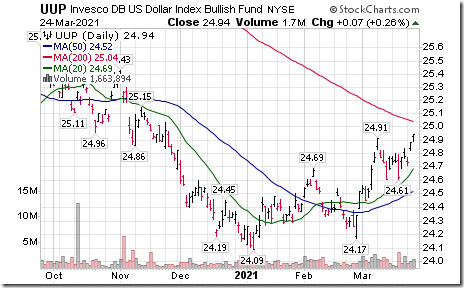

U.S. Dollar ETN (UUP) moved above $24.91 extending an intermediate uptrend.

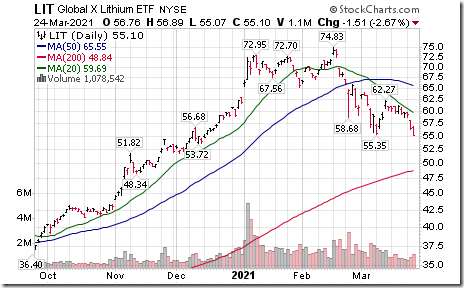

Industrial commodity stocks generally were under technical pressure partially in response to strength in the U.S. Dollar Index. Global X Lithium ETN (LIT) moved below $55.35 extending an intermediate downtrend

More base metal stock breakdowns! HudBay Minerals (HBM) moved below Cdn$7.92 setting an intermediate downtrend.

Forest product stocks and related ETFs on both sides of the border were under technical pressure. Canfor (CFP) moved below Cdn$23.62 completing a double top pattern.

IBM (IBM), a Dow Jones Industrial Average stock moved above $130.50 and $131.80 extending an intermediate uptrend.

Applied Materials (AMAT). a NASDAQ 100 stock moved above $124.26 to an all-time high extending an intermediate uptrend.

Seagen (SGEN), a NASDAQ 100 stock moved below $141.50 extending an intermediate downtrend.

IDEXX Laboratories (IDXX), a NASDAQ 100 stocks moved below $478.20 setting an intermediate downtrend

Match (MTCH), a NASDAQ 100 stock moved below $140.01 setting an intermediate downtrend.

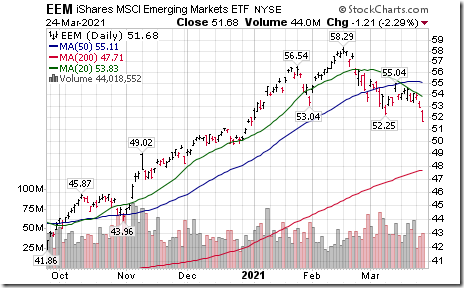

Emerging Markets iShares (EEM), heavily weighted in Far East stocks, moved below $52.25 completing a Head & Shoulders pattern.

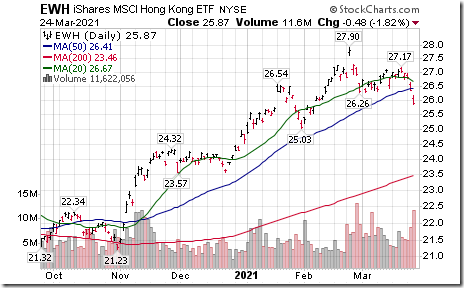

Hong Kong iShares (EWH) moved below $26.26 completing a double top pattern.

Pacific ex Japan iShares (EPP) moved below $49.51 completing a double top pattern.

Inter-listed Chinese equities remain under technical pressure. JD.com (JD), a NASDAQ 100 stock moved below support at $79.07 extending an intermediate downtrend.

Trader’s Corner

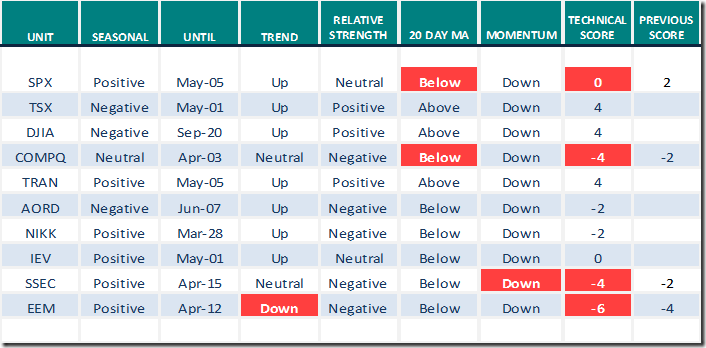

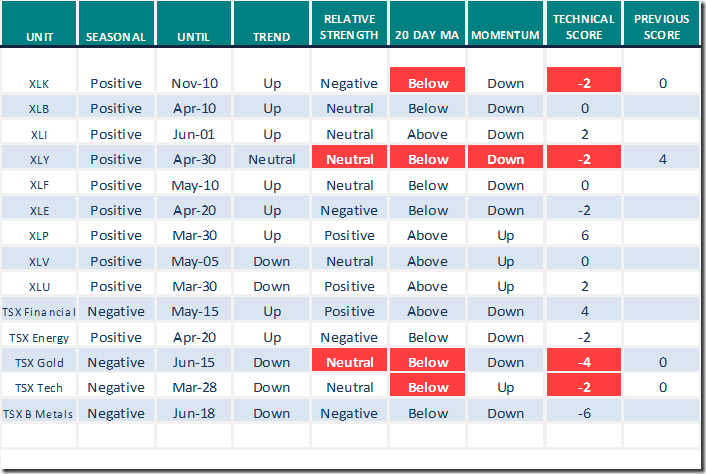

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

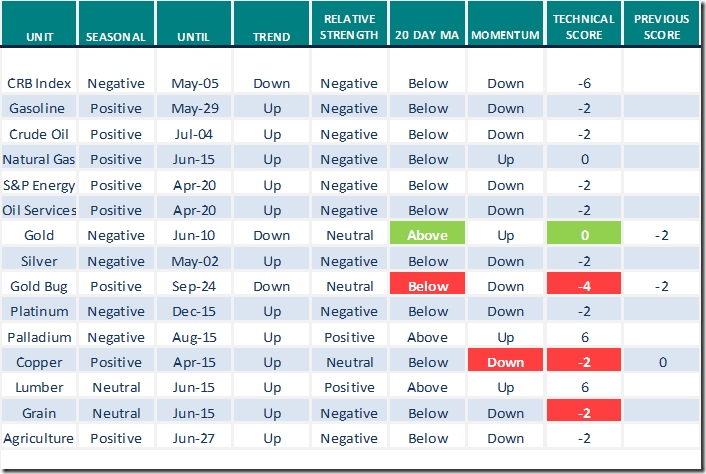

Commodities

Daily Seasonal/Technical Commodities Trends for March 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for March 24th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Market Buzz

Greg Schell discusses “A Deeper Look At Market Conditions”:

The market continues to struggle here. What was working a month ago is struggling to hold the gains. However, the NASDAQ is still unable to rally to new highs too. Greg explores how some of the breadth indicators are telling us to be careful, and others have yet to break down. It’s a very tricky market, some of these charts will help guide you forward. Following is a link:

https://www.youtube.com/watch?v=OEkLmJPF2hs

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image008[1] clip_image008[1]](https://advisoranalyst.com/wp-content/uploads/2021/03/clip_image0081_thumb.png)