by Frank Caruso, AllianceBernstein

The recent selloff of US growth market darlings reflects increasing questions about whether their growth potential still justifies exceptionally high valuations. Away from the froth, growth investors can still find solid return potential in quality companies with profitable, sustainable business models.

The Russell 1000 Growth Index soared by 81.1% from its March 22 low through December 31, led by a concentrated group of mostly tech companies that benefitted as digitization enablers throughout the COVID-19 crisis. However, the strong momentum seems to be faltering so far this year. By the end of February, the growth benchmark was down 0.8% year-to-date and several of its largest constituents were trading 15-20% below their recent highs.

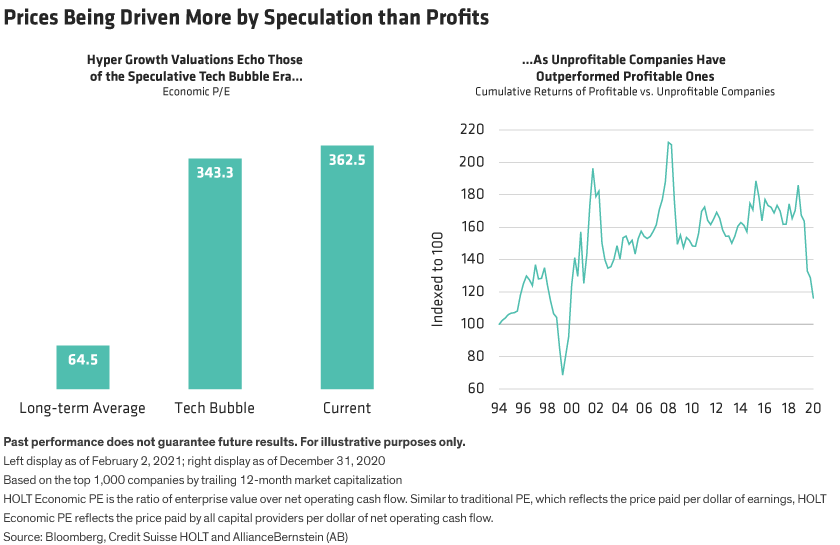

The recent selloff follows a period of equity market speculation in 2020, from record-breaking IPOs to explosive retail investor participation. Valuations of hyper growth stocks have reached near 2000 tech bubble levels, according to economic price to earnings, which are based on cash flows to assess a company’s underlying economic worth more accurately than earnings-based metrics (Display left). Meanwhile, unprofitable businesses significantly outperformed profitable ones (Display right). All told, these trends further exacerbated the disconnect between company valuations and fundamentals that had been developing even before the pandemic.

Many investors question the sustainability of such high valuations, especially if interest rates rise and business conditions improve for other industries. The pandemic’s biggest winners may also be challenged to meet the market’s lofty growth expectations amid tough year-over-year revenue and earnings comparisons. Where are growth investors supposed to turn now? In our opinion, they ought to turn to companies with the same fundamental strengths that were attractive during the runup—provided they follow the right clues.

Real Growth Begins with Persistent Fundamentals

Today’s excesses remind us that markets can occur in which companies deliver exceptional returns without even showing a steady profit. Among 15 “high-flying” US growth companies whose stocks returned 250% on average in 2020, eight were unprofitable based on trailing 12-month earnings before interest and taxes, while the rest had negligible profits for their size. Our research suggests that their future growth prospects accounted for 87% of their current enterprise value on average. This suggests investors are putting nearly all the value of these businesses on their ability to execute successfully—but in the future, not today.

Many of these companies are benefiting from high sales growth. Indeed, the average sales growth trajectory of highflier companies is projected to hover above 20% through 2024, according to Credit Suisse HOLT. After that, the pattern probably won’t hold. In fact, a company’s early high-growth experience has rarely continued in perpetuity. Among the top 1,000 US highfliers—defined as early-stage rapid-growth companies—very few had annual growth rates of 15% within just five years, according to HOLT. And sales growth is not a good predictor of consistent profitability.

Yet, investors can find large-cap companies delivering high profitability with more consistent performance. Many of these stocks have lagged their soaring cohorts, but still offer attractive long-term investment cases, especially when they check certain boxes: solid return on assets and invested capital, self-funding reinvestment disciplines, durable growth models and cultures of vision and accountability.

Return on Assets: A Longer-Term Lens

Profitability often offers a better gauge of fundamental performance than earnings. Reported earnings don’t always show the whole picture and can easily be manipulated by companies, in our view. We believe that return on invested capital (ROIC) and return on assets (ROA) are better measures of economic performance and sustainability, especially when comparing across firms.

ROIC and ROA were particularly helpful during the pandemic’s height, when many companies suspended forward guidance. Both metrics will be especially important if interest rates rise, which would increase the cost of capital and discount rates used to value future cash flows. The potential for inflation in an improving economy could also add risks. ROIC and ROA can net undistorted, independent views of what might happen to a company after the recovery.

Reinvestment: Sowing Sustainable Growth

Pay attention to how profitable companies deploy excess cash. Corporate buybacks and dividends are enticing for investors, but we believe a company succeeds best when it invests in its future. Strategic, self-funded reinvestment creates long-term return potential, which creates real shareholder value.

As the economy picks up, reinvestment and sustainability are hand in glove. For instance, companies currently underinvesting may enjoy high margins that mask hidden weaknesses and unpreparedness for potential threats to their models. When looking at growth companies that did well during the pandemic, revenue growth can be misleading. Investors should ask whether fast-growing companies are investing enough to maintain and grow profitability when consumer and business behavior normalizes across industries.

Culture: Why Attitude Makes All the Difference

Investors should also weigh the impact of environmental, social and governance (ESG) issues on a company’s profit and growth durability. In this vein, corporate culture is especially telling, as it demonstrates a commitment to diversity, trust, accountability and vision—all building blocks to long-term success. Culture is deemed an intangible asset, but has measurable impact on company performance. For example, companies that met the challenge to keep employees safe throughout the pandemic often have a corporate culture that understands why protecting staff can help support profitable business.

More COVID-19 vaccinations and supportive policies should lead to more economic certainty. Companies with exceptional, resilient business models should come out stronger on the other side. And, in time, we expect the rebound to benefit an even wider swath of growth companies. Maintaining a disciplined focus on companies with valuations aligned to their fundamental strengths is the best way to capture US growth potential for the next stage of recovery.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

Frank Caruso is Chief Investment Officer of US Growth Equities at AB

This post was first published at the official blog of AllianceBernstein..