by Brian Levitt, Global Market Strategist, North America, Invesco Canada

“Buying low and selling high” feels like a good idea, but markets have tended to go up far more often than they’ve gone down.

It’s the one-year anniversary of the 2020 market bottom.1 Time flies when you’re sitting by yourself in a home office all day. A year ago, the swiftest bear market in U.S. history — a 34% drop in the S&P 500 Index in 23 trading days — mercifully concluded.2 Since bottoming, the S&P 500 Index has advanced by 80%.3

Buy low and sell high, right? It’s an adage that’s etched in our heads from the moments we contemplate our first investments. But do we recognize the low when it happens? Alas, investors are often too panicked to invest when markets are “low.” Case in point, investors allocated over $1.2 trillion USD into money market strategies from the end of February 2020 through the end of May 2020.4 Anecdotally, I had more friends predict Oral Roberts University to be in the NCAA Tournament’s Sweet 16 than I had predict the March 23, 2020, market bottom.

Buy low and sell high feels like a good idea, but it’s often hard to do and misaligned with our emotional biases. I fear that that the saying not only places unrealistic expectations on investors during bear markets, but worse yet may condition investors to not participate as bull markets advance.

And yet, as the market, as represented by the S&P 500 Index, trades near all-time highs (16 record highs this year and 49 since the COVID-19 outbreak5), I’m left wondering if the saying has done us more harm than good. The challenge is that markets aren’t mean reverting and have tended to go up far more often than they’ve gone down.

I’m often asked what I’ve learned over the past year. Perhaps it’s simply that the saying shouldn’t be to “buy low and sell high,” but rather to “buy high and sell higher.” Hear me out.

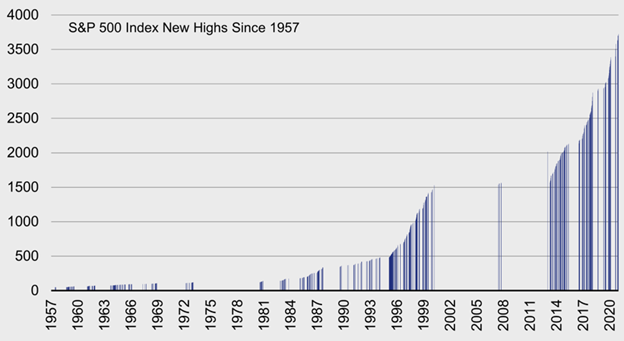

The S&P 500 Index has closed at a new high on 1,101 days since 1957, or on average once every 15 days.6 In fact, the market closed at all-time highs in 275 of a total 2,015 trading days between 2013 and 2020, including 33 days in 2020 alone.7

Exhibit 1: The S&P 500 Index’s new highs since 1957

Sources: Bloomberg, L.P., Standard & Poor’s, as of Dec. 31, 2020. Indices cannot be purchased directly by investors. Past performance does not guarantee future results.

That’s the equivalent of the market being at a new high roughly every other pay period (at least for those of us who are compensated on a bi-weekly basis). Would the “buy low” motto thus advise us to not invest a portion of our paychecks into the market every pay period? Few among us would agree with that philosophy, particularly when we have witnessed the potential benefits of automated bi-weekly investments.

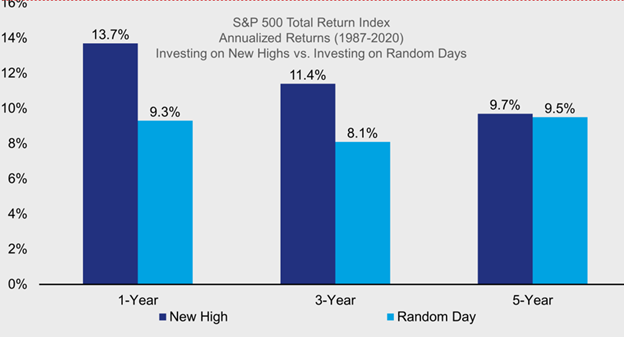

Let’s take it a step further. Rather than waiting to “buy low,” what if we instead purposefully invested each time the market closed at a new high? It turns out that since 1987 (when the S&P 500 Total Return Index went live), investing when the market was at a new all-time high was a better approach than simply investing on random days. The subsequent 1-, 3-, and 5-year annualized returns were higher. Momentum tends to be a powerful force in investing.8

Exhibit 2: Investing on new highs versus on random days

Sources: Bloomberg, L.P., Standard & Poor’s, as of Dec. 31, 2020. Indices cannot be purchased directly by investors. Past performance does not guarantee future results.

As I’ve said before, a new high is not in itself any kind of danger sign. A rising stock market tends to reflect an improving economic backdrop, which is what many economists are forecasting now. If you believe that the world will continue to get better, as it has for most of human history, then you should expect markets to trend upward over long periods. Literally buying low therefore is an unrealistic burden we place on ourselves.

If, as investors, we take anything away from the past year, buy high and sell higher might be our best lesson. It is historically a better approach, and more practical.

1 Sources: Bloomberg, L.P., and Standard & Poor’s, based on the S&P 500 Index as of March 23, 2021

2 Sources: Bloomberg, L.P., and Standard & Poor’s

3 Sources: Bloomberg, L.P., and Standard & Poor’s, as of March 23, 2021

4 Source: Investment Company Institute. Represents the increase in money market assets from the end of February 2020 until the 2020 peak on May 27.

5 Sources: Bloomberg, L.P., and Standard & Poor’s, as of March 23, 2021

6 Sources: Bloomberg, L.P., and Standard & Poor’s, as of March 23, 2021

7 Sources: Bloomberg, L.P., and Invesco, as of Dec. 31, 2020 8 Sources: Bloomberg, Invesco, as of February 2021

This post was first published at the official blog of Invesco Canada.