by Don Vialoux, EquityClock.com

Media Events

Don Vialoux is a guest on two radio shows tomorrow (Saturday): Michael Campbell’s Money Talks at approximately 9:00 AM Vancouver time (Noon Toronto time) on www.CKND.com and Wolf on Bay Street at 7:00 PM Toronto time on Corus 640.

Technical Notes for Thursday February 25th

U.S. equity indices responded sharply to a spike in long term Treasury yields.

Dollar Tree (DLTR), a NASDAQ 100 stock moved below $99.82 extending an intermediate downtrend.

Gildan Activewear (GIL), a TSX 60 stock moved above $36.92 extending an intermediate uptrend. Fourth quarter sales and earnings exceeded consensus estimates.

Citigroup (C), an S&P 100 stock moved above $68.84 extending an intermediate uptrend.

TSX REIT iShares (XRE) moved above $16.77 extending an intermediate uptrend.

Oracle (ORCL), an S&P 100 stock moved above $65.95 to an all-time high extending an intermediate uptrend.

Canadian Tire (CTC.A), a TSX 60 stock moved below $163.87 completing a double top pattern.

Coffee ETN (JJOFF) moved above $11.60 extending an intermediate uptrend.

Health Care Providers iShares (IHF) moved below $237.22 completing a double top pattern.

ANSYS (ANSS), a NASDAQ 100 stock moved below intermediate support at $345.45/

Monster Beverages (MNST), a NASDAQ 100 stock moved below $85.36 completing a double top pattern.

Copart (CPRT), a NASDAQ 100 stock moved below $106.68 completing a modified Head & Shoulders pattern.

Duke Energy (DUK), an S&P 100 stock moved below $86.72 completing a double top pattern.

Trader’s Corner

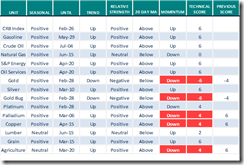

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for February 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

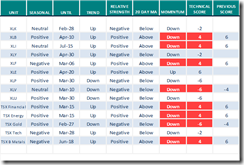

Commodities

Daily Seasonal/Technical Commodities Trends for February 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for February 25th 2021

Green: Increase from previous day

Red: Decrease from previous day

The Canadian Technician

Greg Schnell notes “Large Cap Tech Drifts Lower”. Following is a link:

Large Cap Tech Drifts Lower | The Canadian Technician | StockCharts.com

Changes in Seasonality Ratings

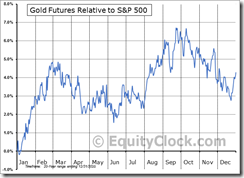

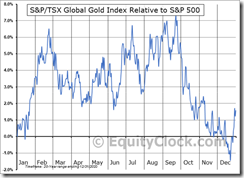

Gold futures change from Positive to Negative to June 10th

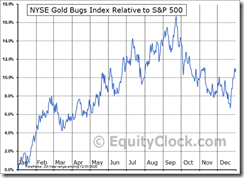

Gold Bug Index changed from Positive to Neutral to March 20th

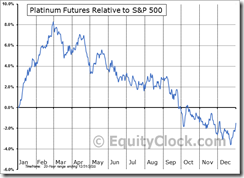

Platinum changes from Positive to Negative to December 15th

TSX Gold changes from Positive to Negative to June 15th

S&P Technology changes from Neutral to Positive to November 10th

S&P 500 Momentum Barometers

The intermediate Barometer dropped 7.41 to 60.12 yesterday. It remains Overbought and trending down.

The long term Barometer slipped 3.41 to 82.77 yesterday. It remains Extremely Overbought and trending down.

TSX Momentum Barometers

The intermediate Barometer slipped 1.18 to 56.31 yesterday. It remains Neutral and trending down.

The long term Barometer added 0.36 to 73.79 yesterday. It remains Overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.