by Don Vialoux, EquityClock.com

The Bottom Line

North American equity indices moved higher again last week. Greatest influences on North American equity markets remain evidence of a possible third wave of the coronavirus (negative) and timing of distribution of a vaccine (positive).

Observations

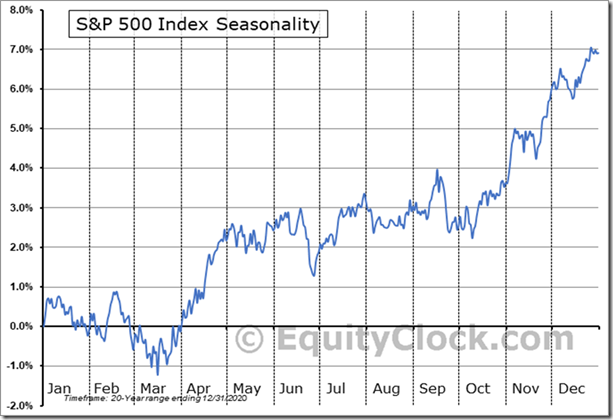

The S&P 500 Index has just entered into its strongest eight week period of seasonal strength for the year from mid-March to the first week in May.

The second distribution for Covid 19 relief cheques paid by the U.S. government to 330 million American citizens (except individuals earning more than $80,000 per year or $160,000 per couple) starts to flow into bank accounts this week. Value of the distribution is estimated at $415 billion out of the $1.9 trillion program passed by Congress and the President last week. A major reason for recent strength in U.S. equity prices was because at least a small part of the first $600 per person distributions valued at $200 billion recently forwarded to U.S. citizens was diverted into the purchase of equities. The second series of cheques from the U.S. government is expected to trigger additional purchases of equities, Exchange Traded Funds and mutual funds and is expected to add to short and intermediate strength in U.S. equity prices.

Short term short term indicators for U.S. equity indices, commodities and sectors (20 day moving averages, short term momentum indicators) moved higher again last week.

Intermediate term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 50 day moving average) moved higher last week. It remained Overbought. See Barometer chart at the end of this report.

Long term technical indicator for U.S. equity markets (e.g. Percent of S&P 500 stocks trading above their 200 day moving average) moved higher last week. It remained Extremely Overbought. See chart at the end of this report.

Short term momentum indicators for Canadian indices and sectors also continued to move higher last week

Medium term technical indicator for Canadian equity markets moved higher last week. It remained Overbought. See Barometer chart at the end of this report.

Long term technical indicator for Canadian equity markets (i.e. Percent of TSX stocks trading above their 200 day moving average) moved higher last week. It remained Overbought. See Barometer chart at the end of this report.

Consensus estimates for earnings and revenues by S&P 500 companies turn strongly positive on a year-over-year basis particularly in the first and second quarters of 2021. Moreover, consensus estimates continue to increase. According to www.FactSet.com earnings in the first quarter of 2021 on a year-over-year basis are expected to increase 22.1% (versus previous estimate of 21.8% last week) and revenues are expected to increase 6.2% (versus previous estimate at 6.1%). Earnings in the second quarter are expected to increase 50.7 % (versus previous estimate at 50.0%) and revenues are expected to increase 16.4% (versus previous estimate at 16.2%). Earnings in the third quarter are expected to increase 17.6% (versus previous estimate at 17.3%) and revenues are expected to increase 9.9%. Earnings in the fourth quarter are expected to increase 13.7% (versus previous estimate at 13.3%) and revenues are expected to increase 7.1%. Earnings for all of 2021 are expected to increase 24.6% (versus previous estimate at 24.2%) and revenues are expected to increase 9.4% (versus previous estimate at 9.2%).

Economic News This Week

Canadian February Housing Starts to be released at 8:15 AM EDT on Monday are expected to slip to 245,000 units from 282,400 units in January.

March Empire State Manufacturing Survey to be released at 8:30 AM EDT on Monday is expected to increase to 14.50 from 12.10 in February.

February Retail Sales to be released at 8:30 AM EDT on Tuesday are expected to drop 0.6% versus a gain of 5.3% in January. Excluding auto sales, February Retail Sales are expected to slip 0.1% versus a gain of 5.9% in January.

February Capacity Utilization to be released at 9:15 AM EDT on Tuesday is expected to remain unchanged from January at 75.6%. February Industrial Production is expected to increase 0.4% versus a gain of 0.9% in January.

January Business Inventories to be released at 10:00 AM EDT on Tuesday are expected to increase 0.3% versus a gain of 0.6% in December.

U.S. February Housing Starts to be released at 8:30 AM EDT on Wednesday are expected to slip to 1.565 million units from 1.580 million units in January.

Canadian February Consumer Price Index to be released at 8:30 AM EDT on Wednesday is expected to increase 0.7% versus a gain of 0.6% in January.

FOMC Statement on interest rates to be released at 2:00 PM EDT on Wednesday is expected to maintain the Fed Fund Rate at 0.25%. Press conference is scheduled at 2:30 PM EDT.

March Philly Fed Manufacturing Index to be released at 8:30 AM EDT on Thursday is expected to remain unchanged from February at 23.1.

February Leading Economic Indicators to be released at 10:00 AM EDT on Thursday are expected to increase 0.4% versus a gain of 0.5% in January.

Canadian January Retail Sales to be released at 8:30 AM EDT on Friday are expected to drop 3.0% versus a decline of 3.4% in December. Excluding auto sales, Canadian January Retail Sales are expected to drop 2.8% versus a decline of 4.1% in December.

Selected Earnings Reports This Week

Seven S&P 500 companies (including one Dow Jones Industrial Average company: Nike) are scheduled to release quarterly results this week

Trader’s Corner

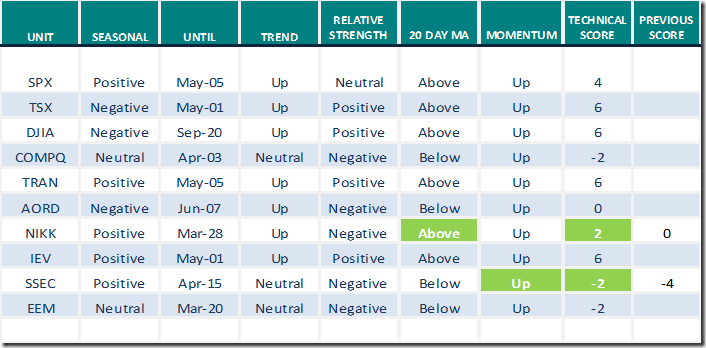

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for March 12th 2021

Green: Increase from previous day

Red: Decrease from previous day

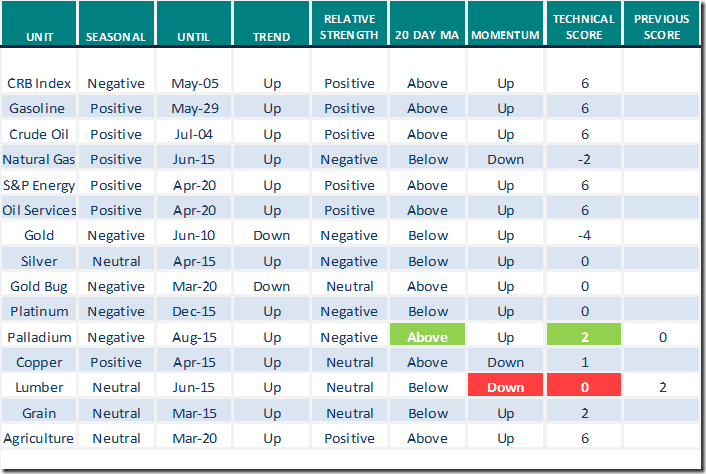

Commodities

Daily Seasonal/Technical Commodities Trends for March 12th 2021

Green: Increase from previous day

Red: Decrease from previous day

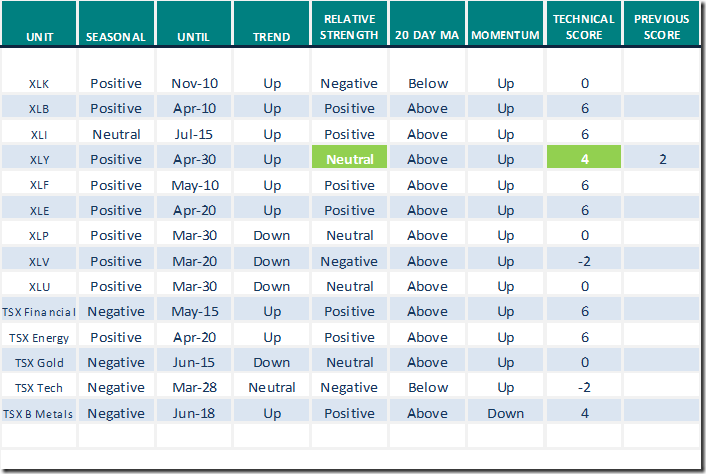

Sectors

Daily Seasonal/Technical Sector Trends for March 12th 2021

Green: Increase from previous day

Red: Decrease from previous day

All seasonality ratings are based on performance relative to the S&P 500 Index

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment. Headline reads,” Empire decline, Canadian surprise, stock highs, infinite QE, excited bugs, energetic winners, crypto mania”. Following is the link:

Technical Scores

Calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

(Higher highs and higher lows)

Intermediate Neutral trend: Score 0

(Not up or down)

Intermediate Downtrend: Score -2

(Lower highs and lower lows)

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of -2.0 or higher. Conversely, a short position requires maintaining a technical score of +2.0 or lower

Changes Last Week

Technical Notes for Friday

Honeywell (HON), a Dow Jones Industrial Average stock moved above $215.74 to an all-time high extending an intermediate uptrend.

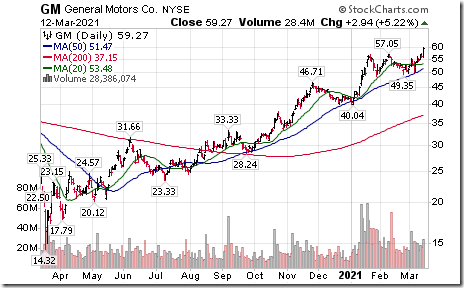

General Motors (GM), an S&P 100 stock moved above $57.05 to an all-time high extending an intermediate uptrend.

Ford (F), an S&P 100 stock moved above a 7 year high at $13.05 extending an intermediate uptrend.

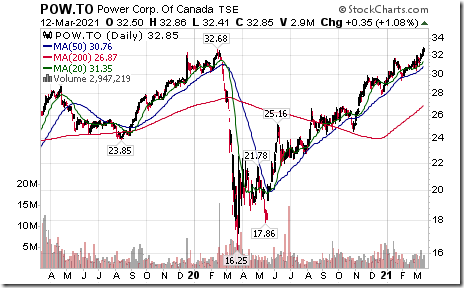

Power Corp (POW), a TSX 60 stock moved above $32.68 to an all-time high extending an intermediate uptrend.

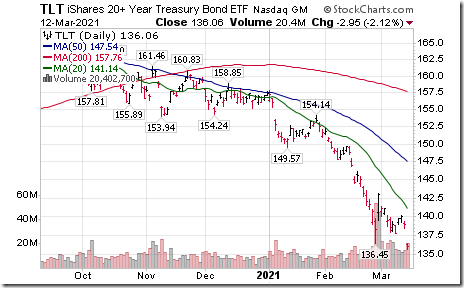

U.S. long term Treasury Bond (TLT) moved below $136.45 extending an intermediate downtrend.

S&P 500 Momentum Barometers

The intermediate Barometer added 0.80 on Friday and 11.42 last week to 74.15. It remains Overbought.

The long term Barometer added 0.80 on Friday and 3.60 last week to 86.37. It remains Extremely Overbought.

TSX Momentum Barometers

The intermediate Barometer slipped 0.95 on Friday, but gained 6.63 last week to 71.56. It remains Overbought.

The long term Barometer added 0.47 on Friday and 5.22 last week to 79.15. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed