by Tawhid Ali, AllianceBernstein

European stocks have lagged developed market peers because the regional economy has been especially hard hit. But selective equity investors can find promising return potential in undervalued companies that are poised to recover in a post-pandemic world.

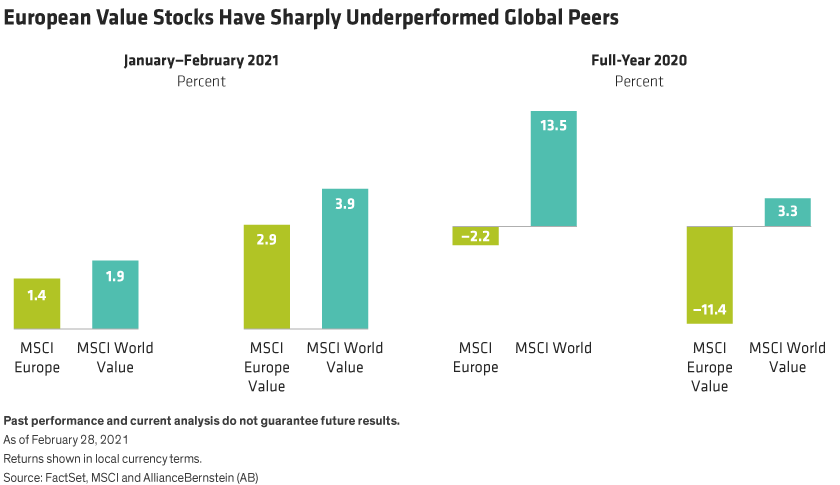

Equity markets in Europe continue to struggle. The MSCI Europe Index trailed the MSCI World Index this year through February, after sharply underperforming in 2020. Regional value stocks have done even worse. The MSCI Europe Value fell by 11.4% last year, well behind the MSCI World Value (Display).

Weakness in European stocks reflects the macroeconomic environment. The euro area’s GDP fell by about 6.8% in 2020, a much deeper recession than the US, which contracted by 3.5%. European markets also have fewer growth stocks that thrived through COVID-19, such as US technology and consumer megacap companies.

From Pain to Gain?

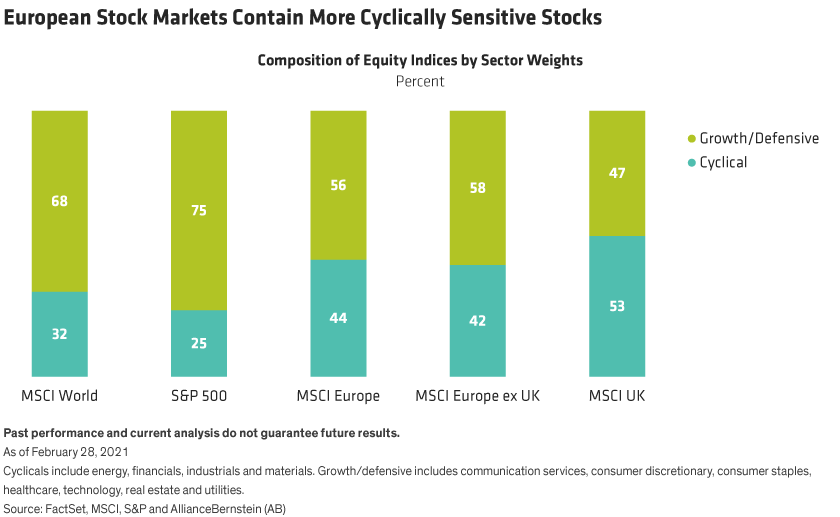

Coming out of the pandemic, Europe’s weakness could signal an attractive opportunity—particularly for value investors. European markets have relatively more cyclically sensitive stocks that should do well in a broadening recovery of macroeconomic growth (Display). And the underperformance during COVID-19 may represent pent-up recovery potential, in our view.

Capturing that potential requires a balanced assessment of what’s changed over the past year—and what hasn’t. As the effects of the pandemic fade, people will begin to return to restaurants and travel for holidays, while businesses recalibrate spending for a new normal. Cheaper products and faster service will always be in demand, just like before the coronavirus. To prepare for the post-pandemic world, it’s too simplistic to look only at COVID-induced changes.

Three Types of Post-COVID Opportunities

Value investors are well placed for this environment. The philosophy of value investing is rooted in identifying market overreactions to controversy and buying stocks with unrecognized potential that other investors are unloading. In today’s conditions, we see three types of opportunities:

-

- Resilient businesses—companies that are much more durable than perceived

-

- Transition champions—companies adapting effectively to the new world

-

- Normalization plays—companies poised to benefit as consumer and business behaviors normalize

Resilient companies often have underappreciated business models. For example, before COVID-19, large food retailers were seen as prey to hard discounters or online upstarts. Tesco, the UK’s largest supermarket chain, was considered especially vulnerable because it had also expanded abroad. During the pandemic, Tesco showed that an incumbent retail giant could have surprising staying power by virtue of its compelling online presence.

Other companies must change to survive and thrive, especially through a global shock. In technology, European companies are generally perceived to be less attractive than peers elsewhere, given the strengths of US and Asian technology rivals. Companies like Ubisoft Entertainment, a French video-game maker, defy such stereotypes. The company has created increasingly complex games to cater to gamers’ evolving tastes and expectations. Giants like Amazon and Google have failed to penetrate the video-game market, where content development requires a unique culture that combines computer science and creative skills. Ubisoft has continued to reinvent its games and consoles, which supported demand from stuck-at-home gamers during COVID-19 lockdowns.

Preparing for a New Normal

When the pandemic recedes, what will the new normal look like? In some respects, it might look very much like the old normal. Real estate markets are a good example. In Germany, government rules allowing hotels to defer rental payments to landlords have hurt Aroundtown, a leading property group. Aroundtown has 24% of its assets in hotels, 50% in office buildings and 13% in residential property. The company identifies underinvested assets for purchase, improves them and then increases rent. In time, we believe travel and tourism will resume and hotels will start paying rent again. Real estate groups with a solid, attractively valued asset base should be well positioned to recover.

Some companies may benefit from all three trends. Take the auto industry––where demand for electric vehicles is picking up, while the pandemic may push more people to move out of cities, boosting demand for cars as economic growth recovers. Shares of Faurecia, a profitable French auto- parts supplier, were hurt along with the global decline in demand for vehicles during 2020. The company has a resilient business and is at the heart of the transformation of the auto industry, selling increasingly sophisticated content required both for electric vehicles and for conventional cars. Eventually, we expect car sales to recover, and behind-the-scenes companies that are integral to the industry should benefit as well.

Focus on Business Fundamentals and Cash Flows

To be sure, companies like these—even those with a global focus—are operating in a challenging European environment. But as vaccination programs accelerate, more countries recover and fiscal stimulus filters through, we expect economic behavior to start returning to normal, even if it takes longer in Europe than elsewhere.

Finding promising investment candidates requires a clearheaded focus on business fundamentals and cash-flow generation instead of relying on multiple expansion, which has fueled high-growth companies in recent years based on future expectations. As conditions improve, digging for value in resilient businesses, transition champions and normalization plays across Europe can help position an equity portfolio to capture return potential for the long-term recovery.

Tawhid Ali is Chief Investment Officer—European Value Equities at AllianceBernstein (AB)

Andrew Birse is Portfolio Manager—European Value Equities at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

This post was first published at the official blog of AllianceBernstein..