by Don Vialoux, EquityClock.com

Technical Notes for Monday February 22nd

Regeneron (REGN), a NASDAQ 100 stock moved below $467.00 extending an intermediate downtrend.

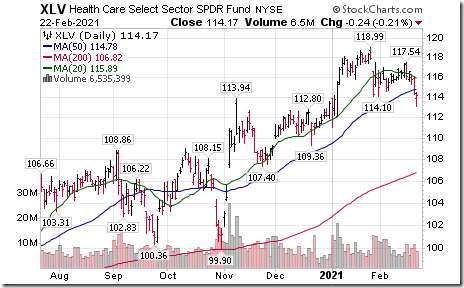

Healthcare SPDRs (XLV) moved below $114.10 completing a double top pattern.

Brazil iShares (EWZ) moved below $34.06 extending an intermediate downtrend.

Bank of America (BAC), an S&P 100 stock moved above $34.37 extending an intermediate uptrend.

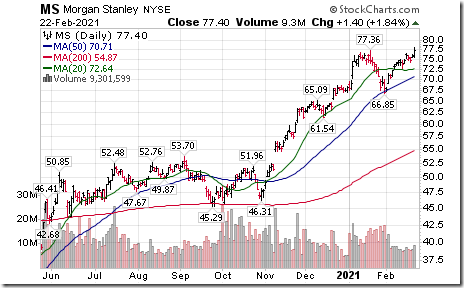

Morgan Stanley (MS), an S&P 100 stock moved above $77.36 to an all-time high extending an intermediate uptrend.

American Express (AXP), a Dow Jones Industrial Average stock moved above $135.70 to an all-time high extending an intermediate uptrend.

US Bancorp (USB), an S&P 100 stock moved above $50.93 extending an intermediate uptrend

General Electric (GE), an S&P 100 company moved above $12.23 extending an intermediate uptrend.

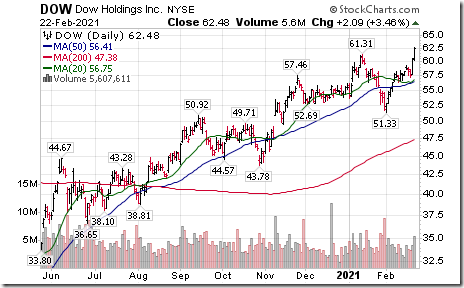

Dow Holdings (DOW), an S&P 100 stock moved above $61.31 extending an intermediate uptrend.

Bank of Montreal (BMO), a TSX 60 stock moved above $101.27 to an all-time high extending an intermediate uptrend.

Fortis (FTS), a TSX 60 stock moved below $50.15 extending an intermediate downtrend.

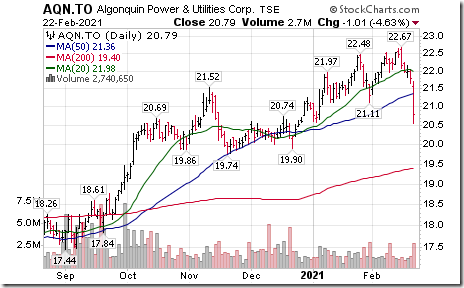

Algonquin Power (AQN), a TSX 60 stock moved below intermediate support at $21.11.

Imperial Oil (IMO), a TSX 60 stock moved above $28.27 extending an intermediate uptrend.

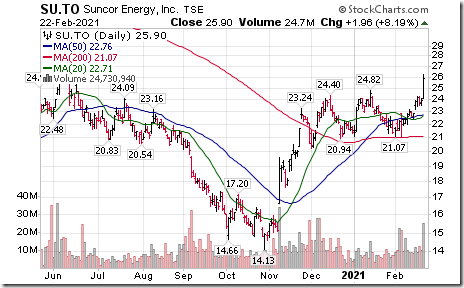

Suncor (SU), a TSX 60 stock moved above $24.82 extending an intermediate uptrend.

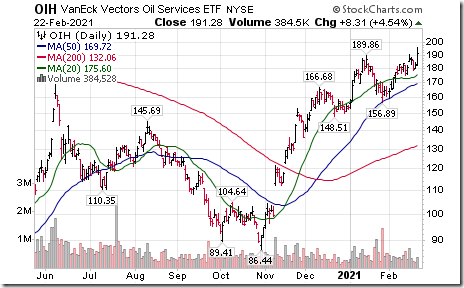

U.S. Oil Services ETF (OIH) moved above $189.86 extending an intermediate uptrend.

Loblaw Companies (L), a TSX 60 Index moved below $61.42 extending an intermediate downtrend.

Utilities SPDRs (XLU) moved below $60.32 setting an intermediate downtrend.

Exelon (EXC), an S&P 100 stock moved below intermediate support at $40.53.

Apple (AAPL), a Dow Jones Industrial Average stock moved below intermediate support at 126.19.

QualComm (QCOM), a NASDAQ 100 stock moved below intermediate support at $141.89.

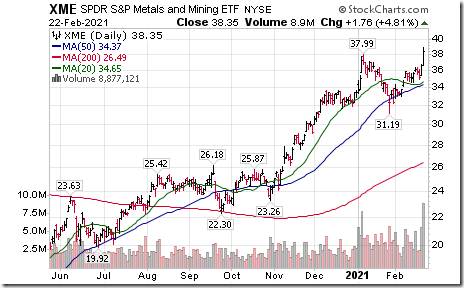

Metals & Mining SPDRs (XME) moved above $37.99 to an all-time high extending an intermediate uptrend. The ETF is heavily weighted in the steel industry (48.8%)

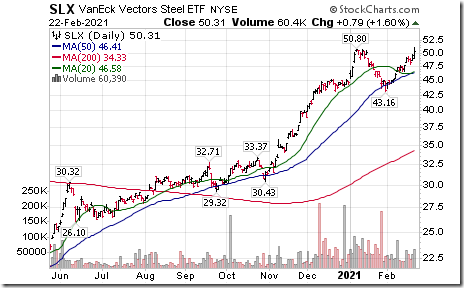

Steel ETF (SLX) moved above $50.80 to an all-time high extending an intermediate uptrend.

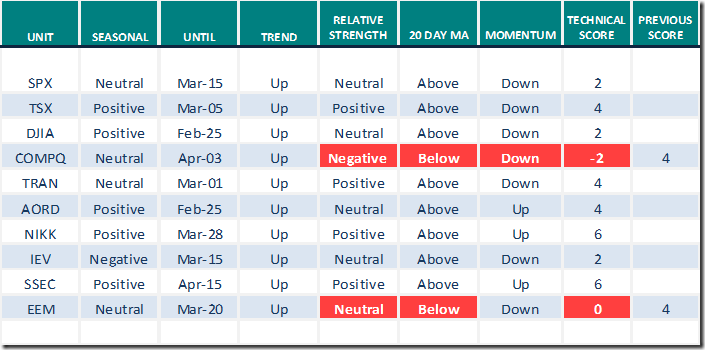

Short term technicals turned negative for the NASDAQ Composite Index: Dropped below its 20 day MA, the three daily momentum indicators rolled over, strength relative to the S&P 500 turned negative. Most of the weakness occurred in Technology stocks in the Index.

U.S. Insurance iShares (IAK) moved above $70.58 extending an intermediate uptrend.

Trader’s Corner

Equity Indices and Related ETFs

Daily Seasonal/Technical Equity Trends for February 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

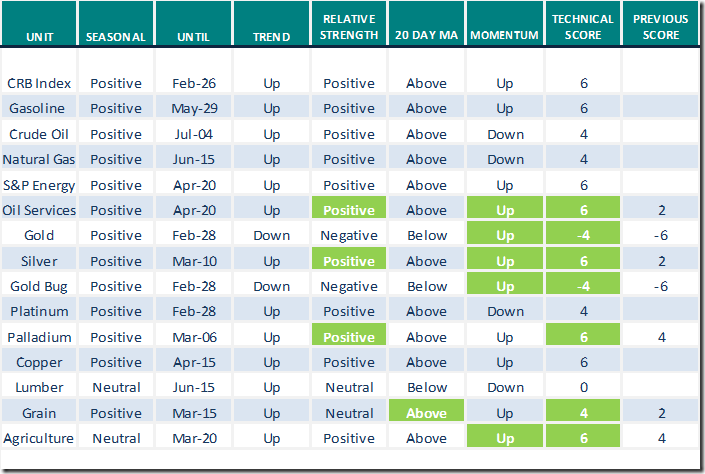

Commodities

Daily Seasonal/Technical Commodities Trends for February 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

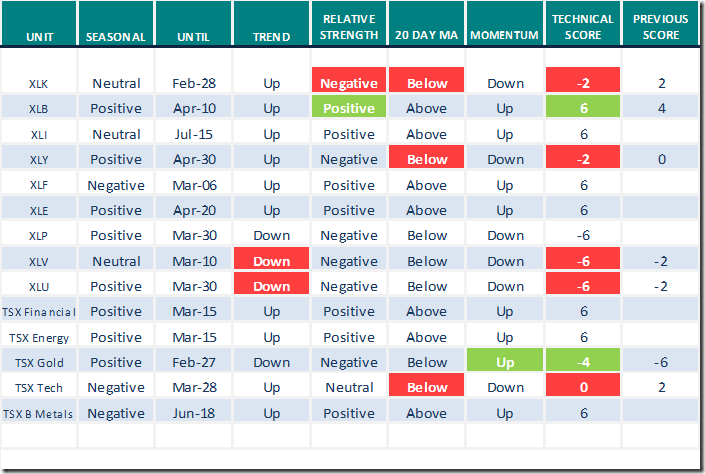

Sectors

Daily Seasonal/Technical Sector Trends for February 22nd 2021

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometers

The intermediate Barometer dropped another 3.21 yesterday to 63.73. It remains overbought and trending down.

The long term Barometer dropped 2.00 yesterday to a three month low at 85.97. It remains extremely intermediate overbought.

TSX Momentum Barometers

The intermediate Barometer slipped another 2.14 yesterday to 59.02. It changed from overbought to neutral on a drop below 60.00 and is trending down.

The long term Barometer slipped another 0.61 yesterday to 74.63. It remains overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.